//

It’s a big day for Timescale, makers of the open source time series database, TimescaleDB. The company announced a $15 million investment and a new enterprise version of the product.

The investment is technically an extension of the $12.4 million Series A it raised last January, which it’s referring to as A1. Today’s round is led by Icon Ventures with existing investors Benchmark, NEA and Two Sigma Ventures also participating. With today’s funding, the startup has raised $31 million.

Timescale makes a time series database. That means it can ingest large amounts of data and measure how it changes over time. This comes in handy for a variety of use cases from financial services to smart homes to self-driving cars — or any data-intensive activity you want to measure over time.

While there are a number of time scale database offerings on the market, Timescale co-founder and CEO Ajay Kulkarni says that what makes his company’s approach unique is that it uses SQL, one of the most popular languages in the world. Timescale wanted to take advantage of that penetration and build its product on top of Postgres, the popular open source SQL database. This gave it an offering that is based on SQL and highly scalable.

Timescale admittedly came late to the market in 2017, but by offering a unique approach and making it open source, it has been able to gain traction quickly. “Despite entering into what is a very crowded database market, we’ve seen quite a bit of community growth because of this message of SQL and scale for time series,” Kulkarni told TechCrunch.

In just over 22 months, the company has over a million downloads and a range of users from older guard companies like Charter, Comcast and Hexagon Mining to more modern companies like Nutanix and and TransferWise.

With a strong base community in place, the company believes that it’s now time to commercialize its offering, and in addition to an open source license, it’s introducing a commercial license.”Up until today, our main business model has been through support and deployment assistance. With this new release, we will be also will have enterprise features that are available with a commercial license,” Kulkarni explained.

The commercial version will offer a more sophisticated automation layer for larger companies with greater scale requirements. It will also provide better lifecycle management, so companies can get rid of older data or move it to cheaper long-term storage to reduce costs. It’s also offering the ability to reorder data in an automated fashion when that’s required, and finally, it’s making it easier to turn the time series data into a series of data points for analytics purposes. The company also hinted that a managed cloud version is on the road map for later this year.

The new money should help Timescale continue fueling the growth and development of the product, especially as it builds out the commercial offering. Timescale, which was founded in 2015 in NYC, currently has 30 employees. With the new influx of cash, it expects to double that over the next year.

from Startups – TechCrunch https://tcrn.ch/2Scn2H6

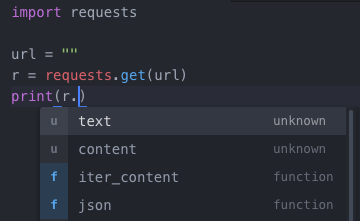

Looking ahead, what Smith really wants to achieve is what he calls ‘fully automated programming.’ “It’s that Star Trek vision of where you tell computers in a high-level language what to do,” he said. “If it’s ambiguous, the computer will ask questions.”

Looking ahead, what Smith really wants to achieve is what he calls ‘fully automated programming.’ “It’s that Star Trek vision of where you tell computers in a high-level language what to do,” he said. “If it’s ambiguous, the computer will ask questions.” Doctor’s offices and exam rooms are rethought to ensure a more comfortable relationship between doctor and patient. There are no desks that separate patient from doctor, instead featuring a couch with a small side table to write on.

Doctor’s offices and exam rooms are rethought to ensure a more comfortable relationship between doctor and patient. There are no desks that separate patient from doctor, instead featuring a couch with a small side table to write on. Even the lab is built adjacent to a restroom where patients can pass their specimen through a small compartment in the wall instead of walking it through the hallways.

Even the lab is built adjacent to a restroom where patients can pass their specimen through a small compartment in the wall instead of walking it through the hallways.