//

India is growing at more than 7 per cent YOY and faster than the UK, the US and Japan, the top trading partners of China. So, it makes more sense for China to divert a major chunk of its investment towards India

India has always shared a love-hate and mostly frosty relationship with its north-eastern neighbour China. There has been a fair share of bilateral turbulences over the past seven decades over territorial disputes, political support to Pakistan, the influx of cheap Chinese goods in the Indian consumer market and most recently, the blockade of Brahmaputra river tributary and opposing India’s NSG bid.

However, these issues haven’t deterred the trade relations between the land of elephants and the land of dragons. In fact, it has only blossomed over the last decade.

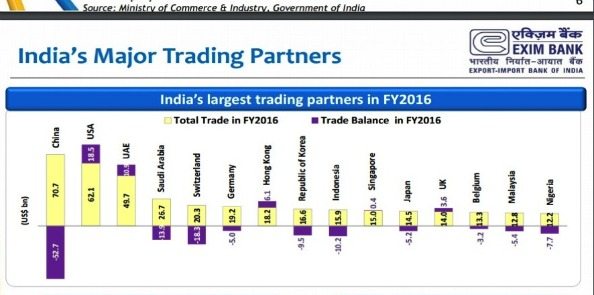

The total bilateral trade stood at US$72B in 2014-15, with India’s exports to China at US$12B and imports crossing US$60B. This year has begun on a good note as well. China has emerged as the largest trading partner of India in FY2016 with business worth US$7.07B already taking place between the two Asian giants. Further, according to a CII-Avalon Consulting report, India will too become China’s top five trading partners by 2018.

(Source)

(Source)

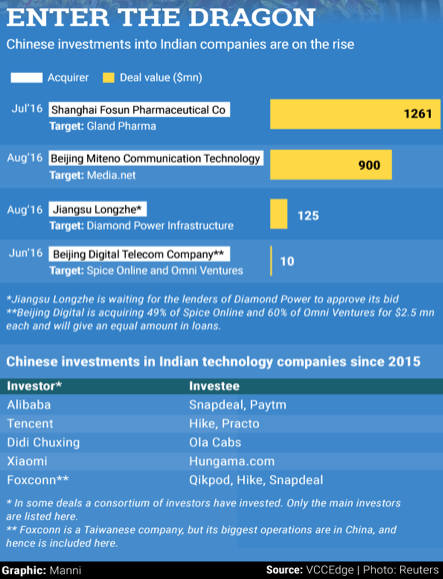

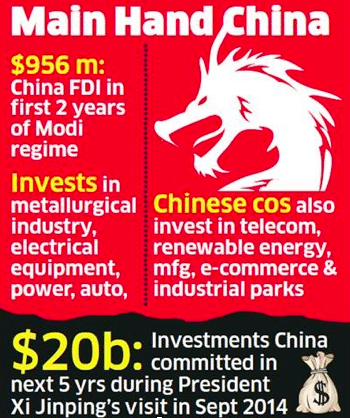

At the same time, China’s investment in India is also growing at a rapid pace. So far, China has invested over US$27B in India over last 13 years. The total FDI inflow from China to India was US$426M during the first nine months of 2015-16, up from US$126 million between 2001 and 2012. This year, they have invested US$2.3B in three months alone. Prime Minister Narendra Modi, during his visit to China in May 2015, brought home 24 signed agreements between Indian and Chinese companies that amounted to US$22B worth of investment.

Why is China Investing in India?

1- India is a global investment hotspot

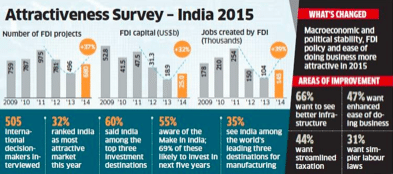

The India Attractiveness Survey 2015 by Ernst & Young reported that India is the number one investment destination internationally, owing to a pro-reform government and strong economic fundamentals. It comes as no surprise that India emerged as the world’s top recipient of FDI in 2015 with US$63B inward capital investment. China, which is now the third largest source of overseas investment, also views India in the same light and expects to ride on ‘Shining India’ bandwagon to seek high returns on its capital outflow.

Also, the fact that India is growing at more than 7 per cent YOY and faster than the UK, the USA and Japan, the top trading partners of China, it makes more sense for China to divert a major chunk of its investment towards India.

