//

PagerDuty, an eight-year-old, San Francisco-based company that sends companies information about their technology, doesn’t receive a fraction of the press that other fast-growing enterprise software companies receive. In fact, though it counts as customers heavyweight companies like Capital One, Spotify and Netflix; it employs 500 employees; and it has five offices around the world, it has largely operated out of the spotlight.

That’s changing. For one thing, the company is now a so-called unicorn, after raising $90 million in a September round led by Wellington and T. Rowe Price that brought its total funding to $173 million and its valuation to $1.3 billion. Crowded as the unicorn club may be these days, that number, and those backers, makes PagerDuty a startup of interest to a broader circle of industry watchers.

Another reason you’re likely to start hearing more about PagerDuty is its CEO of three years, Jennifer Tejada, who is rare in the world of enterprise startups because of her gender, but whose marketing background makes her even more of an anomaly — and an asset.

In a world that’s going digital fast, Tejada knows PagerDuty can appeal to a far wider array of customers by selling them a product they can understand.

It’s a trick she first learned at Proctor & Gamble, where she spent seven years after graduating from the University of Michigan with both a liberal arts and a business management degree. In fact, in her first tech job out of P&G, working for the bubble-era supply chain management startup I2 Technologies (it went public and was later acquired), Tejada says she became “director of dumb it down.”

Sitting in PagerDuty’s expansive second floor office space in San Francisco — space that the company will soon double by taking over the first floor — Tejada recalls acting “like a filter for very technical people who were very proud of the IP they’d created” but who couldn’t explain it to anyone without relying on jargon. “I was like, ‘How are you going to get someone to pay you $2 million for that?’”

Tejada found herself increasingly distilling the tech into plain English, so the businesspeople who have to sign big checks and “bet their careers on these investments” could understand what they were being pitched. She’s instilling that same ethos at PagerDuty, which was founded in 2009 to help businesses monitor their tech stacks, manage disruptions and alert engineers before things catch on fire but, under Tejada’s watch, is evolving into a service that flags opportunities for its customers, too.

As she tells it, the company’s technology doesn’t just give customers insights into their service ecosystem and their teams’ health, and it doesn’t just find other useful kernels, like about which operations teams are the most productive and why. PagerDuty is also helping its clients become proactive. The idea, she says, is that “if you see traffic spiking on a website, you can orchestrate a team of content marketers or growth hackers and get them in that traffic stream right then, instead of reading about it in a demand-gen report a week later, where you’re, like, ‘Great, we totally missed that opportunity.’”

The example is a bit analogous to what Tejada herself brings to the table, which includes strong people skills (she’s very funny) and a knack for understanding what consumers want to hear, but also a deep understanding of financing and enterprise software.

As corny as it sounds, Tejada seems to have been working toward her current career her whole life.

As corny as it sounds, Tejada seems to have been working toward her current career her whole life.

Not that, like the rest of us, she knew exactly what she was doing at all times. On the contrary, one part of her path started when, after spending four years as the VP of global marketing for I2 — four years during which the dot-com bubble expanded wildly, then popped — Tejada quit her job, went home for the holidays and, while her baffled family looked on, booked a round-trip ticket to Australia to get away and learn about yachts.

She left the experience not only with her skipper certification but in a relationship with her now-husband of 16 years, an Australian with whom she settled in Sydney for roughly 12 years.

There, she worked for a private equity firm, then joined Telecom New Zealand as its chief marketing officer for a couple of years, then landed soon after at an enterprise software company that catered to asset-intensive industries, including mining, as its chief strategy officer. When that private-equity backed company was sold, Tejada took a breath, then was recruited to lead, for the first time, another company: Keynote Systems, a publicly traded internet and mobile cloud testing and monitoring company that she steered to a sale to the private equity firm Thomas Bravo a couple of years later.

The move gave her an opportunity to spend time with her now teenage daughter and husband, but she also didn’t have a job for the first time in many years, and Tejada seems to like work. Indeed, within one year, after talking with investors who’d gotten to know her over the years, as well as eager recruiters, Tejada — who says she is “not a founder but a great adoptive parent” — settled on the 50th of 51 companies she was asked to consider joining. It was PagerDuty.

