//

You will never know as much as your lawyers do about the legal services they provide to you. It is a classic asymmetry of information, where the party that knows less gets the worse deal. In this case, that is you, the startup founder.

As an attorney and a co-founder of a venture-backed startup that made it over the finish line, I have been on both sides of the table. Through that experience, I’ve adopted an approach for managing legal spend which you can use to help ensure that you get the most from the money you put toward legal fees.

Have you had a great experience with a startup lawyer? Tell us in this brief survey.

Overview of Common Fee Structures

There are really only three legal fee structures: flat, hourly and contingency. In addition to these, attorneys may charge differently for consultations (free vs. paid), may or may not require a retainer to be paid before starting work, and perhaps will entertain certain forms of deferred compensation, such as delayed payment or equity in lieu of cash (though most will not, knowing that odds are well stacked against your startup).

Flat fees. Always good for self-contained, relatively routine legal tasks, such as business formation and subsequent stock issuance, standard IP assignments, employee handbooks, employee compensation plans, trademarks, etc. In the ideal case, you are paying your lawyer to do something they have done a hundred times before, with only minor tweaks along the way – it is predictable work that comes at a predictable price. Recent changes to the California Rules of Professional Conduct (effective 11/1/2018) have provided further guidance to lawyers and clients concerning flat fee structures, making them relatively more transparent in theory, if not in practice.

The key question for flat fees, of course, is how much should your particular matter cost? The most accurate answer here, unsurprisingly, is that “it depends” – on the experience of the attorney, on the particular legal task at hand, on your unique business circumstances, etc. While the typical business incorporation might be $2,000 all-in, a seed financing (assuming common forms are used) could be anywhere between $5,000 and $20,000).

What are the exact flat fees you should pay? We’ll have more on that soon.

Hourly fees. This is the preferred method of billing for most attorneys, not necessarily because it results in more total fees, but because the lawyer has at least some assurance she will not end up working “for free” when the client inevitably has additional questions, makes unexpected changes, or requires counsel on ancillary topics. The particular hourly rate you pay depends primarily on the experience of the attorney, usually measured in years (the absolute minimum I would suggest you consider is three years), with most solo practitioners charging somewhere between $175 to $300 per hour, boutique firms charging between $300 and $500 per hour, and large firms charging anywhere between $400 (junior associates) to $950 (experienced partners) per hour — though everything in Manhattan is more expensive.

Contingency fees. While conceptually intriguing to some, contingency fees (usually 30 percent to 40 percent of the amount potentially awarded in a given legal matter, hence the contingency) are not typically relevant for early-stage startups where the goal is generally to avoid litigation. For that reason, I will focus mostly on flat versus hourly fees.

Finally, when it comes to retainer fees, it is helpful to know that lawyers must follow strict trust accounting practices (see Rules of Professional Conduct 4-100; and also Rule 4-200 for attorney fees in general). You can even reference these rules if you ever find yourself in a fee dispute. Remember, too, that government administrative or filing fees (e.g. the cost of filing for a trademark) are always distinct from the fees paid to compensate your lawyer and therefore should be itemized separately on any billing statement you receive.

How to Keep the Fees Down

Given that background, there are a number of things you can do to help keep your lawyer fees in check:

1. Hire lawyers who have experience with the particular task you are asking them to perform. Most lawyers have a specialty of some sort (however broadly defined) in which they are most adept and therefore efficient. The last thing you want to do is pay a lawyer to educate themselves in a new practice area. Lawyers will generally list their core practice areas on their website, and it is in these areas they are most likely to be proficient. It would be a mistake in my opinion to hire a lawyer to do any work outside the explicitly enumerated practice areas shown on their website. If you are considering hiring a true business generalist, then at least try to get a sense for the practice areas in which he or she most often provides counsel and be sure there is significant overlap with your needs, including experience working with startups specifically; also, consider ratcheting up the required minimum level of experience to at least 7-10 years.

2. Educate yourself and then let your lawyer know you understand the basics. Today there are numerous high-quality, free templates and other resources available for the most common legal tasks facing startups (see links below). If you need new Terms of Service, for example, carefully read one of the many templates available, insert comments where you see fit, and pass on this marvelous example of intellectual aspiration to your attorney for final drafting. This will let the attorney know you have a basic understanding of what the assignment entails and at the very least reduce perceived asymmetries of information, improving your relative bargaining position.

a. Startup documents: Docracy, Upcounsel, Cooley Go.

b. Financing documents – Y Combinator, NVCA, SeriesSeed.