2- India’s investment-friendly initiatives

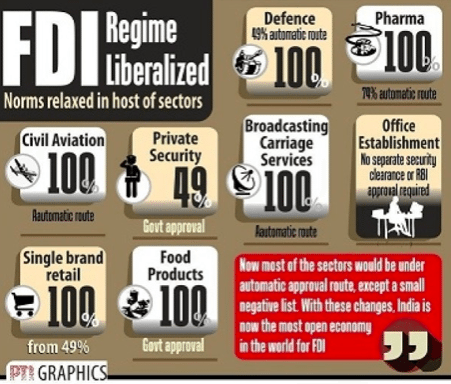

India is making efforts to make investment environment friendly for China. During the India-China Business Forum in May 2016, the President Pranab Mukherjee invited Chinese industrialists and businessmen to participate in its ‘Make in India, ‘Digital India’ and ‘100 Smart Cities’ programmes and invest in capital-intensive sectors such as infrastructure, railways and manufacturing. India has liberalised its FDI policy, relaxed tax norms, set up industrial corridors and put up new sectors to automatic route investment. The government has also promised to provide better road and railway infrastructure and uninterrupted power supply for mega projects. This has further opened a host of investment opportunities in various sectors for China.

(Source)

(Source)

3- India’s startup boom

India is the fastest growing startup ecosystem and is home to more than 12,000 startups, making it further a more favourable investment destination for China. In fact, Chinese investors had allocated a collective fund of US$50M for the startups, in one such conglomeration at a technology summit in Bengaluru.

Also Read: Move over China. India takes centre stage for VCs

4- Economic slowdown in China

China’s economic growth in 2015 was the slowest in the last 25 years. To make the matters worse, the turbulence in the Chinese stock market earlier this year put the dragon’s market valuation at stake. It is gradually trying to rebalance its economy by reducing its reliance on exports and increasing domestic consumption. This has created a worrisome situation among the Chinese investors and they have started looking abroad, including India, for a safe haven for investment.

5- Rising manpower cost in China

China is the most populous country in the world and was known for producing goods at very cheap rates. However, the labour cost is steadily rising, so much that it is now only 4 per cent cheaper than in the US. So, manufacturing goods at mass level without incurring high labour cost is becoming a major concern for China. As compared to China, an Indian worker can be employed at 22 per cent lesser cost than his Chinese counterpart. So, Chinese companies are vying the Indian subcontinent to invest and manufacture their goods here.

China has in particular shown a keen interest in India’s Telecom and E-commerce sector.

Telecom Sector

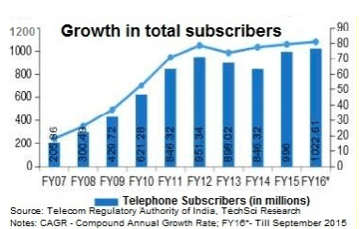

India’s telecommunications market is estimated to grow at 10.3 per cent YOY to reach US$103.9 billion by 2020. India is also poised to become the second largest smartphone market by 2017 overtaking the US; grow five times faster than China which is currently the largest smartphone market in the world; and grab a 14 per cent share in global smartphone market. This certainly makes telecom an attractive sector for investment for China.

(Source)

(Source)

China has made significant deals with India in the telecom sector recently.

OnePlus, the Chinese smartphone manufacturer has tied up with Taiwan based iPhone maker Foxconn to start manufacturing its devices in India. OnePlus plans to manufacture 90 per cent of its devices sold in India locally.

The Chinese internet ecosystem company LeEco has invested US$7M to manufacture Le2 smartphones in India in association with Taiwan’s Compal Electronics.

The Chinese handset retailer Beijing Digital Telecom has acquired 49 per cent stake in Spice Online, the online retail arm of Spice Group.

China’s telecom gear maker Huawei has strengthened its footprint in India through setting up its largest Global Service Centre (GSC) at Bengaluru at an investment of INR136 crore (US$20.28 mn). Prior to this, Huawei had invested US$170M in its R&D sector in Bengaluru.

The Chinese smartphone maker Gionee has announced investment of INR500 crore (US$74.56M) to set up a manufacturing facility in India. Currently, Gionee assembles more than half of its devices through Foxconn and Dixon on a contract basis.

