//

More posts by this contributor

2018 saw Africa’s tech sector become more dynamic and international. VC firms on the continent multiplied. There were numerous investment rounds. And startups pursued acquisitions and global expansion. Here’s a snapshot of the news that shaped African tech over the last year.

Surge in VC funds

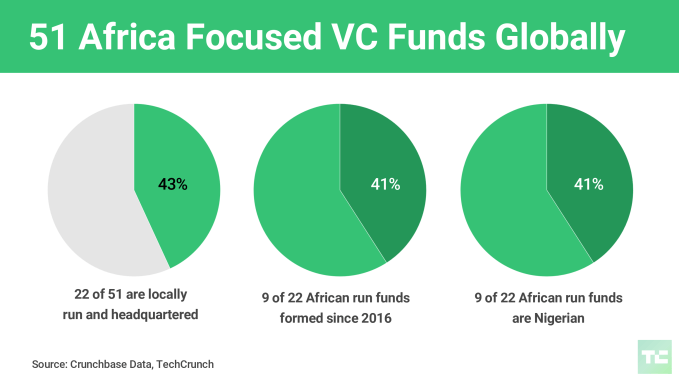

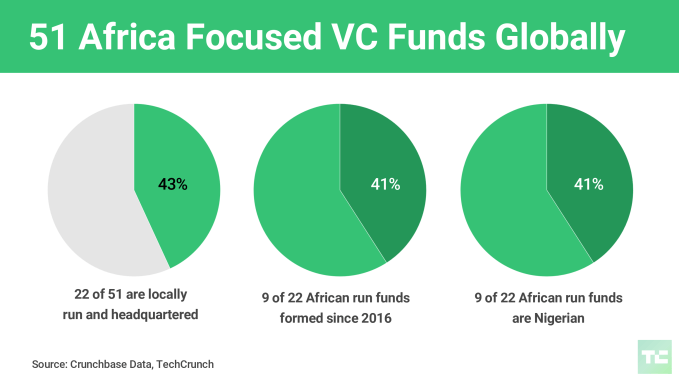

A notable 2018 trend was Africa’s VC landscape becoming more African, with an increasing number of investment funds headquartered on the continent and run by locals, according to Crunchbase data released in this TechCrunch exclusive.

Drawing on its database and primary source research, Crunchbase identified 51 viable Africa-focused VC funds globally with at least 7-10 investments in African startups from seed to series stage.

Of the 51 funds, 22 (or 43 percent) were headquartered in Africa and managed by Africans. Of those 22, nine (or 41 percent) were formed since 2016 and nine were Nigerian.

Four of the nine Nigeria-based funds were formed within the last year: Microtraction, Neon Ventures, Beta.Ventures and CcHub’s Growth Capital fund.

Four of the nine Nigeria-based funds were formed within the last year: Microtraction, Neon Ventures, Beta.Ventures and CcHub’s Growth Capital fund.

The Crunchbase study also tracked more Africans in top positions at outside funds and the rise of homegrown corporate venture arms.

One of those entities with a corporate venture arm, Naspers, announced a $100 million fund named Naspers Foundry to invest in South African tech startups. This was part of a $300 million (4.6 billion Rand) commitment by the South African media and investment company to support South Africa’s tech sector overall, as reported here at TechCrunch.

Another DFI came on the scene when France announced a $76 million African startup fund administered by the French Development Agency, AFD. TechCrunch got the skinny on how it will work here.

Investment and expansion

If African VC investment headlines were scarce a decade ago, in 2018 we became overwhelmed with them. This was largely a result of several recently closed Africa funds — TLcom’s $40 million, Partech’s $70 million, TPG’s 2 billion — beginning to deploy that capital.

In March, Nigerian consumer data analytics firm Terragon raised $5 million from TLcom. Kenyan business enterprise software company Africa’s Talking raised $8.6 million in a round led by IFC.

Investment startup Piggybank.ng closed $1.1 million in seed funding and announced a new product — Smart Target, for traditional savings groups. Trucking Logistics company Kobo360 raised two rounds, for a total of $7.2 million. Kenya-based agtech supply chain startup Twiga Foods raised $10 million. B2B retail supply chain Sokowatch closed a $2 million seed round led by 4DX ventures.

White-label lending startup Mines.io secured a $13 million Series A round. South African SME payment venture Yoco raised $16 million. Paga Payments added $10 million in fresh funding.