3. Ask to be notified when a certain dollar amount has been billed, or to receive an informal billing update at the end of each week (even if the billing is not strictly itemized). When subject to hourly billing, it is always a good idea to stay informed of where exactly you stand. While providing detailed off-cycle billing can be a burden for lawyers, providing an informal billing update to a client generally is not and most attorneys will oblige. Also, it never hurts to ask your lawyer for time/cost estimates before starting an assignment — here again you can request the attorney notify you when they surpass their estimate; if only subconsciously, you have anchored the amount the attorney believes is appropriate to bill on the matter, which can provide you leverage on future assignments if they ultimately exceed that amount.

4. Ask for an “emerging company” discount. Most lawyers who work with startups are willing to provide discounts to smaller companies: in the case of large firms, to attract the most well-funded startups; and in the case of smaller firms or solo practitioners, to better serve their primary client type — small, undercapitalized enterprises. Remember, too, most solo practitioners are themselves entrepreneurs who have taken the risk of launching their own businesses (albeit a law firm) so they can be surprisingly sympathetic to other founders in the same situation.

5. Consider deferred fee structures. Deferred fee structures generally involve payment in something other than cash, or payment at a time in the future; there are two primary types: (a) payment of fees delayed until close of pending investment; and (b) equity (or other consideration) offered in lieu of cash. I once heard of an attorney who accepted a vintage Martin acoustic guitar as full payment for fees in the high four-figure range. Although I would very carefully consider any deferred fee structures — because they can create a misalignment of incentives (or worse, an outright conflict of interest) — they can in certain situations be a workable choice for cash-strapped startups and risk-tolerant attorneys.

6. Get clarity on costs, expenses, billing rates for administrative assistants, paralegals, etc. One advantage to working with firms who staff assistants, paralegals, junior and senior associates — all of whom support the partners of a firm — is that billable rates generally range from lowest to highest, respectively. Whenever possible, you can request that paralegals and junior associates do the most routine (yet time-consuming) work, leaving critical negotiations to the partners and high-level drafting to senior associates. Finally, make sure you understand in advance what costs and expenses the firm will pass on to you (e.g. photocopying, postage, couriers, travel) and whenever possible, ask if these costs can be waived or reduced.

Follow these tips from the outset and with some experience, you can be sure that you will efficiently allocate resources against your legal service needs.

On that note, have you already had a great experience with a startup lawyer? TechCrunch is looking for the ones founders love to work with the most. Fill out this quick survey to tell us about your experiences and we’ll share the results with you.

Daniel T. McKenzie, Esq., manages the Law Offices of Daniel McKenzie, specializing in the representation of startups and startup founders. Prior to establishing his law offices, Daniel McKenzie co-founded and served as lead in-house counsel for Reelio, Inc., backed by eVentures, and acquired in 2018 by Fullscreen (a subsidiary Otter Media and AT&T).

DISCLAIMER: This post discusses general legal issues, but it does not constitute legal advice in any respect. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel in the relevant jurisdiction. TechCrunch, the author and the author’s firm expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this post.

from Startups – TechCrunch https://tcrn.ch/2RFpqWr

“I don’t have an altruistic reason to care about retail, but I really want to put a dent in the universe and I think retail is severely under-innovated” Gao candidly remarked. Most founders try to spin a “super hero origin story” about why they’re the right person for the job. For Gao, chasing autonomous retail is just good business. He built is first startup in gaming commerce at age 14. The jewelry company he launched at 19 still operates. He went on to become an investment banker at Goldman Sachs and JP Morgan but “I always felt like I was more of a startup guy.”

“I don’t have an altruistic reason to care about retail, but I really want to put a dent in the universe and I think retail is severely under-innovated” Gao candidly remarked. Most founders try to spin a “super hero origin story” about why they’re the right person for the job. For Gao, chasing autonomous retail is just good business. He built is first startup in gaming commerce at age 14. The jewelry company he launched at 19 still operates. He went on to become an investment banker at Goldman Sachs and JP Morgan but “I always felt like I was more of a startup guy.”

