//

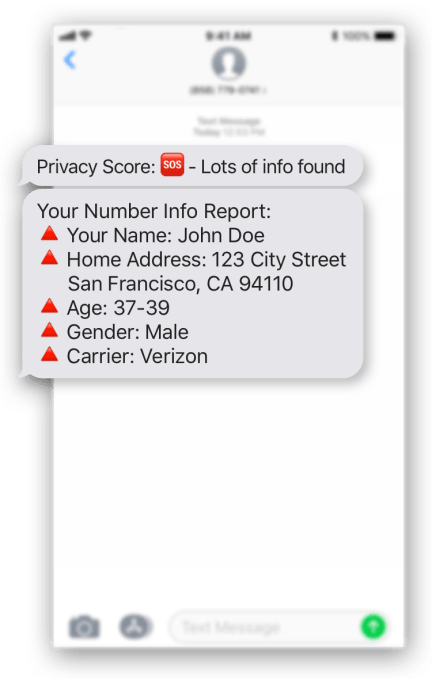

Ever wonder how much of your personal information is accessible to marketers? Well, there’s a new service called My Number Lookup that makes it easy (and free) for you to check the data that’s publicly available and tied to your mobile phone number.

The service was created by Keepsafe, maker of privacy-centric products. While there is a My Number Lookup website, the service actually operates over SMS — you just text HELLO to (855) 228-4539 and it will start sending you a report.

Keepsafe co-founder and CEO Zouhair Belkoura said that while marketers are able to access this information with relative ease, it’s difficult for consumers to check.

“We said, ‘Why don’t we make it super easy?’” he said. “Here’s a number you can text that tells you what information is publicly available.”

Specifically, My Number Lookup will tell you whether it was able to find a name, home address, age, gender, mobile carrier and associated people tied to your mobile number. It will even show you the data (several of the data points about me were missing, out-of-date or flat-out wrong), then point you towards Keepsafe Unlisted, a service for creating “burner” phone numbers (so you don’t have to share your real number widely), and also towards a Keepsafe blog post that outlines how someone can try to remove their personal information from various data brokers.

Belkoura admitted that even though you’ve got the report, you won’t necessarily be able to scrub the data from the Internet. Instead, he sees it as more of “a wakeup call” that people need to be more careful about giving out their phone numbers. And if it leads them to use Keepsafe Unlisted, even better.

“Once information is out there, it’s very difficult to delete,” he said. “The Internet is a place that just doesn’t forget.”

As for why the service operates over SMS, Belkoura said My Number Lookup will only provide data about the number you’re texting from. Hopefully that means users will only check on their own data, not someone else’s: “We don’t actually want to create a service where people who don’t have a legitimate interest can pay to look up information.”

from Startups – TechCrunch https://ift.tt/2SIJmET

The Montreal-based financial technology company

The Montreal-based financial technology company  Shakepay is not the first company to offer this type of cryptocurrency purchasing technique with rounded up debit purchases. Back in the spring of 2015, the project Lawnmower.io offered a spare change-into-bitcoin conversion tool that was tethered to Coinbase accounts. However, Lawnmower stopped offering the rounded change feature back in March 2016.

Shakepay is not the first company to offer this type of cryptocurrency purchasing technique with rounded up debit purchases. Back in the spring of 2015, the project Lawnmower.io offered a spare change-into-bitcoin conversion tool that was tethered to Coinbase accounts. However, Lawnmower stopped offering the rounded change feature back in March 2016.