The Blockchain Transparency Institute (BTI) has published its December 2018 “Exchange Volumes Report,” claiming that only two of the top 25 cryptocurrency exchanges by reported volume on Coinmarketcap pairings accurately report their trade volume. The report also asserts that wash-trading is estimated to comprise 99 percent of the purported volume for 12 of the top 25 cryptocurrency pairings by reported volume.

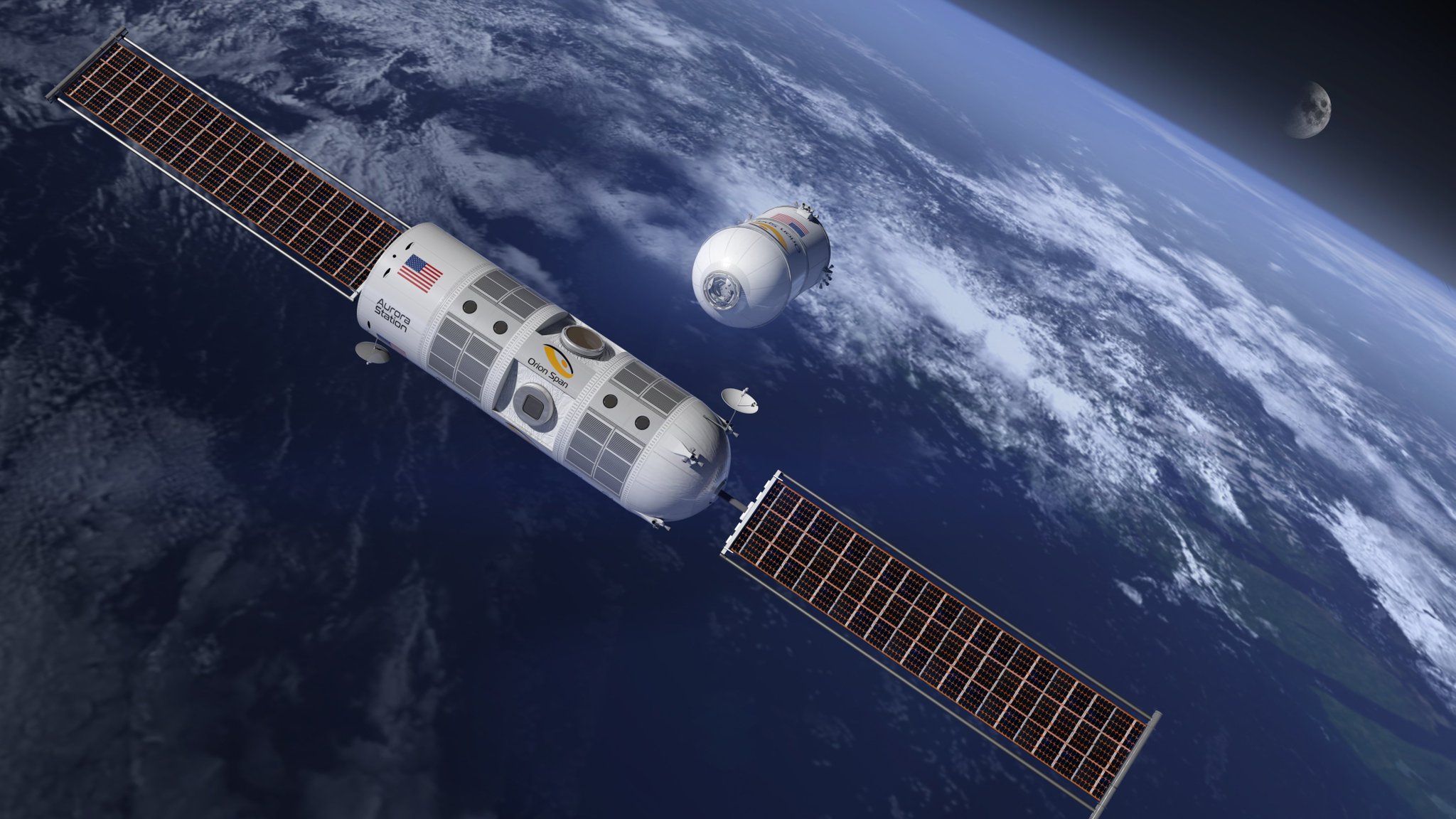

Also Read: Cryptocurrency Enthusiasts Can Pay $10 Million for a 12-Night Stay in Space

BTI Claims Binance and Bitfinex Accurately Report Volume

According to the BTI’s December report, the two largest exchanges by trade volume are Binance and Bitfinex, both of which the report asserts do not distort their volume through wash-trading. According to Coinmarketcap’s reported volume rankings, as of this writing, Binance ranks as the third largest by 24-hour volume, with Bitfinex positioned at 21st place.