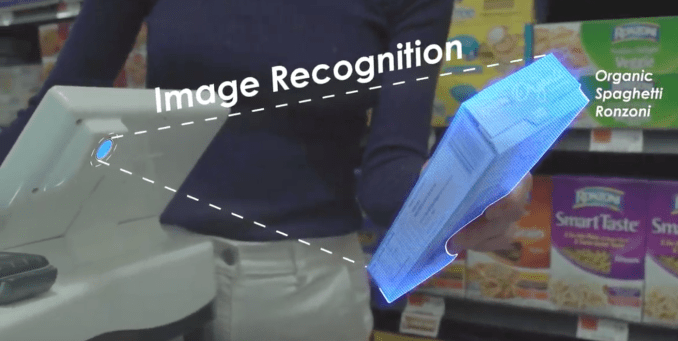

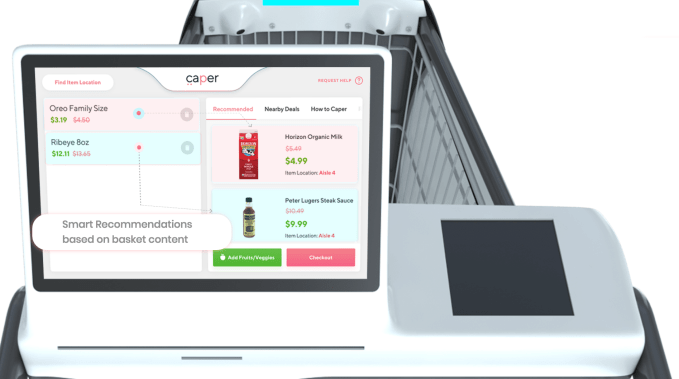

Soon, Caper wants to go entirely scanless, and sections of its two pilot stores already use the technology. The cameras on the cart will use image recognition matched with weight sensor to identify what you toss in your cart. You shop just like normal but then just pay and leave with no line. Caper pulls in a store’s existing security feed to help detect shoplifting, which could be a bigger risk than with ceiling and shelf camera systems, but Gao says it hasn’t been a problem yet. He woudn’t reveal the price of the carts but said “they’re not that much more expensive than a standard shopping cart. To outfit a store it should be comparable to the price of implementing traditional self-checkout.” Shops buy the carts outright and pay a technology subscriptions but get free hardware upgrades.

Soon, Caper wants to go entirely scanless, and sections of its two pilot stores already use the technology. The cameras on the cart will use image recognition matched with weight sensor to identify what you toss in your cart. You shop just like normal but then just pay and leave with no line. Caper pulls in a store’s existing security feed to help detect shoplifting, which could be a bigger risk than with ceiling and shelf camera systems, but Gao says it hasn’t been a problem yet. He woudn’t reveal the price of the carts but said “they’re not that much more expensive than a standard shopping cart. To outfit a store it should be comparable to the price of implementing traditional self-checkout.” Shops buy the carts outright and pay a technology subscriptions but get free hardware upgrades.

New investment figures published by the U.K.’s London & Partners and Pitchbook show that British tech firms raised a total of £2.49 billion in 2018, down from £3.12 billion the previous year. London, both the capital and the economic heart of the country, was responsible for about 72 percent of the actions, with tech companies based in the city raising £1.8 billion during the year, again down from £2.53 billion in 2017.

New investment figures published by the U.K.’s London & Partners and Pitchbook show that British tech firms raised a total of £2.49 billion in 2018, down from £3.12 billion the previous year. London, both the capital and the economic heart of the country, was responsible for about 72 percent of the actions, with tech companies based in the city raising £1.8 billion during the year, again down from £2.53 billion in 2017. Despite the drop in total venture capital investment from 2017, the figures show that both the U.K. and its capital remain the most meaningful markets for tech startups in Europe in 2018. Among the top three countries by total venture capital funding poured into technology companies in 2018, the U.K. dominates with £2.49 billion, followed by Germany with £1.38 billion and France at the last place with £1.03 billion. Looking at the top three cities we get a similar picture with London leading with £1.8 billion, Berlin at second place with £936.53 million and last comes Paris with £797.04 million.

Despite the drop in total venture capital investment from 2017, the figures show that both the U.K. and its capital remain the most meaningful markets for tech startups in Europe in 2018. Among the top three countries by total venture capital funding poured into technology companies in 2018, the U.K. dominates with £2.49 billion, followed by Germany with £1.38 billion and France at the last place with £1.03 billion. Looking at the top three cities we get a similar picture with London leading with £1.8 billion, Berlin at second place with £936.53 million and last comes Paris with £797.04 million.