//

When the former CTOs of YouTube, Facebook, and Dropbox seed fund a database startup, you know there’s something special going on under the hood. Jiten Vaidya and Sugu Sougoumarane saved YouTube from a scalability nightmare by inventing and open sourcing Vitess, a brilliant relational data storage system. But in the decade since working there, the pair have been inundated with requests from tech companies desperate for help building the operational scaffolding needed to actually integrate Vitess.

So today the pair are revealing their new startup PlanetScale that makes it easy to build multi-cloud databases that handle enormous amounts of information without locking customers into Amazon, Google, or Microsoft’s infrastructure. Battletested at YouTube, the technology could allow startups to fret less about their backend and focus more on their unique value proposition. “Now they don’t have to reinvent the wheel” Vaidya tells me. “A lot of companies facing this scaling problem end up solving it badly in-house and now there’s a way to solve that problem by using us to help.”

PlanetScale has quietly raised a $3 million seed round in April led by SignalFire and joined by a who’s who of engineering luminaries. They include YouTube co-founder and CTO Steve Chen, Quora CEO and former Facebook CTO Adam D’Angelo, former Dropbox CTO Aditya Agarwal, PayPal and Affirm co-founder Max Levchin, MuleSoft co-founder and CTO Ross Mason, Google director of engineering Parisa Tabriz, and Facebook’s first female engineer and South Park Commons Founder Ruchi Sanghvi. If anyone could foresee the need for Vitess implementation services, it’s these leaders who’ve dealt with scaling headaches at tech’s top companies.

But how can a scrappy startup challenge the tech juggernauts for cloud supremacy? First, by actually working with them. The PlanetScale beta that’s now launching lets companies spin up Vitess clusters on its database-as-a-service, their own through a licensing deal, or on AWS with Google Cloud and Microsoft Azure coming shortly. Once these integrations with the tech giants are established, PlanetScale clients can use it as an interface for a multi-cloud setup where they could keep their data master copies on AWS US-West with replicas on Google Cloud in Ireland and elsewhere. That protects companies from becoming dependent on one provider and then getting stuck with price hikes or service problems.

PlanetScale also promises to uphold the principles that undergirded Vitess. “It’s our value that we will keep everything in the query pack completely open source so none of our customers ever have to worry about lock-in” Vaidya says.

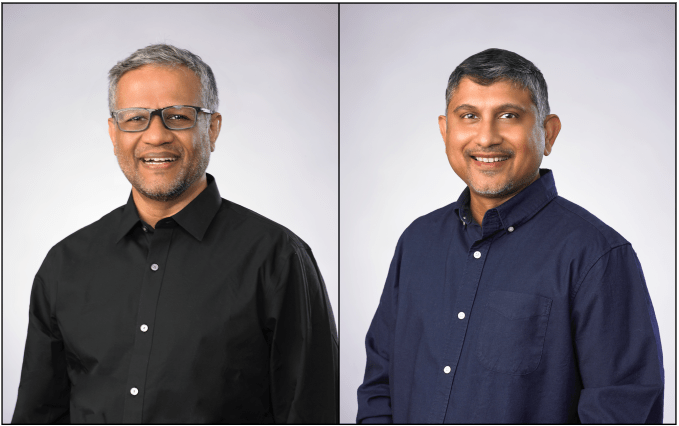

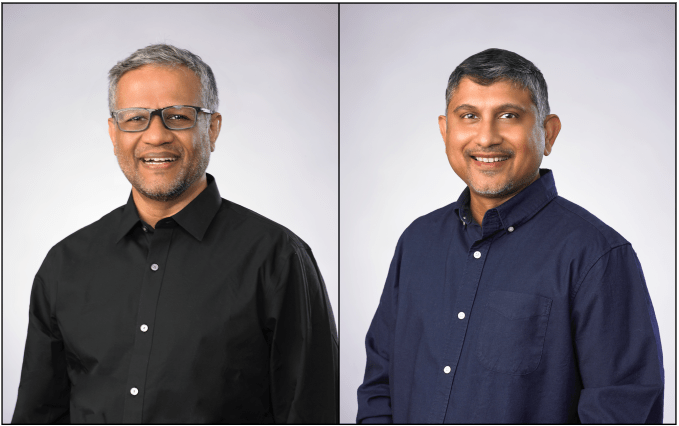

PlanetScale co-founders (from left): Jiten Vaidya and Sugu Sougoumarane

Battletested, YouTube Approved

He and Sougoumarane met 25 years ago while at Indian Institute Of Technology Bombay. Back in 1993 they worked at pioneering database company Informix together before it flamed out. Sougoumarane was eventually hired by Elon Musk as an early engineer for X.com before it got acquired by PayPal, and then left for YouTube. Vaidya was working at Google and the pair were reunited when it bought YouTube and Sougoumarane pulled him on to the team.