According to the BTI’s December report, the two largest exchanges by trade volume are Binance and Bitfinex, both of which the report asserts do not distort their volume through wash-trading. According to Coinmarketcap’s reported volume rankings, as of this writing, Binance ranks as the third largest by 24-hour volume, with Bitfinex positioned at 21st place.

The BTI estimates that Upbit is the third largest exchange, despite ranking 39th on Coinmarketcap, followed by 27th-ranked Kraken, 34-ranked Coinbase, 41st-ranked Bitstamp, 54-ranked Bitflyer, 62nd-ranked Poloniex, 50th-ranked Bittrex, and 55th-ranked Gate.io. As such, BTI estimates that only one of the top 20 exchanges by reported volume should be ranked in the top 10.

The report also takes particular aim at Okex, claiming to have found “just about all of their top 30 traded tokens to be engaging in wash trading.”

Wash-Trading Estimated to Comprise 80% of Reported Volume Among Top 25 Crypto Pairings

BTI’s December volume rankings report also analyzed the purported volume of the top 25 virtual currency pairings by reported trade activity, again finding Binance and Bitfinex to have accurately reported trade volume.

Wash-trading has been estimated to comprise 80 percent of reported volume among top 25 crypto pairings. The BTI also found wash-trading forms 99 percent of trade activity for 12 of the pairings, including Coinbene’s top-ranked BTC/USDT pairing, Oex’s fifth-ranked ETH/BTC pairing, Digifinex’s eighth-ranked BTC/USDT pairing, and Coinbit’s ninth-ranked BTC/KRW pairing.

The BTI estimated only one percent of the reported trade volume to be genuine for the top 25-ranking pairings hosted on Coinsbank, Ooobtc, Rightbtc, Dobi trade, Bcex, Simex, and Coinzest.

Of Adjusted Volume Rankings by Crypto Pairing, 30% Found to Engage in Wash-Trading

Based on BTI’s research, the most-traded cryptocurrencies pairing is Binance’s BTC/USDT pairing, despite ranking third on Coinmarketcap at the time of the report’s publication. The BTI asserts that all of the top five-ranked pairings by adjusted volume to have accurately reported trade activity, with Bitfinex’s then fourth-ranked BTC/USD pairing ranking as the second largest by volume, followed by 33rd-ranked BTC/USD pairing on Coinbase, Bitflyer’s 42nd-ranked BTC/JPY pairing, and Kraken’s 47th-ranked BTC/USD pairing.

Based on BTI’s research, the most-traded cryptocurrencies pairing is Binance’s BTC/USDT pairing, despite ranking third on Coinmarketcap at the time of the report’s publication. The BTI asserts that all of the top five-ranked pairings by adjusted volume to have accurately reported trade activity, with Bitfinex’s then fourth-ranked BTC/USD pairing ranking as the second largest by volume, followed by 33rd-ranked BTC/USD pairing on Coinbase, Bitflyer’s 42nd-ranked BTC/JPY pairing, and Kraken’s 47th-ranked BTC/USD pairing.

Despite the BTI finding only a quarter of the reported volume for the BTC/USDT pairings hosted by Hitbtc and Huobi to be genuine, both pairings retained their rankings as the sixth and seventh most traded cryptocurrency pairings.

Upbit was found to accurately report the volume of its BTC/KRW pairing. According to BTI, the pairing ranks as the eighth-most traded cryptocurrency pairing, despite ranking 60th according to Coinmarketcap. The purportedly second-ranked BTC/USDT on Okex was found to comprise the ninth most traded cryptocurrency market, despite only 11 percent of reported volume having been found to be genuine. BTI found the then 82nd-ranked BTC/USD pairing on Gemini to comprise the tenth most traded market, also estimating reported volume to be accurate.

The BTI warns token projects against paying to list on exchanges suspected of wash-trading, arguing that the tactic is employed to entice aspiring crypto projects into paying exorbitant listing fees.

What is your response to the BTI’s December findings? Share your thoughts in the comments section below!

Images courtesy of Shutterstock

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post BTI Claims Only Two of Top 25 Crypto Exchanges Accurately Report Volume appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2CeyObi BTI Claims Only Two of Top 25 Crypto Exchanges Accurately Report Volume

Social network platform Gab announced on Thursday that its integration of Btcpay Server has been completed. Its store now accepts payments in BTC and LTC.

