//

If you are a web developer, you know how complex many of the traditional web content management systems have been. One of the big problems has been managing the underlying infrastructure for the system. Cosmic JS, a member of the Winter 2019 Y Combinator class, wants to simplify that by taking care of the infrastructure part for you, while providing a flexible front end for content creators.

“Our customers benefit from using Cosmic because they can avoid the pain of building and maintaining their own CMS infrastructure. For a monthly service fee, we provide a seamless infrastructure for them, and it allows them to focus on what really matters, building great products and user experiences,” Cosmic JS CEO and co-founder Tony Spiro told TechCrunch.

As with so many YC companies, this one started with a pain point the founders were feeling in their jobs developing websites in an agency setting in 2014. Spiro was building the websites and CMO and co-founder Carson Gibbons was servicing accounts, and they saw a problem with the infrastructure piece.

“We found that there was a huge bottleneck just installing and maintaining our own backend infrastructure management. So around that time, I began building out Cosmic on the side. I thought it would be great if there was just a web dashboard and an API to deliver content as a service. And so that’s how it all got started,” Spiro explained. By removing infrastructure management from the equation, Cosmic was freeing developers to concentrate solely on the customer-facing bits.

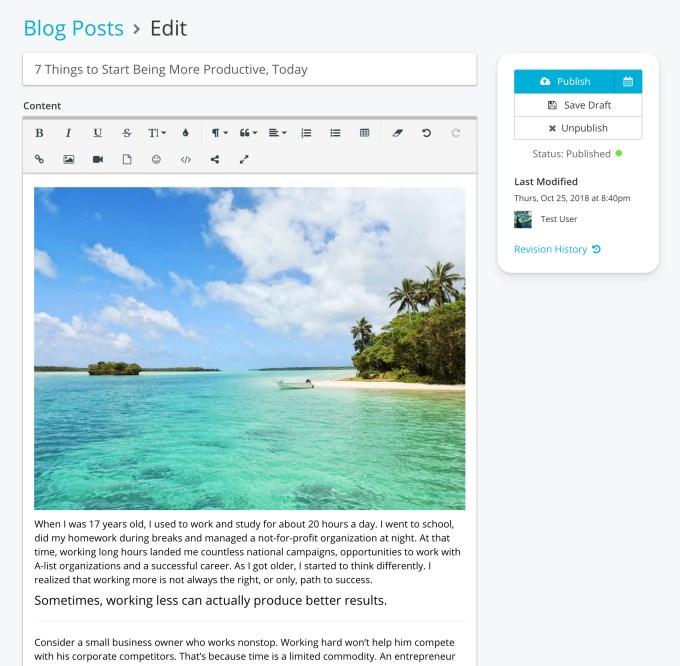

Cosmic JS content edit view. Screenshot: Cosmic JS

Spiro and Gibbons left their jobs to concentrate on Cosmic full time after the release of the initial version in 2016. They aim the product at web development teams with between 5 and 100 members. The product has three main user types: developers, site managers and content producers. So far, it has attracted 250 customers in 100 countries.

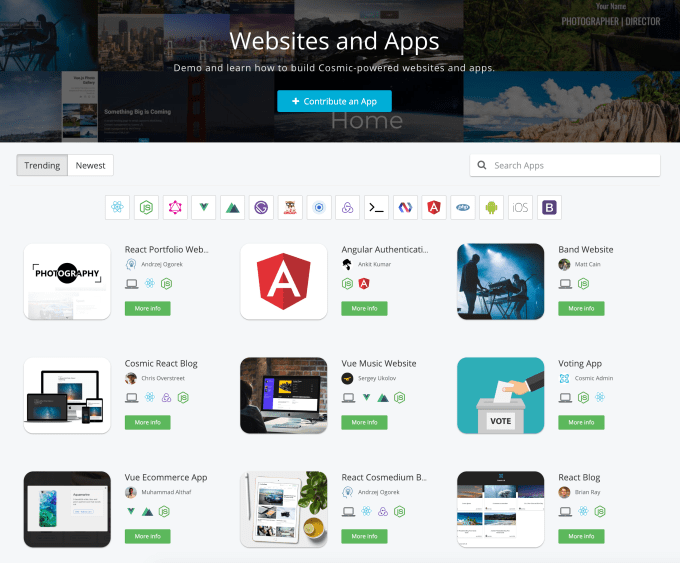

While it’s not open source, it does rely on community members to build extensions and apps. “We have hundreds of apps (ready-made websites and applications) and extensions built by our community,” Spiro said. These tools enable Cosmic to connect to best of breed services and tools like photos, videos or search without having to create them from scratch.

Cosmic JS website templates and apps. Screenshot: Cosmic JS

Spiro says that they joined Y Combinator at the behest of their advisors and investors and it has been a formative experience. “We applied and got in, and and now we’re surrounded by just some of the most impressive and intelligent people in technology.” Spiro said.

So far Cosmic JS includes the two co-founders with some contractors and freelancers helping out along with the extended development community. The company has received some funding, but the founders weren’t ready to share the amount just yet.

Their goal is to continue building the paid user base, and increase community participation through outreach and events.

from Startups – TechCrunch https://tcrn.ch/2FY4XXt