She has been overseeing wild growth ever since. The company now counts more than half of the Fortune 50 as its customers. It has also doubled its headcount a couple of times since she joined roughly 28 months ago, and many of its employees (upwards of 43 percent) are now women, as well as engineers from more diverse backgrounds than you might see at a typical Silicon Valley startup.

She has been overseeing wild growth ever since. The company now counts more than half of the Fortune 50 as its customers. It has also doubled its headcount a couple of times since she joined roughly 28 months ago, and many of its employees (upwards of 43 percent) are now women, as well as engineers from more diverse backgrounds than you might see at a typical Silicon Valley startup.

That’s no accident. Diversity breeds diversity, in Tejada’s view, and diversity is good for business.

“I wouldn’t say we market to women,” offers Tejada, who says diversity to her is not just about gender but also age and ethnic background and lifestyle choice and location and upbringing (and functional expertise).

“We’ve made a conscious effort to build an inclusive culture where all kinds of people want to work. And you send that message out into the market, there’s a lot of people who hear it and wonder if it could possibly be true. And then they come to a PagerDuty event, or they come into the office, and they see something different than they’ve seen before. They see people they can relate to.”

Why does it matter when it comes to writing code? For one thing, because a big part of coding is problem-solving, says Tejada. “When you have people from diverse backgrounds chunking through a big hairy problem together, those different perspectives will get you to a more insightful answer.” Tejada also believes there’s too much bias in application development and user experience. “There’s a lot of gobbledygook in our app that lots of developers totally understand but that isn’t accessible to everyone — men, women, different functional types of users, people of a different age. Like, how accessible is our mobile app to someone who’s not a native-first mobile user, who started out on an analog phone, moved to a giant desktop, then to a laptop and is now using a phone? You have to think about the accessibility of your design in that regard, too.”

What about the design of PagerDuty’s funding? We ask Tejada about the money PagerDuty raised a couple of months ago, and what it means for the company.

Unsurprisingly, as to whether the company plans to go public any time soon, her answers are variously, “I’m just building an enduring company,” and, “We’re still enjoying the benefits of being a private company.”

But Tejada also seems mindful of not raising more money for PagerDuty than it needs to scale, even while there’s an ocean of capital surrounding it.

“Going back to the early ’90s, in my career I have not seen a market where there has been more ready availability to capital, between tax reforms and sovereign cash and big corporates and low interest rates and huge venture funds, not to mention the increased willingness of big institutional investors to become LPs.” But even while the “underlying drivers and secular trends and leading indicators” suggest a healthy market for SaaS technology for a long time to come, that “doesn’t mean the labor markets are going to stay the same. It doesn’t mean the geopolitical environments are not going to change. When you let the scarcity issue in the market drive your valuation, you’re also responsible for growing into that valuation, no matter what happens in the macro environment.”

Where Tejada doesn’t necessarily want to be so measured is when it comes to PagerDuty’s place in its market. And that can be challenging as the company gains more traction — and more attention.

“If you do the right thing for your customers, and you do the right thing by your employees, all the rest will fall into place,” she says. “But the minute you take your eye off the ball, the minute you don’t earn the trust of your customer every day, the minute you stop innovating in service of them, you’re gonna start going backwards,” she says with a shrug.

Tejada recalls a conversation she had with her executive team last week, including with Alex Solomon, the company’s CTO and the one of three PagerDuty founders who remains actively engaged with the company. (Co-founder Andrew Miklas moved on to venture capital last year; Baskar Puvanathasan meanwhile left the company in March.) “They probably wanted to kill me,” she says laughing. “I told them I don’t think we’re disrupting ourselves enough. They’re like, ‘Jenn, let up.’ But that’s what happens to companies. They have their first success and they miss that second wave or third wave, and the next thing you know, you’re Kodak.”

PagerDuty, she says, “is not going to be Kodak.”

from Startups – TechCrunch https://ift.tt/2B5HKPs

As corny as it sounds, Tejada seems to have been working toward her current career her whole life.

As corny as it sounds, Tejada seems to have been working toward her current career her whole life. She has been overseeing wild growth ever since. The company now counts more than half of the Fortune 50 as its customers. It has also doubled its headcount a couple of times since she joined roughly 28 months ago, and many of its employees (upwards of 43 percent) are now women, as well as engineers from more diverse backgrounds than you might see at a typical Silicon Valley startup.

