//

K Health, the startup providing consumers with an AI-powered primary care platform, has raised $25 million in series B funding. The round was led by 14W, Comcast Ventures and Mangrove Capital Partners, with participation from Lerer Hippeau, Primary Ventures, BoxGroup, Bessemer Venture Partners and Max Ventures – all previous investors from the company’s seed or Series A rounds.

Co-founded and led by former Vroom CEO and Wix co-CEO, Allon Bloch, K Health (previously Kang Health) looks to equip consumers with a free and easy-to-use application that can provide accurate, personalized, data-driven information about their symptoms and health.

“When your child says their head hurts, you can play doctor for the first two questions or so – where does it hurt? How does it hurt?” Bloch explained in a conversation with TechCrunch. “Then it gets complex really quickly. Are they nauseous or vomiting? Did anything unusual happen? Did you come back from a trip somewhere? Doctors then use differential diagnosis to prove that it’s a tension headache vs other things by ruling out a whole list of chronic or unusual conditions based on their deep knowledge sets.”

K Health’s platform, which currently focuses on primary care, effectively looks to perform a simulation and data-driven version of the differential diagnosis process. On the company’s free mobile app, users spend three-to-four minutes answering an average of 21 questions about their background and the symptoms they’re experiencing.

Using a data set of two billion historical health events over the past 20 years – compiled from doctors notes, lab results, hospitalizations, drug statistics and outcome data – K Health is able to compare users to those with similar symptoms and medical histories before zeroing in on a diagnosis.

With its expansive comparative approach, the platform hopes to offer vastly more thorough, precise and user-specific diagnostic information relative to existing consumer alternatives, like WebMD or – what Bloch calls – “Dr. Google”, which often produce broad, downright frightening, and inaccurate diagnoses.

Ease and efficiency for both consumers and physicians

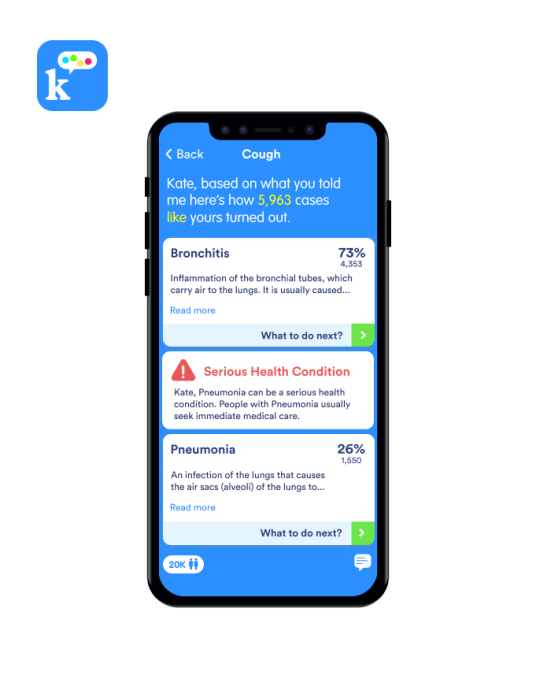

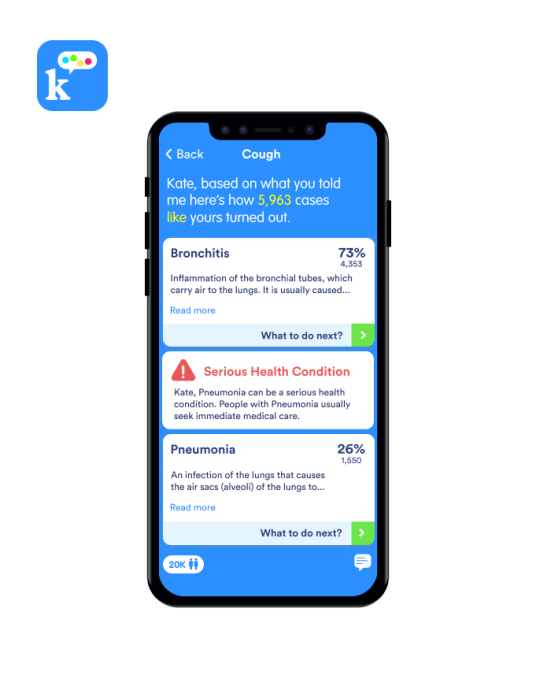

Users are able to see cases and diagnoses that had symptoms similar to their own, with K Health notifying users with serious conditions when to consider seeking immediate care. (K Health Press Image / K Health / https://www.khealth.ai)

In addition to pure peace of mind, the utility provided to consumers is clear. With more accurate at-home diagnostic information, users are able to make better preventative health decisions, avoid costly and unnecessary trips to in-person care centers or appointments with telehealth providers, and engage in constructive conversations with physicians when they do opt for in-person consultations.

