//

It was the Lehman Brothers of blockchain. 850,000 Bitcoin disappeared when cryptocurrency exchange Mt. Gox imploded in 2014 after a series of hacks. The incident cemented the industry’s reputation as frighteningly insecure. Now a controversial crypto celebrity named Brock Pierce is trying to get the Mt. Gox flameout’s 24,000 victims their money back and build a new company from the ashes.

Pierce spoke to TechCrunch for the first interview about Gox Rising — his plan to reboot the Mt. Gox brand and challenge Coinbase and Binance for the title of top cryptocurrency exchange. He claims there’s around $630 million and 150,000 Bitcoin are waiting in the Mt. Gox bankruptcy trust, and Pierce wants to solve the legal and technical barriers to getting those assets distributed back to their rightful owners.

The consensus from several blockchain startup CEOs I spoke with was that the plot is “crazy”, but that it also has the potential to right one of the biggest wrongs marring the history of Bitcoin.

The Fall Of Mt. Gox

The story starts with Magic: The Gathering. Mt. Gox launched in 2006 as a place for players of the fantasy card game to trade monsters and spells before cryptocurrency came of age. The Magic: The Gathering Online eXchange wasn’t designed to safeguard huge quantities of Bitcoin from legions of hackers, but founder Jed McCaleb pivoted the site to do that in 2010. Seeking to focus on other projects, he gave 88 percent of the company to French software engineer Mark Karpeles, and kept 12 percent. By 2013, the Tokyo-based Mt. Gox had become the world’s leading cryptocurrency exchange, handling 70 percent of all Bitcoin trades. But security breaches, technology problems, and regulations were already plaguing the service.

Then everything fell apart. In February 2014, Mt. Gox halted withdrawls due to what it called a bug in Bitcoin, trapping assets in user accounts. Mt. Gox discovered that it had lost over 700,000 Bitcoins due to theft over the past few years. By the end of the month, it had suspended all trading and filed for bankruptcy protection, which would contribute to a 36 percent decline in Bitcoin’s price. It admitted that 100,000 of its own Bitcoin atop 750,000 owned by customers had been stolen.

Mt. Gox is now undergoing bankruptcy rehabilitation in Japan overseen by court-appointed trustee and veteran bankruptcy lawyer Nobuaki Kobayashi to establish a process for compensating the 24,000 victims who filed claims. There’s now 137,892 Bitcoin, 162,106 Bitcoin Cash, and some other forked coins in Mt. Gox’s holdings, along with $630 million cash from the sale of 25 percent of the Bitcoin that Kobayashi handled at a precient price point above where it is today. But five years later, creditors still haven’t been paid back.

A Rescue Attempt

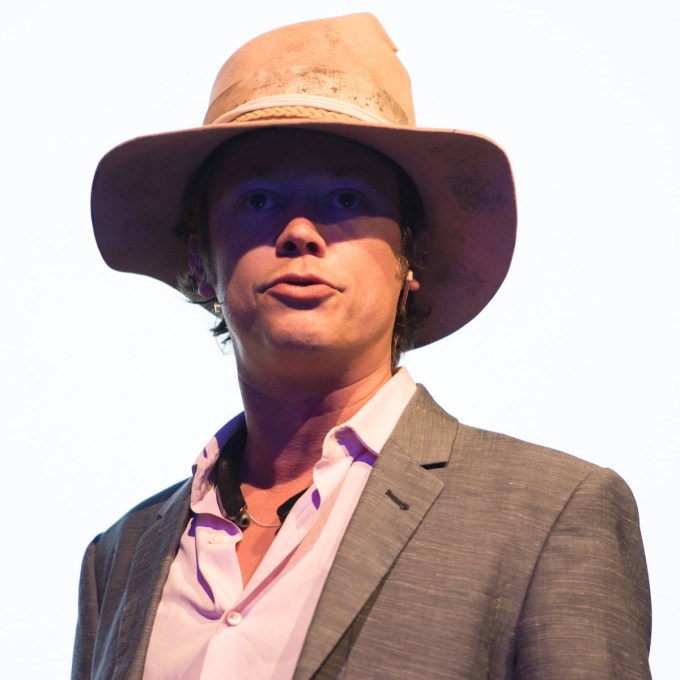

Brock Pierce, the eccentric crypto celebrity

Pierce had actually tried to acquire Mt. Gox in 2013. The child actor known from The Mighty Ducks had gone on to work with a talent management company called Digital Entertainment Network. But accusations of sex crimes led Pierce and some team members to flee the US to Spain until they were extradited back. Pierce wasn’t charged and paid roughly $21,000 to settle civil suits, but his cohorts were convicted of child molestation and child pornography.