White-label lending startup Mines.io secured a $13 million Series A round. South African SME payment venture Yoco raised $16 million. Paga Payments added $10 million in fresh funding.

And then there were the three huge raises of the year. Kenyan digital payment company Cellulant hauled in $37.5 million in a Series C round led by TPG Growth. South African lending startup Jumo raised $52 million led by Goldman Sachs. And just this month, The Carlyle Group invested $40 million in Africa-focused online travel site Wakanow.com.

Acquisitions and expansion

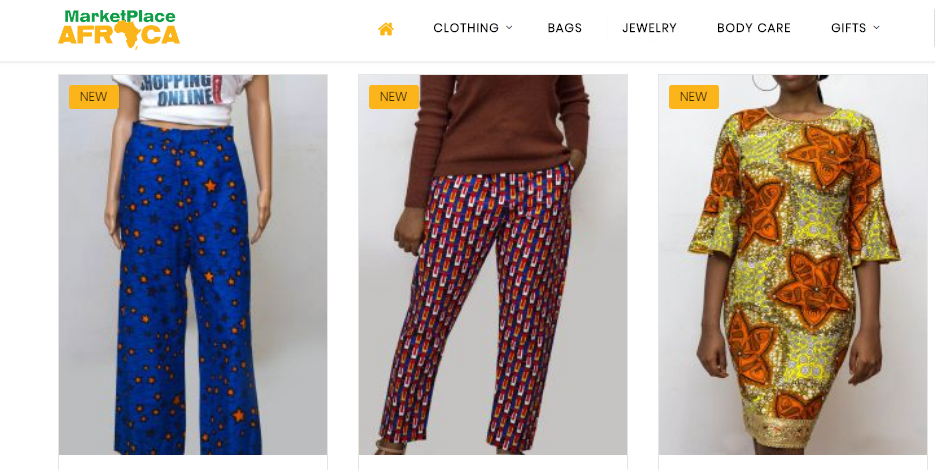

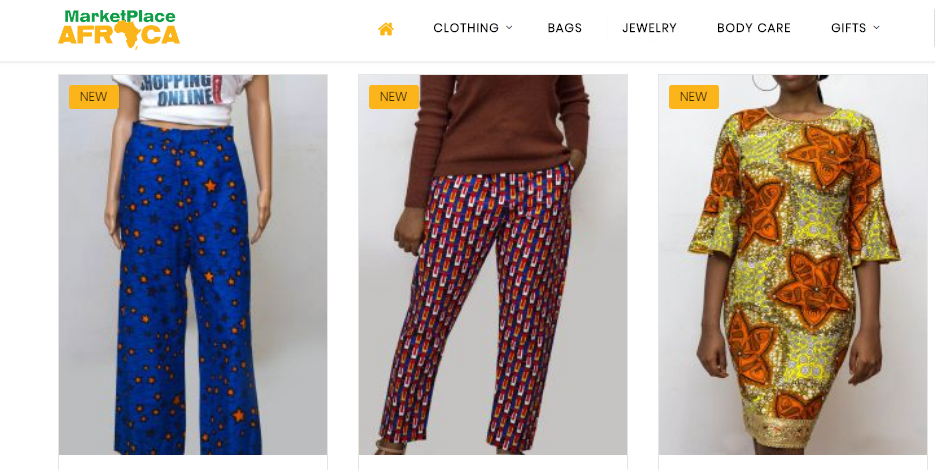

In 2018, African tech demonstrated it can travel, as several digital companies expanded on the continent and abroad. In May, MallforAfrica and DHL launched MarketPlaceAfrica.com, a global e-commerce site for select African artisans to sell wares to buyers in any of DHL’s 220 delivery countries.

Paga announced plans to expand in Africa and internationally, with an eye on Ethiopia, Mexico and the Philippines, CEO Tayo Oviosu told TechCrunch. Kobo360 is moving into in new markets — Ghana, Togo and Cote D’Ivoire.

Paga announced plans to expand in Africa and internationally, with an eye on Ethiopia, Mexico and the Philippines, CEO Tayo Oviosu told TechCrunch. Kobo360 is moving into in new markets — Ghana, Togo and Cote D’Ivoire.

On the back of its $52 million round, Jumo said it would expand in Asia and started by opening an office in Singapore.

On the acquisition front, Terragon bought Asian mobile marketing company Bizense in a cash and stock deal. The company is exploring greater growth opportunities in Latin America and Southeast Asia, CEO Elo Umeh told TechCrunch.

