//

Genies is emerging as the top competitor to Snapchat’s wildly popular Bitmoji as Facebook, Apple, and Google have been slow to get serious about personalized avatars. Over one million people have customized dozens of traits to build a realistic digital lookalike of themselves from over a million possible permutations.

When Genies launched a year ago after raising $15 million in stealth, it misstepped by trying to show people’s Genies interpreting a few weekly news stories and seasonal moments. Now the startup has figured out users want more control, so it’s shifting its iOS and Android apps to let you chat through your avatar, who acts out keywords and sentiments in reaction to what you type, which you can then share elsewhere. And Genies is launching an SDK that charges other apps apps to let you create avatars and use them for chat, stickers, games, animations, and augmented reality.

To power these new strategies and usher in what CEO Akash Nigam calls “the next wave of communication through avatars where people feel comfortable expressing themselves”, Genies has raised $10 million more. The party round comes from a wide range of investors from institutional firms like NEA and Tull Co; angels like Tinder’s Sean Rad, Raya’s Jared Morgenstern, and speaker Tony Robbins, athletes like Carmelo Anthony, Kyrie Irving, and Richard Sherman; and musicians including A$AP Rocky, Offset from Migos, The Chainsmokers, and 50 Cent. Some like Offset have even used their Genie to stand in for them brand sponsorships so their avatar poses for photos instead of them.

“We’ve transitioned from being an app to an avatar services company” Nigam tells me. The son of WebMD’s co-founder, Nigam build a string of failed apps before meeting his Genies co-founders through University Of Michigan hackathons. Watching Snapchat-owned Bitmoji stay glued atop the app download charts inspired them to see more opportunity in the avatar space.

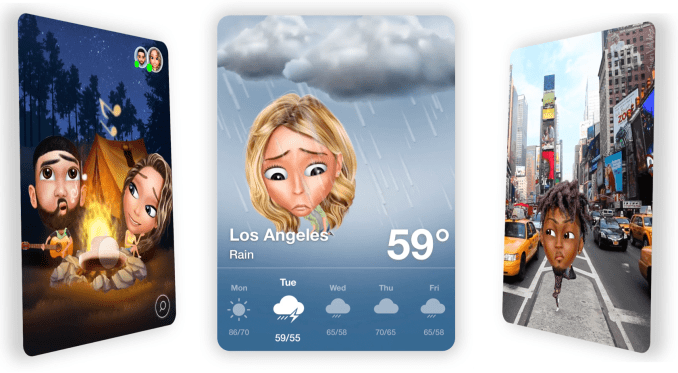

With the Genies SDK, the startup is ready to challenge Snapchat’s new Snap Kit that lets apps build Bitmoji into their keyboards. But for $100,000 to $1 million in licensing fees, Genies allows apps to develop much deeper avatar features. Beyond creating keyboard stickers, games can plaster your Genies’ face over your character’s head, and utilities apps can have your Genie act out the weather or celebrate transactions. And since Genies is still taking off, partners can create experiences that feel fresh rather than just a repurposing of Bitmoji’s already-established cartoony avatars. Genies has also launched its first official brand deal, where Gucci has created a wheel in the Genies creator so you can deck out your mini-you with luxury clothing.

The Avatar Wars (from left): Facebook Avatars, Google Gboard Mini Stickers, Apple Memoji

Despite Bitmoji’s years of success, it’s yet to have a scaled competitor. TechCrunch broke the news that Facebook is working on a “Facebook Avatars” feature but seven months later it’s still not publicly testing and the prototype looks childish. Google’s Gboard just added the ability to create avatars based on a selfie, but they’re bland, low on detail, and far from fun looking. And Apple’s latest mobile operating system lets you create a Memoji, though they too look generic like actual emoji rather than something instantly identifiable as you. By designing avatars that not only look like you but like a cooler version of you, Genies could capture the hearts and faces of millions of teens and the influencers they follow.

from Startups – TechCrunch https://ift.tt/2DNWLbr