The situation still haunts Pierce’s reputation and makes some in the industry apprehensive to be associated with him. But he managed to break into the virtual currency business, setting up World Of Warcraft gold mining farms in China. He claims to have eventually run the world’s largest exchanges for WOW Gold and Second Life Linden Dollars.

Soon Pierce was becoming a central figure in the blockchain scene. He co-founded Blockchain Capital, and eventually the EOS Alliance as well as a “crypto utopia” in Puerto Rico called Sol. His eccentric, Burning Man-influenced fashion made him easy to spot at the industry’s many conferences.

As Bitcoin and Mt. Gox rose in late 2012, Pierce tried to buy it, but “my biggest investor was Goldman Sachs. Goldman was not a fan of me buying the biggest Bitcoin exchange” due to the regulatory issues, Pierce tells me. But he also suspected the exchange was built on a shaky technical foundation that led him to stop pursuing the deal. “I thought there was a big risk factor in the Mt. Gox back-end. That was may intuition and I’m glad I was because my intuition was dead right.”

After Mt. Gox imploded, Pierce claims his investment group Sunlot Holdings successfully bought founder McCaleb’s 12 percent stake for 1 Bitcoin, though McCaleb says he didn’t receive the Bitcoin and it’s not clear if the deal went through. Pierce also claims he had a binding deal with Karpeles to buy the other 88 percent of Mt. Gox, but that Karpeles tried to pull out of the deal that remains in legal limbo.

The Supposed Villain

The Sunlot has since been trying to handle the bankruptcy proceedings, but that arrangement was derailed by a lawsuit from CoinLab. That company had partnered with Mt. Gox to run its North American operations but claimed it never received the necessary assets, and sued Mt. Gox for $75 million, though Mt. Gox countersued saying CoinLab wasn’t legally certified to run the exchange in the US and that it hadn’t returned $5.3 million in customer deposits. For a detailed account the tangle of lawsuits, check out Reuters’ deep-dive into the Mt. Gox fiasco.