TPG Growth acquired a majority stake (of an undisclosed value) in Africa entertainment content company TRACE. After previous investments, Naspers acquired 96 percent of Southern African e-commerce venture Takealot.

And in December, California-based Emergent Technology Holdings acquired Ghanaian fintech payment company InterpayAfrica.

Partnerships

Collaboration between local tech firms and big global names continued in 2018. Liquid Telecom and Microsoft continued their partnership to offer connectivity cloud services such as Microsoft’s Azure, Dynamics 365 and Office 365 to select startups and hubs. This is part of Liquid Telecom’s strategy to go long on Africa’s startups as its future clients and the continent’s next big companies.

Facebook teamed up with Nigerian tech hub CcHub to launch its NG_Hub high-tech incubator.

Blockchain

As crypto fever gripped many leading economies in 2018, Africa was shaping its own blockchain narrative — one more grounded in utility than speculation. 500 Startups-backed SureRemit launched a crypto token product aimed at disrupting Africa’s multi-billion-dollar remittance market and raised $7 million in an ICO. South African payments venture Wala and solar energy startup Sun Exchange also had ICOs.

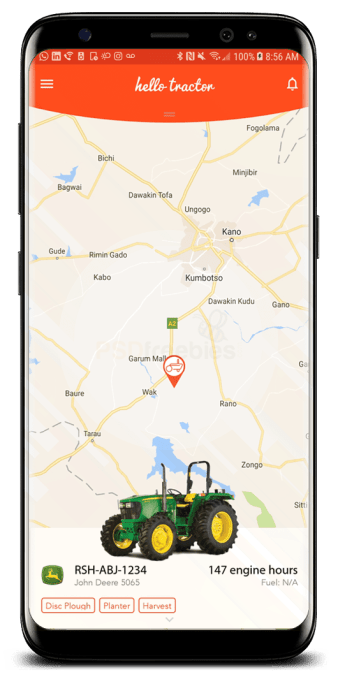

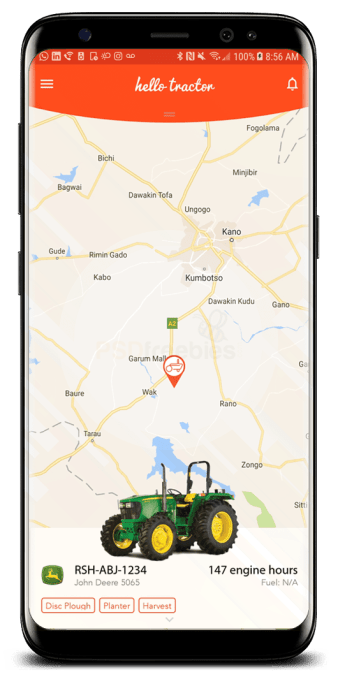

For blockchain as a platform, agtech startups Twiga Foods and Hello Tractor partnered with IBM Research to use the digital ledger tech to advance small-scale farmers and agriculture on the continent.

For blockchain as a platform, agtech startups Twiga Foods and Hello Tractor partnered with IBM Research to use the digital ledger tech to advance small-scale farmers and agriculture on the continent.

Ride-hail boda bodas

Ride-hail tech expanded into the continent’s frequently used motorcycle taxi market. Uber entered the three-wheeled tuk tuk moto taxi market in Tanzania in March and Uber and Taxify launched motorcycle passenger services in East Africa, including Kenya and Uganda.

Fails

Last year saw Y Combinator-backed VOD startup Afrostream shutter. In February 2018, Nigerian e-commerce startup Konga — backed by VC — was sold in a distressed acquisition. There were high expectations for Konga and its much-liked founder Sim Shagaya. I made the case that Konga’s acquisition was one of Africa’s first big startup fails that flew under the radar.

Drones

TechCrunch did a deep dive into Africa’s drone scene, talking to several experts and looking at emerging use cases across delivery services, agtech and surveying. On the regulatory side, several countries — Rwanda, Tanzania, South Africa, Zambia and Malawi — are doing some interesting things around regulation and creating drone-testing corridors for global players.

TechCrunch and Africa

In 2018 TechCrunch did more with Africa than any previous year. In addition to more content, there was a market engagement trip to Ghana and Nigeria, with meet-and-greets at Impact Hub, MEST Accra and Lagos, and CcHub.