Chinese handset and components makers are likely to further invest US$2B to US$3B over a period of next two years.

(Source)

(Source)

E-commerce

A report by Credit Suisse revealed that India’s internet and e-commerce growth bears close similarity with that of China, with a lag of 8-10 years. It is also believed that the number of Indians with the internet access in the next five years will reach the level of China as it was back in 2012. India’s internet users will double from 350 million to 730 million by 2020. Also, given that India is now the third biggest startup hub (a majority of them being e-commerce ones), in the world, the Chinese investors hope to repeat the success story of their country in India.

Another reason that the Indian e-commerce sector is a fertile ground for Chinese investments is that it still remains untapped by the US companies, barring Amazon and Uber. So, the Chinese want to take the first mover advantage and cash on the big opportunities that India is offering in its e-commerce space.

There have been some big ticket e-commerce deals that have further fuelled the investment interest of other Chinese investors back home. For instance, Didi Kauidi-Ola (US$900M), Alibaba/Ant Financial-Paytm (US$890M), Alibaba/Soft Bank-Snapdeal (US$500M), and Tencent-Practo (US$120M). The year 2016 has been so far a good year for the Indian e-commerce companies such as CarDekho, Hungama and Hike among a few others, having received financial backing from China.

In the coming months, the Indian e-commerce market may expect pleasant surprises. Alibaba is gearing up to strengthen its foothold by – it is eyeing the logistics companies Delhivery and Xpressbees. It is believed that Alibaba may also set up a team to explore possible M&A opportunities. Even the Chinese logistics firms such as SF Express, STO Express and TTK express are looking at entering the e-commerce delivery space in India. China’s internet giant Baidu is seriously contemplating to enter India and is in the talks with e-commerce companies such as Zomato, Big Basket, Mydala and BookMyShow.

In the coming months, the Indian e-commerce market may expect pleasant surprises. Alibaba is gearing up to strengthen its foothold by – it is eyeing the logistics companies Delhivery and Xpressbees. It is believed that Alibaba may also set up a team to explore possible M&A opportunities. Even the Chinese logistics firms such as SF Express, STO Express and TTK express are looking at entering the e-commerce delivery space in India. China’s internet giant Baidu is seriously contemplating to enter India and is in the talks with e-commerce companies such as Zomato, Big Basket, Mydala and BookMyShow.

But…There Are Challenges…

While both India and China are actively engaged in giving a push to their investment relations, there are challenges that need to be taken care to make their efforts fruitful.

The Chinese firms must acclimatise themselves with India’s complex tax laws that vary from state to state, despite the obvious relaxation, in order to safeguard themselves. The introduction of GST, which is touted similar to China’s, should be of some relief to the Chinese investors.

India’s labour laws are also undergoing changes and a sound understanding of the prevailing laws is also a must for Chinese investors.

Given the slow pace of implementation and the slow-moving legal system, the Chinese companies must study their risks thoroughly before making their investments.

The standoff between major political issues between the two countries silently acts as deterrents and even poses unforeseen threats to bilateral trade progress.

China has invested much more in infrastructure development in the neighbouring countries of Nepal, Pakistan and even Sri Lanka as compared to India, and this seems to point at isolating and marginalising India, which is worrisome.

China is also facing serious competition in terms of investment from Taiwan, which has overtaken the latter in Vietnam already and is keen to replay the same success in India as well.

The FDI from China to India is relatively smaller, less than 0.5 per cent of the total FDI. Also, there is a bilateral trade deficit in India, as China seems more keen to export finished products to India than take imports from India (primarily raw material centric). India has been urging China to take the investment path to close on the trade deficit.

Both the countries seem keen to bridge the investment gap. There are many counterpart units being set up in both the nations, to act as facilitators for a robust investment roadmap and a smoother execution of strategic business deals. India’s top brass in governance has reached out in multiple forums to assure China of its dedicated efforts to ensure ease of conducting business with India.

With such focus, the future looks promising. China will need to tread carefully and India will have to live up to its promises to keep the momentum going.

—

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your article here.

—

Image Credit: ximagination / 123RF Stock Photo

The post Despite a frosty relationship, why is China so interested in investing in India? appeared first on e27.

from e27 http://e27.co/chinas-growing-investment-interest-in-india-with-a-special-focus-on-some-sectors-20161110/

[Source]

[Source] [Source]

[Source]