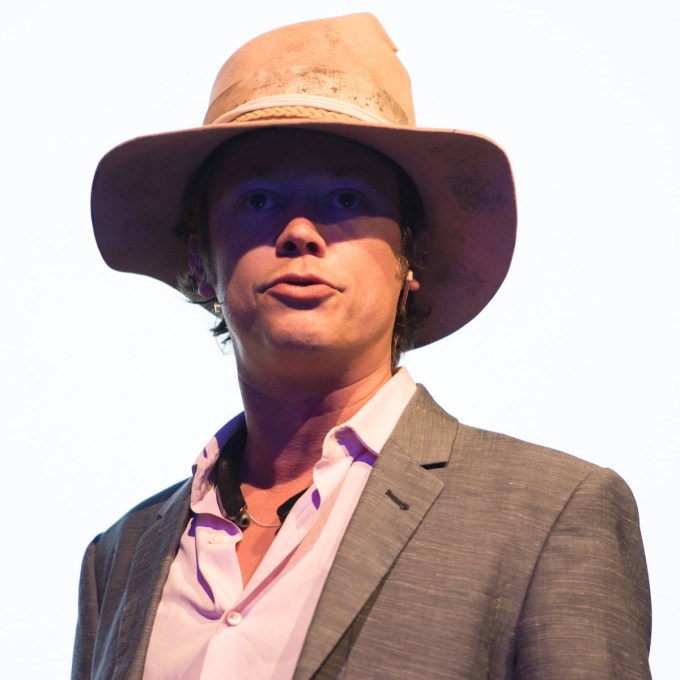

CoinLab co-founder Peter Vessenes

This week, CoinLab co-founder Peter Vessenes increased the claim and is now seeking $16 billion. Pierce alleges “this is a frivolous lawsuit. He’s claiming if [the partnership with Mt. Gox] hadn’t been cancelled, CoinLab would have been Coinbase and is suing for all the value. He believes Coinbase is worth $16 billion so he should be paid $16 billion. He embezzled money from Mt. Gox, he committed a crime, and he’s trying to extort the creditors. He’s holding up the entire process hoping he’ll get a payday.” Later, Pierce reiterated that “Coinlab is the villain trying to take all the money and see creditors get nothing.” Industry sources I spoke to agreed with that characterization

Mt. Gox customers worried that they might only receive the cash equivalent of their Bitcoin according to the currency’s $486 value when Gox closed in 2014. That’s despite the rise in Bitcoin’s value rising to around 7X that today, and as high as 40X at the currency’s peak. Luckily, in June 2018 a Japanese District Court halted bankruptcy proceedings and sent Mt. Gox into civil rehabilitation which means the company’s assets would be distributed to its creditors (the users) instead of liquidated. It also declared that users would be paid back their lost Bitcoin rather than the old cash value.

The Plan For Gox Rising

Now Pierce and Sunlot are attempting another rescue of Mt. Gox’s $1.2 billion assets. He wants to track down the remaining cryptocurrency that’s missing, have it all fairly valued, and then distribute the maximum amount to the robbed users with Mt. Gox equity shareholders including himself receiving nothing.

That’s a much better deal for creditors than if Mt. Gox paid out the undervalued sum, and then shareholders like Pierce got to keep the remaining Bitcoins or proceeds of their sale at today’s true value. “I‘ve been very blessed in my life. I did commit to giving my first billion away” Pierce notes, joking that this plan could account for the first $700 million he plans to ‘donate’.

“Like Game Of Thrones, the last season of Mt. Gox hasn’t been written” Pierce tells me, speaking in terms HBO’s Silicon Valley would be quick to parody. “What kind of ending do we want to make for it? I’m a Joseph Campbell fan so I’m obviously going to go with a hero’s journey, with a rise and a fall, and then a rise from the ashes like a phoenix.”

But to make this happen, Sunlot needs at least half of those Mt. Gox users seeking compensation, or roughly 12,000 that represent the majority of assets, to sign up to join a creditors committee. That’s where GoxRising.com comes in. The plan is to have users join the committee there so they can present a united voice to Kobayashi about how they want Mt. Gox’s assets distributed. “I think that would allow the process to move faster than it would otherise. Things are on track to be resolved in the next three to five years. If [a majority of creditors sign on] this could be resolved in maybe 1 year.

Beyond providing whatever the Mt. Gox estate pays out, Pierce wants to create a Gox Coin that gives original Mt Gox creditors a stake in the new company. He plans to have all of Mt. Gox’s equity wiped out, including his own. Then he’ll arrange to finance and tokenize an independent foundation governed by the creditors that will seek to recover additional lost Mt. Gox assets and then distribute them pro rata to the Gox Coin holders. There are plenty of unanswered questions about the regulatory status of a Gox Coin and what holders would be entitled to, Pierce admits.

Meanwhile, Pierce is bidding to buy the intangibles of Mt. Gox, aka the brand and domain. He wants to then relaunch it as a Gox or Mt. Gox exchange that doesn’t provide custody itself for higher security.

“We want to offer [creditors] more than the bankruptcy trustee can do on its own” Pierce tells me. He concedes that the venture isn’t purely altruistic. “If the exchange is very successful I stand to benefit sometime down the road.” Still, he stands by his plan, even if the revived Mt. Gox never rises to legitimately challenge Binance, Coinbase, and other leading exchanges. Pierce concludes, “Whether we’re successful or not, I want to see the creditors made whole.” Those creditors will have to decide for themselves who to trust.

from Startups – TechCrunch https://tcrn.ch/2GtDcp7