//

The Wing opened its doors to entrepreneurial women in New York City in 2016 with the support of about $2.5 million in seed funding, marketing itself as a place for women of diverse backgrounds to meet and do work. Now, as it officially amends its membership policy to allow all genders — yes, men included — it will have to work harder to stay true to its promise and purpose: to create a feminist co-working empire.

In two years, The Wing built a committed social media following and launched an in-house magazine and an online store offering merchandise adorned with third-wave feminist catchphrases. It established additional co-working spaces in New York, Washington, DC and San Francisco and entered into financial agreements with high-profile venture capitalists. Just three weeks ago, The Wing company announced a $75 million Sequoia-led Series C funding that more than doubled the New York-based female-founded startup’s previous valuation to $375 million, according to PitchBook.

While The Wing grew its community of female-identifying members to more than 6,000, debates surrounding its anti-male doctrine sprang up on and off the internet. Men aren’t allowed in The Wing — is that legal? Many questioned. No, probably not. Why? Because as much as The Wing disguises itself as a social club, it’s technically too large to benefit from laws that actually permit those sorts of groups to practice gender discrimination, according to a Jezebel report. So yes, male-only social clubs were able to thrive for decades because they were lean — small enough to legally discriminate. Still, there’s no reason The Wing needed to bar men from accessing its properties and resources, other than the fact that there have been protected male safe-havens promoting business and entrepreneurship for a very long time, while female-focused rooms of that sort have been few and far between.

Thought pieces were written, Tweets were sent and the New York City Commission on Human Rights opened a “commission-initiated investigation,” which is still ongoing, according to The Wing. Then a man by the name of James Pietrangelo filed a $12 million lawsuit against The Wing alleging its “illegal discrimination against men … was/is egregious: brazen, flagrant, intentional, willful, wanton, actually malicious, motivated by evil and ill-will, deliberately oppressive, outrageous, and willfully and callus disregardful of the rights of men.”

Pietrangelo takes issue with essentially every piece of The Wing’s DNA: its slogans, decor, schemes and employees. “The Wing’s brazen attitude towards the law and the civil rights of men can be summed up by one of The Wing’s own favorite slogans: “Girls Doing Whatever The F*ck They Want,” the lawsuit states.

“Of the 53 corporate and/or front-of-the-house positions, identified on the wing’s About page of its website, all 53 are women — arguably a statistical impossibility if the wing is not discriminating based on sex and/or gender-identity,” it continues.

Now, The Wing says it’s altered its membership policy to allow access to anyone, as first reported by Insider. The company, however, said the transition has been planned for some time and is not a result of the ongoing lawsuit: “The membership policy was codified and adopted before the lawsuit,” a spokesperson for The Wing told TechCrunch.

Keychains for sale on The Wing’s online shop.

“Gender identity and gender presentation are two distinct concepts and do not always align,” co-founder and chief executive Audrey Gelman wrote in a letter to members announcing the policy amendment. “To that end, we’ve made some internal updates and adopted written membership policies to ensure that our staff is trained not to make assumptions about someone’s identity based on how they present, or to ask prospective members or guests to self-identify. We initiated these trainings and policies so that we can continue to build a community that reflects our values and pushes us all to be more inclusive.”

As for how new membership policies will change The Wing’s female-friendly environment and community of women, that’s to be determined. The company is still figuring out just how it will ensure any new members believe and respect its mission of promoting women.

Ultimately, The Wing’s decision to open up membership is good business. Given that it is a space meant for entrepreneurs to get work done, it makes sense that it would be inclusive of all genders, as women and non-binary folk often build businesses with cisgender males, too. The Riveter, another female-focused co-working startup, has allowed men in from the very beginning for that very reason.

“I don’t think the future is female, I think the future is fluid,” The Riveter founder and CEO Amy Nelson told TechCrunch last month. “Gender is becoming an outdated idea but at the same time, it’s important to think of women when we build these spaces … There is a lot of value to women’s only spaces but our take on it is we want to redefine the future of work for women and we want everyone to be part of it.”

Despite demonstrating a certain brand of millennial feminism that isn’t inclusive or appealing to all, The Wing has been very blatant about its diversity and inclusion efforts since its beginning. Sure, it’s learned and adapted along the way, but considering the dearth of attempts in Silicon Valley to create safe spaces for women or to fund women’s businesses, The Wing’s efforts to promote women should be encouraged rather than torn down.

