//

Nested, the London-based “data-driven” estate agency that provides a cash advance to help you buy a new home before you’ve sold your old one, has raised a further £120 million in funding. The new round is a mixture of equity and debt: £20 million and £100 million, respectively. Leading the equity round is Northzone, and Balderton Capital, while the debt finance comes from an unnamed institutional investor.

It is noteworthy that Balderton has only just invested in Nested several rounds into the company’s existence, considering that the London-based venture capital firm typically invests earlier at Series A. Balderton is also a backer of GoCardless, the payments company previously co-founded by Nested founder Matt Robinson. That said, Balderton General Partner Tim Bunting did invest in Nested in a personal capacity very early on.

Launched in late 2016, Nested competes with high-end estate agents by providing all of the services needed to sell your house, but with a key difference. In addition to handling valuation, marketing and sales, the startup will loan you up to 95 per cent of the market value of your property as a cash advance, that way you’re able to purchase a new home prior to your old one selling. Before Brexit and the uncertainty it has caused with regards to London house prices, that figure was up to 97 percent of the market value of the property, and I understand Nested hopes to return to that percentage once things settle down.

More broadly, the idea behind Nested is to eliminate much of the stress and uncertainty of selling and buying a home, including what your final budget will be, and also ensure that you’re never caught up in the dreaded property ‘chain’ and miss out on your desired home, or are kept in limbo indefinitely waiting for your property to sell. By becoming a cash buyer, it also puts you in the strongest possible position to negotiate on your onward purchase. Robinson says this typically sees savings of 2-4 percent.

In return, Nested charges a fee from 2-4 per cent (plus VAT) depending on how soon you want to receive the advance, and takes a loss if it fails to sell the property for an amount above its initial advance. The idea is to incentivise the startup to always try to get you the genuine market price or more.

TechCrunch’s Steve O’Hear giving Nested’s Matt Robinson (pictured right) a hard time at Startup Grind London earlier this year.

Asked how well that is working out so far, Robinson tells me historical valuation accuracy is on average within 1.5 percent of what the company predicted. Better still, Nested is running at 100 percent accuracy for 2018 and is confident enough to make this data public.

“The traditional agents don’t even track it and the online players do their best to obscure the fact that they sell only roughly 4/10th of properties they take on i.e. most customers pay them £1,000 up-front to not sell their house and are left out-of-pocket!” says the Nested founder.

To date, Nested has helped over 400 home-owners, and, aside from increasing volume, including helping property owners outside of London, the company says it plans to further expand its product offering. The bulk of these new products will continue to target sellers to “radically improve the selling experience”. However, I understand that since sellers are buyers, too, future services could also include using Nested’s data, tech and expertise to help with the buying process as well.

Adds Robinson in a statement: “We’re excited to receive the backing from some of Europe’s top VCs who share our vision for fixing the age-old problem of buying and selling homes. We are building an incredible team to offer an unassailable service with the most progressive technology in the property industry. This investment will allow us to continue solving the problems that prevent people from moving home with ease”.

from Startups – TechCrunch https://ift.tt/2T73GRx

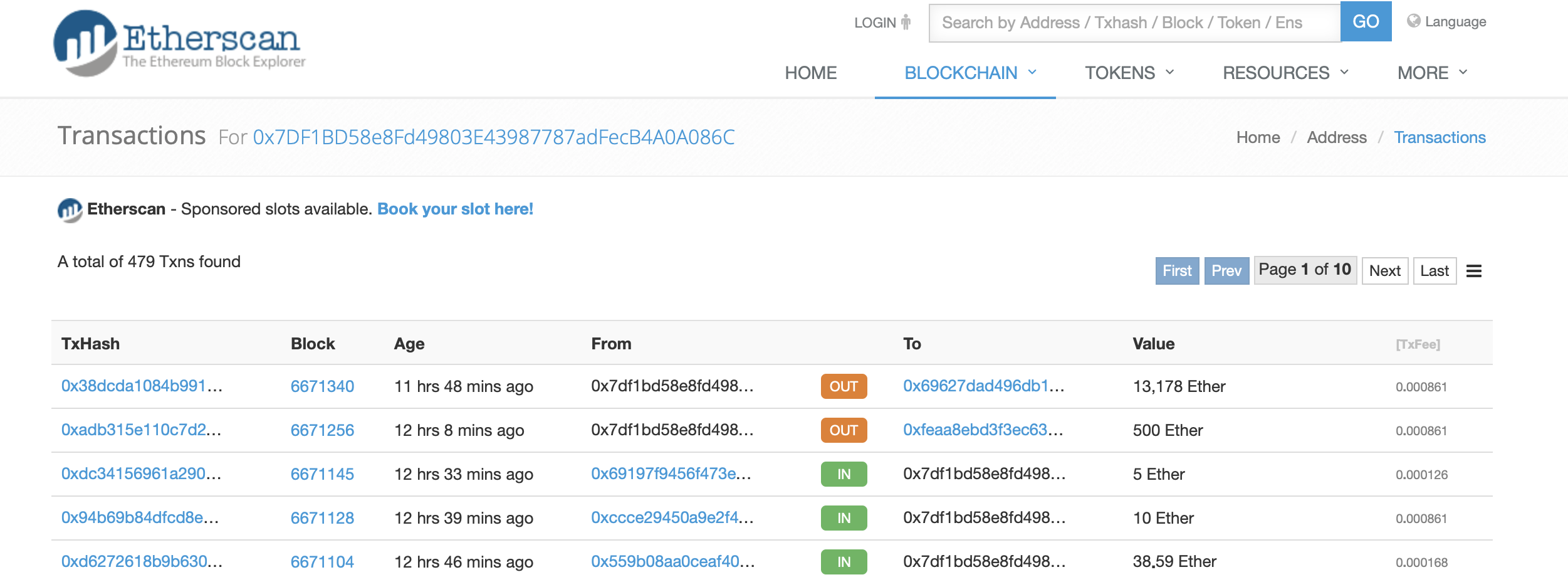

– New Korean exchange Pure Bit just pulled an exit scam claiming 13,000ETH from its investors as we speak. Kakao channels are emptying and the site has been pulled.

– New Korean exchange Pure Bit just pulled an exit scam claiming 13,000ETH from its investors as we speak. Kakao channels are emptying and the site has been pulled.