Quel que soit votre secteur d’activité, savoir se débrouiller en anglais est un « must » pour tous les entrepreneurs. Il est ainsi indispensable d’apprendre l’anglais pour pouvoir se débrouiller un minimum, tant sur le plan personnel (pour les voyages par exemple) que professionnel (gérer des clients étrangers, utiliser des logiciels informatiques, etc.).

L’anglais, la langue universelle

L’anglais est la plus indispensable des langues car elle est considérée comme le point de rencontre mondial au niveau linguistique. Un polonais et un espagnol parleront anglais entre eux, par exemple. La langue de Shakespeare reste la référence et par conséquent une étape obligatoire pour pouvoir lancer sa startup.

Il est donc important de commencer par apprendre l’anglais basique, les structures des phrases etc. afin de pouvoir bâtir le socle qui vous servira de base à l’anglais professionnel. Pour cela, il vous faudra suivre des formations spécifiques d’anglais, bien évidemment. Mais rien ne remplace la pratique et les conversations pour apprendre une nouvelle langue, donc n’hésitez pas à demander à votre entourage de faire quelques sessions « en anglais » autour d’un café ou d’une bière afin de mettre en pratique vos leçons et de dédramatiser le fait de parler une langue qu’on ne maîtrise pas encore complètement.

L’anglais professionnel

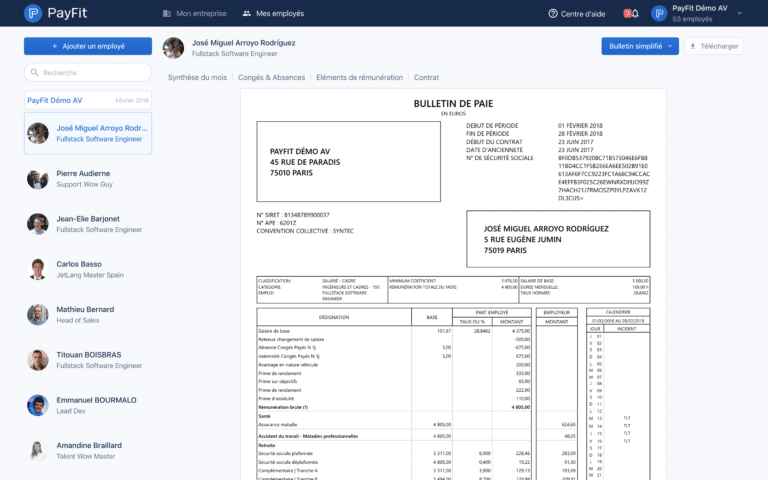

Une fois les principes de base maîtrisés, il vous faudra ensuite vous lancer dans le grand bain de l’anglais professionnel. En effet, de nombreux mots sont courants dans la vie professionnelle mais pas dans la vie personnelle ou dans les leçons d’anglais basique : organiser une réunion, demander un devis ou une facture, planifier une livraison, connaitre les horaires d’ouvertures d’un fournisseur, demander un transfert bancaire, utiliser un logiciel informatique disponible uniquement en anglais, etc. Autant de vocabulaire indispensable à apprendre patiemment en suivant des formations spécifiques et interactives. Ne soyez pas timides : plus vous pratiquerez l’anglais oralement, plus vos progrès seront rapides et votre motivation en hausse.

Les différents accents – un problème récurrent

Bien qu’étant la langue universelle, les accents varient beaucoup d’une personne à une autre selon son pays d’origine. L’accent américain peut sembler plus abordable de prime abord, mais c’est souvent parce que l’on est habitué à entendre l’accent de la côte est (new yorkais) dans nos séries télé. Un texan ou un américain venant du middle-west auront des accents très marqués qui seront difficile à apprivoiser au début.

L’accent anglais est lui aussi assez marqué, même si les londoniens ont généralement un accent plus passe-partout. Les accents écossais et irlandais sont très prononcés et de nombreux interlocuteurs le cultive comme une tradition ancestrale. Les accents canadiens ou encore australiens sont plutôt agréables et rafraichissants.

Les accents les plus difficiles à apprivoiser sont probablement les accents des personnes qui ne sont pas anglophones directement. Un chinois, un espagnol, un indien ou encore un italien qui parle anglais sont bien souvent plus difficile à comprendre qu’un anglophone natif. Mais pas de panique, la pratique, la patience et le travail vous permettront de vous habituer à ces différences linguistiques et à les apprivoiser sans soucis.

L’anglais spécifique à votre secteur d’activité

En plus de l’anglais professionnel de base, il sera important d’identifier les mots, expressions et acronymes spécifiques à votre secteur d’activité, afin de pouvoir rapidement les noter et les apprendre. Ici encore, rien ne remplacera le travail et la patience. N’hésitez pas à demander de l’aide à vos collègues lorsque, au cours d’une réunion, un mot ou une expression que vous ne connaissez pas et comprenez pas est prononcé. Mieux vaut demander de l’aide dès le départ plutôt qu’attendre plusieurs semaines et enchainer les bourdes !