She has been overseeing wild growth ever since. The company now counts more than half of the Fortune 50 as its customers. It has also doubled its headcount a couple of times since she joined roughly 28 months ago, and many of its employees (upwards of 43 percent) are now women, as well as engineers from more diverse backgrounds than you might see at a typical Silicon Valley startup.

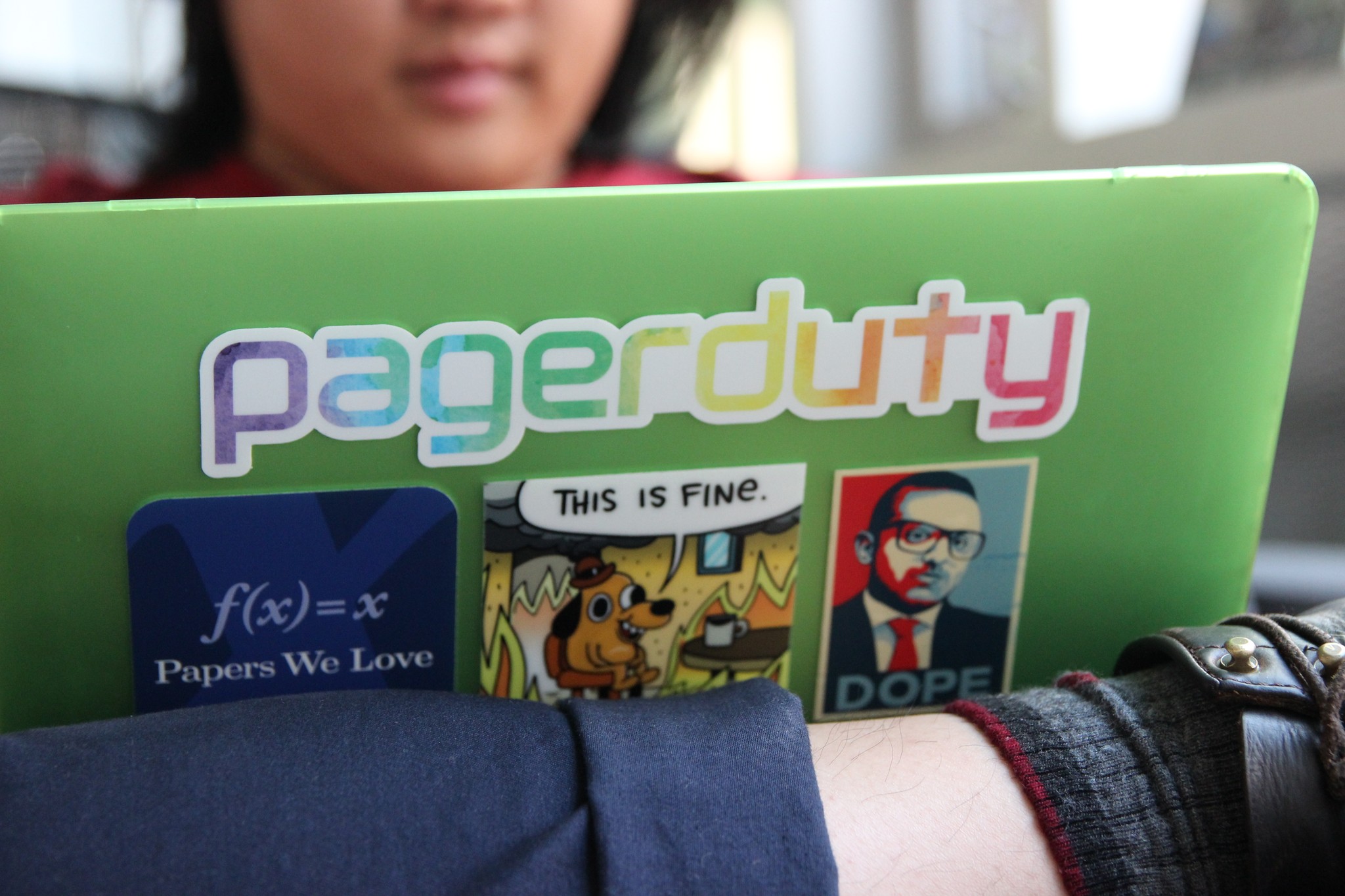

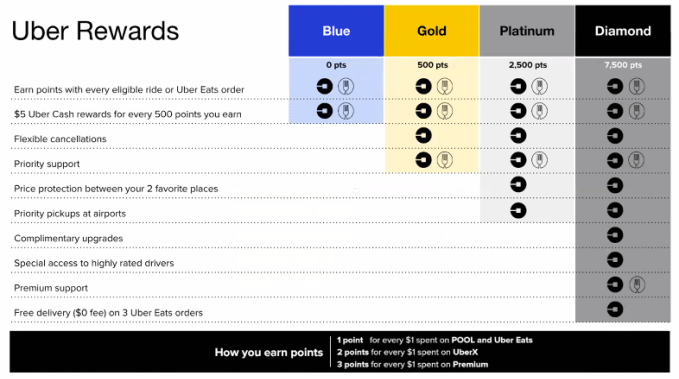

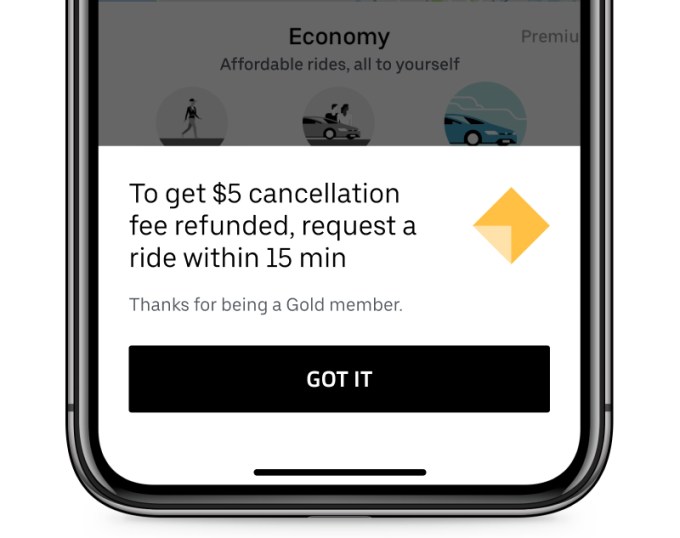

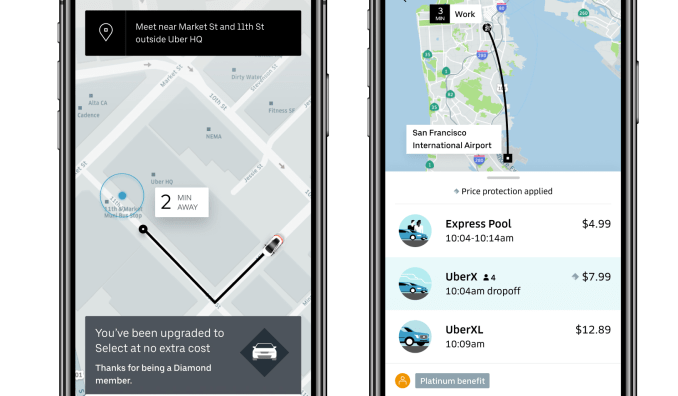

At 7,500 points, you get the Gold and Platinum benefits plus premium support with a dedicated phone line and fast 24/7 responses from top customer service agents. You get complimentary upgrade surprises from UberX to Uber Black and other high-end cars. You’ll be paired with Uber’s highest rated drivers. And you get no delivery fee on three Uber Eats orders every six months. Reaching 7,500 points would require UberX 8 times per week, Uber Eats once per week, and Uber Black to the airport once per month. Diamond is meant usually for business travelers who get to expense their rides, or people who’d ditched car ownership for ridesharing.

At 7,500 points, you get the Gold and Platinum benefits plus premium support with a dedicated phone line and fast 24/7 responses from top customer service agents. You get complimentary upgrade surprises from UberX to Uber Black and other high-end cars. You’ll be paired with Uber’s highest rated drivers. And you get no delivery fee on three Uber Eats orders every six months. Reaching 7,500 points would require UberX 8 times per week, Uber Eats once per week, and Uber Black to the airport once per month. Diamond is meant usually for business travelers who get to expense their rides, or people who’d ditched car ownership for ridesharing.