//

Perry Hewitt works at the intersection of marketing, technology and mission-driven organizations.

Startups salivate at the prospect of entering the enterprise — and for good reason. The enterprise is rife with legacy systems and circuitous processes that frustrate employees and hinder results — and the startup has just the perfect product to fix the problem.

Too often though, the pitch to the enterprise falls flat or a promising pilot gets sidelined. Sometimes there’s a clear obstacle, like a mismatch between product and problem to be solved, an inability to scale, or the loss of an internal sponsor. But more often than one would expect, the startup’s value is simply getting lost in translation.

Even the most forward-looking enterprise leaders are operating in an environment what I like to call “GAAP-based digital strategy.” The budgeting process supports only certain kinds of purchases, like renewable software licensing fees and support contracts with fixed costs. New models, like variable costs for open source development, require workarounds and explanation in the budget process and cause even the most eager internal champion to lose time and energy.

So what’s a startup to do? The more you can help your internal sponsor translate the cost model to adhere to the established norm, the more traction they are likely to get from the hydra of procurement and finance. Once the project has momentum, your champion can work to change the budgeting process – but that’s a tall order before your pilot is launched and showing results.

The concept of GAAP-based digital strategy extends well beyond accounting practices. Consider internal reporting: large organizations spend an inordinate amount of time reporting up, across, and down in an effort to improve transparency and inspire shared ownership of outcomes. What are the KPIs for the department you are serving? How easily will your results translate into their storytelling? Spend some time up front with your client to ensure your results align with (and show up in!) the existing framework for reporting.

Corporations are aware of how hard it is to navigate these control systems, and so they are increasingly creating “innovation departments” with dedicated funding for one-off experiments using new technology. This is often the start of the relationship between a startup and a new client.

For startups, this can be a beneficial approach, since it offers the opportunity to deliver value before wrangling with cumbersome procurement or IT requirements. But too often these divisions lurch from pilot to pilot, and struggle to find line-of-business champions willing to absorb startup technology into their operations. The biggest challenge here is that there’s often no enterprise template for the handoff from the innovation setting – where experiments can operate in a “clean room” apart from procedures and regulations – to ongoing operations.

Here’s how one startup providing augmented reality headsets and software to a complex pharma manufacturing environment crossed over. Their pilot showed clear results: testing with four-five headsets, their AR software measurably helped workers on the floor by augmenting the workflow with voice recording and hands-free capabilities.

The startup team then came on-site, and they partnered with the workers testing the solution to document the improvements and discuss how to ensure the process complied with regulations. This direct interaction fed into their results reporting to make the case for the 30-40 headsets needed on the shop floor. Rather than wait for middle management, the startup developed a grassroots-fortified case for moving into operations.

Similarly, a startup piloting an analytics product in a CPG enterprise was immediately pigeonholed into the IT department’s analytics budget. Surrounded by a range of solutions from business intelligence dashboards to marketing technology tools, their pilot was getting lost.

By closely analyzing results, the startup saw promising early findings in the trade promotions area. They worked through their contacts to reach the executive in charge of trade promotions who took the pilot under her wing – and into her budget. They avoided being locked into a GAAP-based bucket (analytics), and were connected with an executive to unlock a whole different conversation.

In addition to finding your internal champion and changing the GAAP conversation, spend time understanding the larger enterprise backdrop: the initiatives and themes that are driving this quarter’s shareholder value. Help your client position the solution not only in the context of the specific problem to solve, but the overall enterprise goals.

The annual report is your friend here. The focus may be digital transformation or global collaboration or risk management, and aligning to this priority may enable your client to get buy-in internally. Make sure you are fluent in the visible, budgeted, CEO-led, cross departmental initiatives — and how your solution plays a role here.

Take heart: this translation won’t always be a one-way street. The deeper your engagement, the more your enterprise clients will benefit from your startup’s perspective, and change technology, process, and language to reflect that understanding. Ideally, GAAP-based digital strategy recedes as long-established protocols reduce structural lag with how business is conducted today. In the meantime, consider the art of translation as important as pitching the outcome.

from Startups – TechCrunch https://ift.tt/2Da0mjs

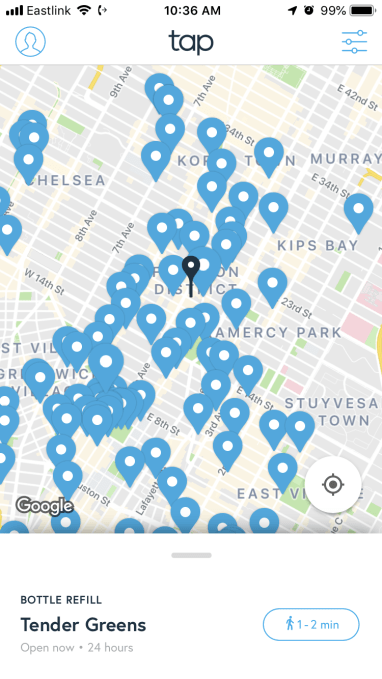

Some people have switched over to reusable water bottles and canteens, but once they do, there is no way to search for water fountains or sources of drinking water. That’s where Tap comes in.

Some people have switched over to reusable water bottles and canteens, but once they do, there is no way to search for water fountains or sources of drinking water. That’s where Tap comes in.