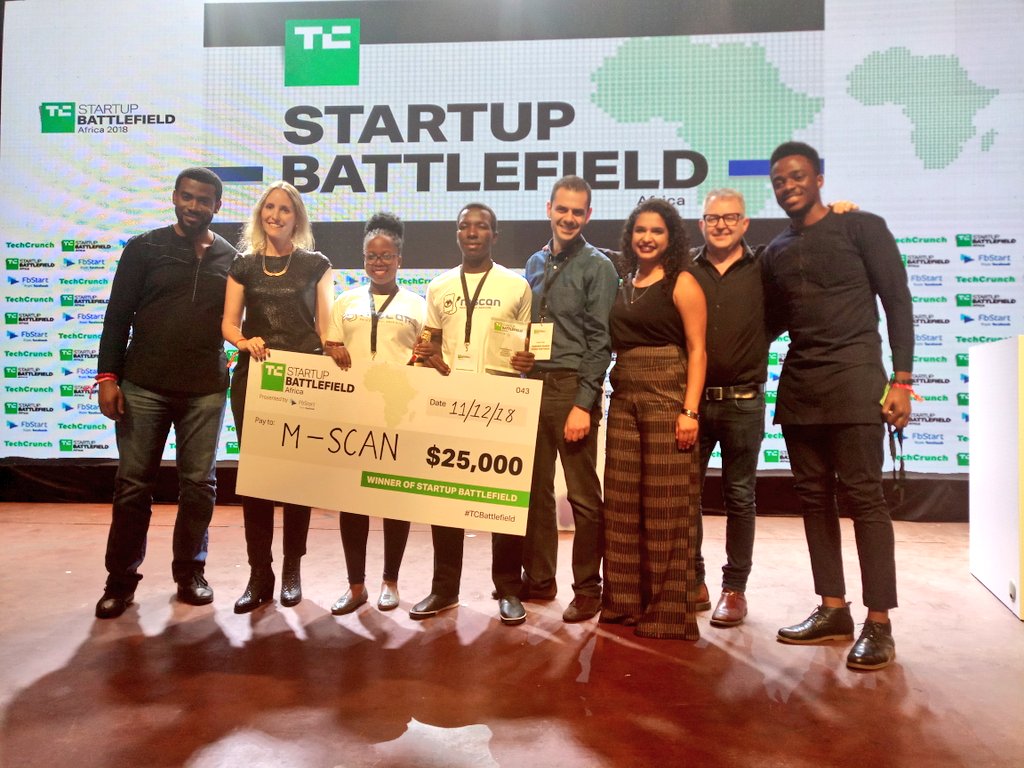

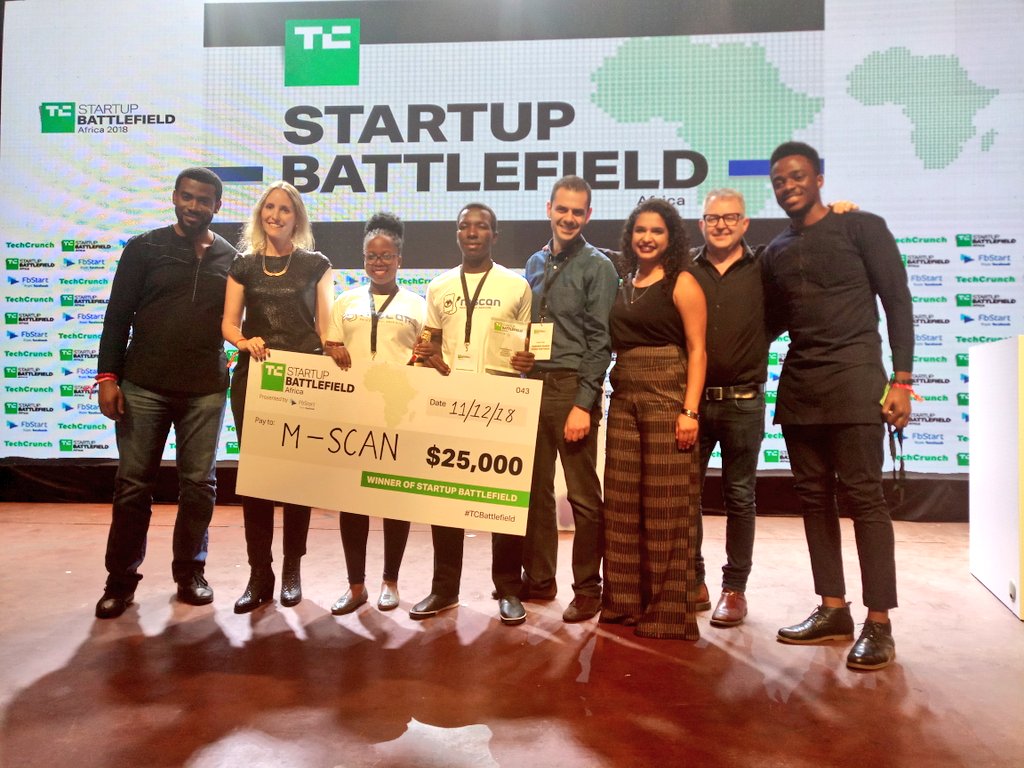

TechCrunch also had its first Africa panel on Disrupt SF’s main stage, an Africa session at Disrupt Berlin and held the second Startup Battlefield Africa in December in Nigeria.

Fifteen startups competed in Lagos in front of a Pan-African and global crowd. South African virtual banking startup Bettr was runner-up. Ultra-affordable ultrasound startup M-Scan from Uganda was the winner.

More Africa-related stories @TechCrunch

African tech around the ‘net

from Startups – TechCrunch https://tcrn.ch/2GJfEyz

Users of the Electrum bitcoin wallet have been targeted in a new phishing attack, the project’s developers

Users of the Electrum bitcoin wallet have been targeted in a new phishing attack, the project’s developers

Huobi Derivative Market’s daily volume has exceeded $1 billion within a month after the launch of the trading service, the Singapore-based cryptocurrency exchange announced. The threshold was reached on Dec. 25, which was also a strong day for the company’s main trading platform, Huobi Global, with the combined trading volume of both Huboi’s platforms amounting to $2 billion on Christmas day. Huobi Global CEO Livio Weng commented:

Huobi Derivative Market’s daily volume has exceeded $1 billion within a month after the launch of the trading service, the Singapore-based cryptocurrency exchange announced. The threshold was reached on Dec. 25, which was also a strong day for the company’s main trading platform, Huobi Global, with the combined trading volume of both Huboi’s platforms amounting to $2 billion on Christmas day. Huobi Global CEO Livio Weng commented: Gustavo Schiavon, one of the founders of the leading Brazilian cryptocurrency exchange Foxbit, has died in a road accident. While driving between Marília and São Paulo, the young entrepreneur reportedly lost control over his car and ran into a cargo truck. Gustavo’s girlfriend, Ariadny Rinolfi, has survived but has been hospitalized in serious condition. Another victim died in the crash that involved a total of two passenger cars and two large trucks.