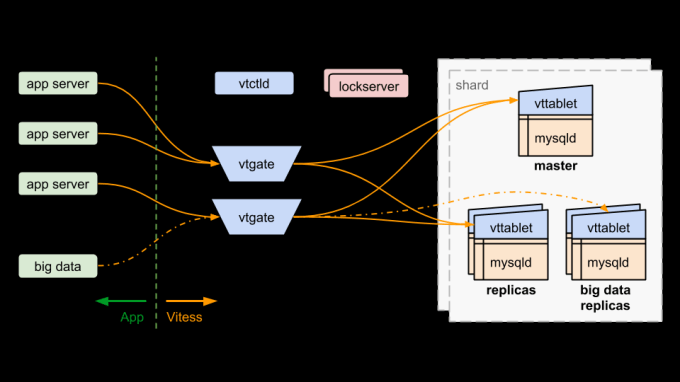

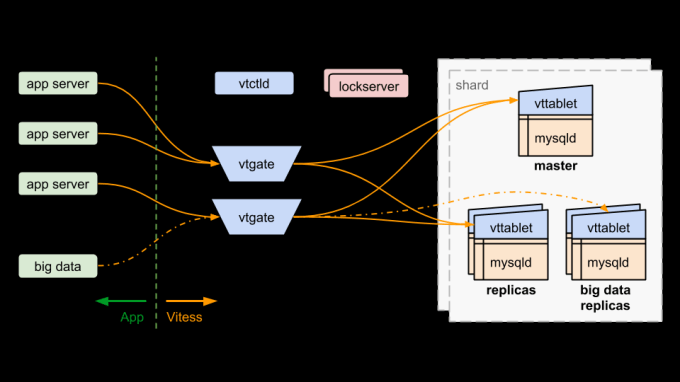

“YouTube was growing really quickly and the relationship database they were using with MySQL was sort of falling apart at the seams” Vaidya recalls. Adding more CPU and memory to the database infra wasn’t cutting it, so the team created Vitess. The horizontal scaling sharding middleware for MySQL let users segment their database to reduce memory usage while still being able to rapidly run operations. YouTube has smoothly ridden that infrastructure to 1.8 billion users ever since.

“Sugu and Mike Solomon invented and made Vitess open source right from the beginning since 2010 because they knew the scaling problem wasn’t just for YouTube, and they’ll be at other companies 5 or 10 years later trying to solve the same problem” Vaidya explains. That proved true, and now top apps like Square and HubSpot run entirely on Vitess, with Slack now 30 percent onboard.

Vaidya left YouTube in 2012 and became the lead engineer at Endorse, which got acquired by Dropbox where he worked for four years. But in the meantime, the engineering community strayed towards MongoDB-style key-value store databases, which Vaidya considers inferior. He sees indexing issues and says that if the system hiccups during an operation, data can become inconsistent — a big problem for banking and commerce apps. “We think horizontally-scaled relationship databases are more elegant and are something enterprises really need.

Database Legends Reunite

Fed up with the engineering heresy, a year ago Vaidya committed to creating PlanetScale. It’s composed of four core offerings: professional training in Vitess, on-demand support for open source Vitess users, Vitess database-as-a-service on Planetscale’s servers, and software licensing for clients that want to run Vitess on premises or through other cloud providers. It lets companies re-shard their databases on the fly to relocate user data to comply with regulations like GDPR, safely migrate from other systems without major codebase changes, make on-demand changes, and run on Kubernetes.

The PlanetScale team

PlanetScale’s customers now include Indonesian ecommerce giant Bukalapak, and it’s helping Booking.com, GitHub, and New Relic migrate to open source Vitess. Growth is suddenly ramping up due to inbound inquiries. Last month around when Square Cash became the number one app, its engineering team published a blog post extolling the virtues of Vitess. Now everyone’s seeking help with Vitess sharding, and PlanetScale is waiting with open arms. “Jiten and Sugu are legends and know firsthand what companies require to be successful in this booming data landscape” says Ilya Kirnos, founding partner and CTO of SignalFire.

The big cloud providers are trying to adapt to the relational database trend, with Google’s Cloud Spanner and Cloud SQL, and Amazon’s AWS SQL and AWS Aurora. Their huge networks and marketing war chests could pose a threat. But Vaidya insists that while it might be easy to get data into these systems, it can be a pain to get it out. PlanetScale is designed to give them freedom of optionality through its multi-cloud functionality so their eggs aren’t all in one basket.

Finding product market fit is tough enough. Trying to suddenly scale a popular app while also dealing with all the other challenges of growing a company can drive founders crazy. But if it’s good enough for YouTube, startups can trust PlanetScale to make databases one less thing they have to worry about.

from Startups – TechCrunch https://ift.tt/2BdiJ3C

Revolut says it will start to experiment with the license in 2019 in Lithuania and hopes it can expand the services to other European regions after the testing. Furthermore, the license will give it the opportunity to provide U.K. direct debit payments. The British-based company also says that it is currently constructing its in-house payment processor. Revolut hopes to implement everything involved with the newly approved banking license over the next 18 months. According to the digital currency payment platform’s website, Revolut will additionally roll out services in the U.S. in the near future.

Revolut says it will start to experiment with the license in 2019 in Lithuania and hopes it can expand the services to other European regions after the testing. Furthermore, the license will give it the opportunity to provide U.K. direct debit payments. The British-based company also says that it is currently constructing its in-house payment processor. Revolut hopes to implement everything involved with the newly approved banking license over the next 18 months. According to the digital currency payment platform’s website, Revolut will additionally roll out services in the U.S. in the near future.

Dashlane is a New York-based password manager app with reportedly ten million users around the globe. It also features a digital wallet for aggregating credit cards and bank accounts. On Wednesday, the company released its third annual “Worst Password Offenders” list, highlighting high-profile individuals and groups that had the most significant password-related blunders in 2018.

Dashlane is a New York-based password manager app with reportedly ten million users around the globe. It also features a digital wallet for aggregating credit cards and bank accounts. On Wednesday, the company released its third annual “Worst Password Offenders” list, highlighting high-profile individuals and groups that had the most significant password-related blunders in 2018.