K Health isn’t looking to replace doctors, and in fact, believes its platform can unlock tremendous value for physicians and the broader healthcare system by enabling better resource allocation.

Without access to quality, personalized medical information at home, many defer to in-person doctor visits even when it may not be necessary. And with around one primary care physician per 1000 in the US, primary care practitioners are subsequently faced with an overwhelming number of patients and are unable to focus on more complex cases that may require more time and resources. The high volume of patients also forces physicians to allocate budgets for support staff to help interact with patients, collect initial background information and perform less-demanding tasks.

K Health believes that by providing an accurate alternative for those with lighter or more trivial symptoms, it can help lower unnecessary in-person visits, reduce costs for practices and allow physicians to focus on complicated, rare or resource-intensive cases where their expertise can be most useful and where brute machine processing power is less valuable.

The startup is looking to enhance the platform’s symbiotic patient-doctor benefits further in early-2019, when it plans to launch in-app capabilities that allow users to share their AI-driven health conversations directly with physicians, hopefully reducing time spent on information gathering and enabling more-informed treatment.

With K Health’s AI and machine learning capabilities, the platform also gets smarter with every conversation as it captures more outcomes, hopefully enriching the system and becoming more valuable to all parties over time. Initial results seem promising with K Health currently boasting around 500,000 users, most having joined since this past July.

Using access and affordability to improve global health outcomes

With the latest round, the company has raised a total of $37.5 million since its late-2016 founding. K Health plans to use the capital to ramp up marketing efforts, further refine its product and technology, and perform additional research to identify methods for earlier detection and areas outside of primary care where the platform may be valuable.

Longer term, the platform has much broader aspirations of driving better health outcomes, normalizing better preventative health behavior, and creating more efficient and affordable global healthcare systems.

The high costs of the American healthcare system and the impacts they have on health behavior has been well-documented. With heavy copays, premiums and treatment cost, many avoid primary care altogether or opt for more reactionary treatment, leading to worse health outcomes overall.

Issues seen in the American healthcare system are also observable in many emerging market countries with less medical infrastructure. According to the World Health Organization, the international standard for the number of citizens per primary care physician is one for every 1,500 to 2,000 people, with some countries facing much steeper gaps – such as China, where there is only one primary care doctor for every 6,666.

The startup hopes it can help limit the immense costs associated with emerging countries educating millions of doctors for eight-to-ten years and help provide more efficient and accessible healthcare systems much more quickly.

By reducing primary care costs for consumers and operating costs for medical practices, while creating a more convenient diagnostic experience, K Health believes it can improve access to information, ultimately driving earlier detection and better health outcomes for consumers everywhere.

from Startups – TechCrunch https://ift.tt/2PDCDdv

Open Finance Network (OFN), a security token trading platform regulated in the U.S., announced it’s transitioning from beta to full trading functionality. According to a blog post on Medium, one of the security tokens available to trade at launch is Blockchain Capital (BCAP). Blockchain Capital is a tokenized venture capital fund focused on digital assets. OFN notes that this is a compliant security token offering.

Open Finance Network (OFN), a security token trading platform regulated in the U.S., announced it’s transitioning from beta to full trading functionality. According to a blog post on Medium, one of the security tokens available to trade at launch is Blockchain Capital (BCAP). Blockchain Capital is a tokenized venture capital fund focused on digital assets. OFN notes that this is a compliant security token offering. Digital asset exchange and crypto wallet provider

Digital asset exchange and crypto wallet provider

Back in early November, the U.S. successfully pressured the banking transactions network

Back in early November, the U.S. successfully pressured the banking transactions network  Besides individual Iranian citizens, such as students studying abroad, the government of the Islamic Republic may also be using cryptocurrency to dodge economic sanctions. However, this appears to be a very small phenomena so far, as

Besides individual Iranian citizens, such as students studying abroad, the government of the Islamic Republic may also be using cryptocurrency to dodge economic sanctions. However, this appears to be a very small phenomena so far, as