Gustavo Schiavon, one of the founders of the leading Brazilian cryptocurrency exchange Foxbit, has died in a road accident. While driving between Marília and São Paulo, the young entrepreneur reportedly lost control over his car and ran into a cargo truck. Gustavo’s girlfriend, Ariadny Rinolfi, has survived but has been hospitalized in serious condition. Another victim died in the crash that involved a total of two passenger cars and two large trucks.

This number is 30 more companies than the previous count the agency revealed in August. At that time, the FSA

This number is 30 more companies than the previous count the agency revealed in August. At that time, the FSA  There are currently 16 registered crypto exchanges in Japan. Under the revised Payment Services Act, crypto operators must register with the FSA. Japan also has three deemed dealers, which are companies that have been allowed to operate while their applications are being reviewed by the regulator. They are Coincheck, Lastroots, and Everybody’s Bitcoin.

There are currently 16 registered crypto exchanges in Japan. Under the revised Payment Services Act, crypto operators must register with the FSA. Japan also has three deemed dealers, which are companies that have been allowed to operate while their applications are being reviewed by the regulator. They are Coincheck, Lastroots, and Everybody’s Bitcoin. In September, regulated crypto exchange Zaif was hacked and was subsequently taken over by another regulated exchange,

In September, regulated crypto exchange Zaif was hacked and was subsequently taken over by another regulated exchange,  DMM.com, the parent company of DMM Bitcoin, a regulated crypto exchange, announced on Tuesday that it will no longer launch its Cointap app. The company began accepting registration for this service in January and initially planned to release the app in the spring. The e-commerce giant emphasized that the group will continue to offer crypto trading services at DMM Bitcoin.

DMM.com, the parent company of DMM Bitcoin, a regulated crypto exchange, announced on Tuesday that it will no longer launch its Cointap app. The company began accepting registration for this service in January and initially planned to release the app in the spring. The e-commerce giant emphasized that the group will continue to offer crypto trading services at DMM Bitcoin.