//

“There’s an implosion of early-stage VC funding, and no one’s talking about it,” was the headline of a viral article posted on this site in late 2017. Venture capitalists are deploying more capital than ever, the author explained, yet the number of deals for early-stage startups has taken a nosedive.

Roughly one year later, little has changed. Seed activity for U.S. startups has declined for the fourth straight year, according to venture data provider CB Insights, as median deal sizes increased at every stage of venture capital. In 2018, seed activity as a percentage of all deals shrank from 31 percent to 25 percent — a decade low — while the share and size of late-stage deals swelled to record highs. Total annual global VC funding, for its part, shot up 21 percent to $207 billion as deal activity only increased by 10 percent to 14,247 transactions.

The median U.S. seed deal was the highest on record in the fourth quarter of 2018, growing to $2.1 million after kicking off the year at an average of $1.7 million. Early-stage financings — i.e. Series A and Series B fundings — experienced the same trend, expanding to a median of $8 million in Q4, a significant increase from the $5.5 million median recorded in the first quarter of 2017.

The decline in seed deals and the simultaneous increase in deal size began in 2012, and is far from an anomaly at this point. What’s caused the end of seed investing as we know it? A record amount of dry powder in the venture ecosystem has pushed VCs downstream, where they can deploy large sums of capital in more mature companies. Even firms specializing in seed investments are muscling their way into Series A deals. Many seed firms have grown up and become more strategic in their bets, often opting to invest in startups that have found product/market fit rather than those still at the idea stage, despite the fact that historically, idea-stage companies were the target of seed financings. Fortunately, pre-seed, a newer stage of investing consisting of investments of around $500,000, has emerged to support those projects.

Not only are deals fewer and fatter, but companies earning seed investments are older, too. In 2016, for example, companies raising seed deals were older than the median age of a company raising a Series A deal 10 years ago, and Series A companies were older than the median age of Series B companies a decade prior, too.

Fundraising activity suggests deal sizes will only continue to inflate, rather than adjust. Firms in the $100 million to $500 million range are currently the most active fundraisers, and if you pay any attention to the tech press, you know there’s no shortage of fresh billion-dollar funds. Investors at those funds aren’t able to deploy small bits of capital into early-stage startups — not only because the return on the investment isn’t meaningful, but they don’t have the time to devote to those projects, which typically require more support and oversight than their late-stage counterparts.

One thing could send deal sizes back to their normal ranges, however, and that’s the market downturn many VCs are expecting in 2019. Median deal sizes shrank during the Great Recession in 2008, and investors tend to turn away from riskier bets when market conditions grow cold. That means, in a bear market, more attention will be paid to stable, later-stage businesses while early-stage companies are left to their own devices.

from Startups – TechCrunch https://tcrn.ch/2C7qKri

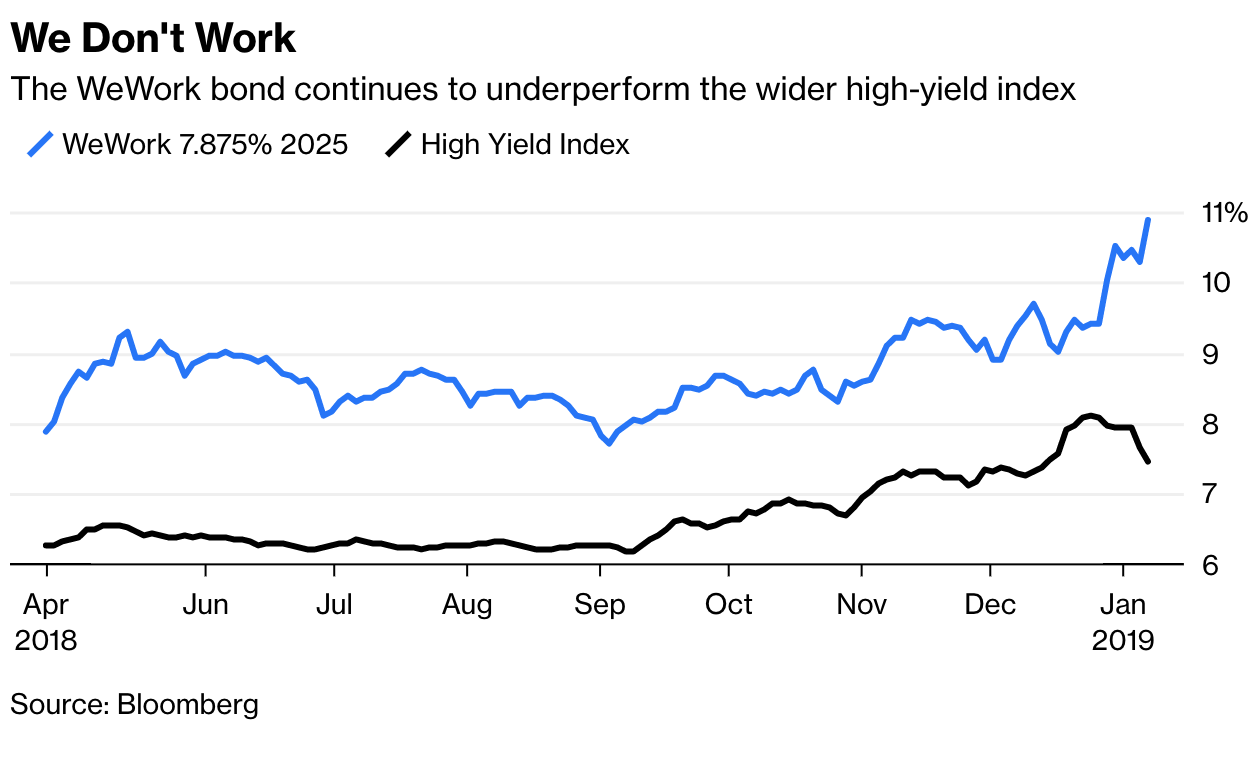

Neumann said the original vision of the company was an all-encompassing network of offerings that would help customers bank, shop, live and play. That’s a mighty goal worthy of a Vision Fund, but its vision may turn out to be a fever dream if the indicators are right and the worldwide slide into recession finally happens.

Neumann said the original vision of the company was an all-encompassing network of offerings that would help customers bank, shop, live and play. That’s a mighty goal worthy of a Vision Fund, but its vision may turn out to be a fever dream if the indicators are right and the worldwide slide into recession finally happens.