Social network platform Gab announced on Thursday that its integration of Btcpay Server has been completed. Its store now accepts payments in BTC and LTC.

Btcpay is a free and open-source payment processor that allows anyone to directly receive payments in several cryptocurrencies “with no fees, transaction cost or a middleman,” its Github page describes. The software conforms to the same invoice API format as Bitpay, allowing merchants to easily migrate from using Bitpay’s paid service to the Btcpay platform.

Btcpay is a free and open-source payment processor that allows anyone to directly receive payments in several cryptocurrencies “with no fees, transaction cost or a middleman,” its Github page describes. The software conforms to the same invoice API format as Bitpay, allowing merchants to easily migrate from using Bitpay’s paid service to the Btcpay platform. Gab has been a victim of censorship for most of its existence, often resulting from racist views posted by some of its users. The matter came to a head on Oct. 27 when Gab made national headlines after one of its users, Robert Bowers, killed 11 people at the Tree of Life Synagogue in Pittsburg.

Gab has been a victim of censorship for most of its existence, often resulting from racist views posted by some of its users. The matter came to a head on Oct. 27 when Gab made national headlines after one of its users, Robert Bowers, killed 11 people at the Tree of Life Synagogue in Pittsburg. Despite the media often painting the platform as an online haven for racists, Gab claims to have staff constantly monitoring all content posted on its platform for violations of its terms of service. Its stated restrictions on expression include threats of violence, promotion of terrorism, child pornography, revenge porn and doxing.

Despite the media often painting the platform as an online haven for racists, Gab claims to have staff constantly monitoring all content posted on its platform for violations of its terms of service. Its stated restrictions on expression include threats of violence, promotion of terrorism, child pornography, revenge porn and doxing.

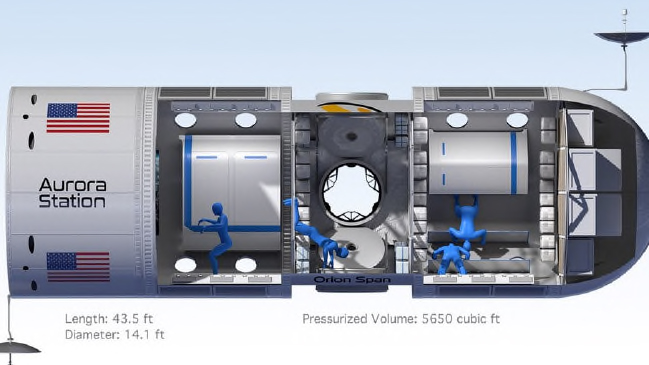

Ever since NASA landed on the moon and other governments launched citizens into space, a number of companies in the private sector have sought to send people into orbit. A project called

Ever since NASA landed on the moon and other governments launched citizens into space, a number of companies in the private sector have sought to send people into orbit. A project called

The regulations have been released for consultation and the bank has set Dec. 31 as the deadline for providing feedback. The proposals have been published on the bank’s website, local media reported.

The regulations have been released for consultation and the bank has set Dec. 31 as the deadline for providing feedback. The proposals have been published on the bank’s website, local media reported. Authorities in Manama launched the sandbox to boost the development of the fintech industry and increase the number of companies offering related services. At the same time, the initiative was part of efforts to reduce government expenditure through the implementation of new financial technology. In fintech Bahrain sees an opportunity to restore its position as a regional banking and business hub.

Authorities in Manama launched the sandbox to boost the development of the fintech industry and increase the number of companies offering related services. At the same time, the initiative was part of efforts to reduce government expenditure through the implementation of new financial technology. In fintech Bahrain sees an opportunity to restore its position as a regional banking and business hub.

Jay Clayton stated that he is “optimistic” that the developing DLT sector will “facilitate capital formation” and provide “investment opportunities for both institutional and Main Street investors.”

Jay Clayton stated that he is “optimistic” that the developing DLT sector will “facilitate capital formation” and provide “investment opportunities for both institutional and Main Street investors.” The SEC chair asserted that the commission has been “focusing a significant amount of attention and resources” to the oversight and regulation of cryptocurrencies and ICOs. Clayton emphasized the inter-division and inter-agency collaboration that the SEC has undertaken recently, highlighting the issuance of public statements regarding ICOs and virtual currencies.

The SEC chair asserted that the commission has been “focusing a significant amount of attention and resources” to the oversight and regulation of cryptocurrencies and ICOs. Clayton emphasized the inter-division and inter-agency collaboration that the SEC has undertaken recently, highlighting the issuance of public statements regarding ICOs and virtual currencies.