from Startups – TechCrunch https://tcrn.ch/2SIU1jo

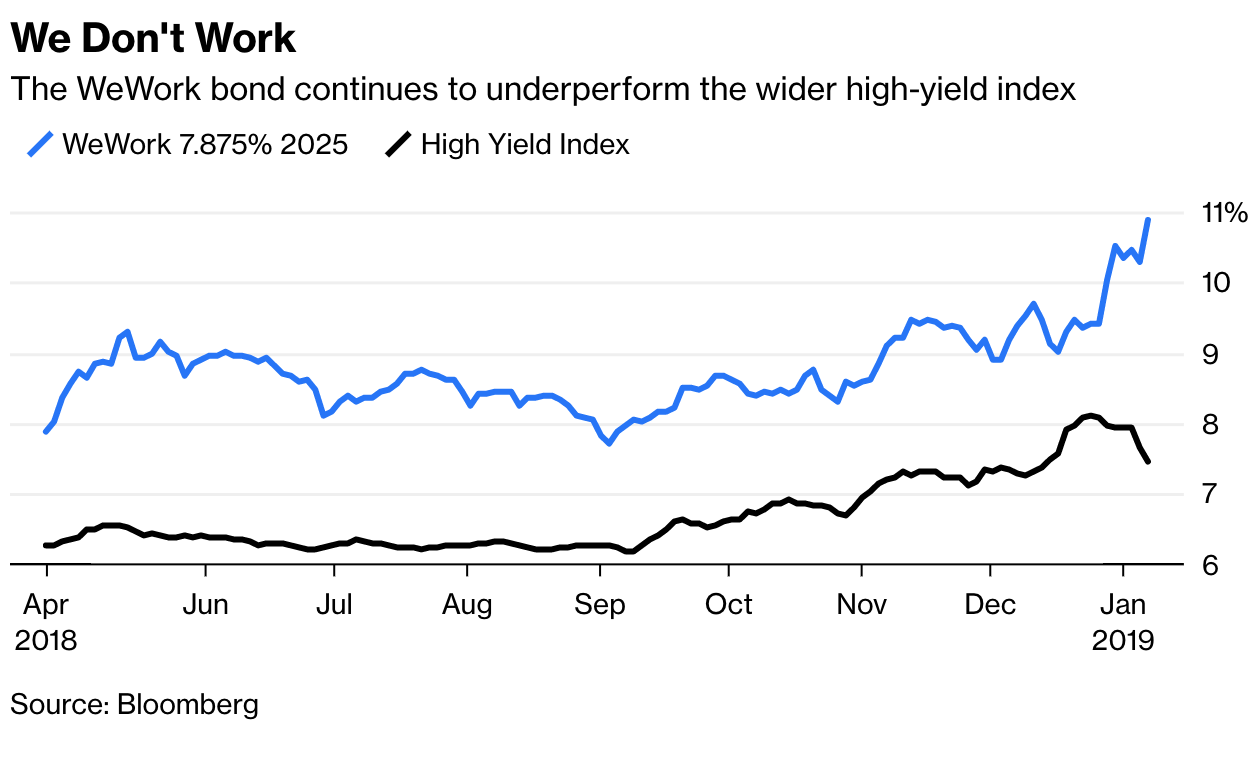

Neumann said the original vision of the company was an all-encompassing network of offerings that would help customers bank, shop, live and play. That’s a mighty goal worthy of a Vision Fund, but its vision may turn out to be a fever dream if the indicators are right and the worldwide slide into recession finally happens.

Neumann said the original vision of the company was an all-encompassing network of offerings that would help customers bank, shop, live and play. That’s a mighty goal worthy of a Vision Fund, but its vision may turn out to be a fever dream if the indicators are right and the worldwide slide into recession finally happens.

Binance, currently the largest crypto exchange by daily trading volume, has

Binance, currently the largest crypto exchange by daily trading volume, has  Security token trading platform Tzero, a subsidiary of Overstock, has secured a patent for a platform that allows integration between traditional trading systems and digital asset exchanges. Tzero’s Crypto Integration Platform is designed to serve as an interface between the two types of systems.

Security token trading platform Tzero, a subsidiary of Overstock, has secured a patent for a platform that allows integration between traditional trading systems and digital asset exchanges. Tzero’s Crypto Integration Platform is designed to serve as an interface between the two types of systems. Jason Williams, co-founder of Morgan Creek Digital Assets, recently tweeted that he is about “to do something that has never been done in crypto.” According to the post, Williams’s Lamborghini is up for sale and the owner wants to buy cryptocurrency with the money he gets for the car. “Offers in BTC accepted,” the entrepreneur noted as well.

Jason Williams, co-founder of Morgan Creek Digital Assets, recently tweeted that he is about “to do something that has never been done in crypto.” According to the post, Williams’s Lamborghini is up for sale and the owner wants to buy cryptocurrency with the money he gets for the car. “Offers in BTC accepted,” the entrepreneur noted as well. Safe storage should be a priority for any investor in possession of large amounts of digital cash. According to the local press, many Brazilians don’t feel that hard wallets and secure passwords provide enough protection. Local companies manufacturing and building physical vaults have registered a growing demand for their services from cryptocurrency owners, which has actually revived the industry.

Safe storage should be a priority for any investor in possession of large amounts of digital cash. According to the local press, many Brazilians don’t feel that hard wallets and secure passwords provide enough protection. Local companies manufacturing and building physical vaults have registered a growing demand for their services from cryptocurrency owners, which has actually revived the industry.

The

The  The paper utilizes a “revenue-cost model from the point of view of miners” to value BTC. The model is based on the assumption that there is “market equilibrium in the mining industry.”

The paper utilizes a “revenue-cost model from the point of view of miners” to value BTC. The model is based on the assumption that there is “market equilibrium in the mining industry.”