//

ShopRunner chief executive Sam Yagan conquered the online dating world. Can he conquer the e-commerce world, too?

Hot off the heels of its first profitable year, ShopRunner is announcing its first infusion of venture funding under Yagan, an acquisition of the shopping app Spring and, sources tell TechCrunch, it’s readying a major overhaul to its mobile app, signaling what could be a new era for the company.

Yagan, the co-founder of OkCupid, former CEO and vice chairman of The Match Group and managing director of the venture fund Corazon Capital joined ShopRunner in 2016 to test the waters of online retail.

“If you look at founding OkCupid, running Match and incubating Tinder, arguably, I had my hands on the three most important dating businesses ever,” Yagan told TechCrunch. “Finally, I was like, ‘what else is there?’ I am either going to the grave as the online dating guy, or this was the moment.”

Yagan replaced former PayPal president Scott Thompson as ShopRunner’s CEO, moved the Alibaba -backed subscription-based digital shopping company from Silicon Valley to his hometown, Chicago, and readied for battle against Amazon.

ShopRunner teams with mid- to high-end retailers to offer its paying members free two-day shipping and free returns on their sites, taking a small cut of each purchase. As much as it might like to, it doesn’t compete with Amazon Prime. It doesn’t even have a centralized marketplace where users can shop all the ShopRunner partner brands at once, but that may change.

This week, it announced a $40 million investment from August Capital, bringing its total equity funding to around $140 million since it was founded in 2009. The company says it plans to use the cash for product development, data science and to amp up its M&A strategy. It’s already begun the latter, confirming to TechCrunch that it’s acquired Alan and David Tisch’s Spring, a deal first reported by Recode.

Yagan declined to disclose both ShopRunner’s latest valuation and the terms of the Spring acquisition. Though he did say ShopRunner’s valuation is in the “hundreds of millions” range and that they had purchased Spring’s platform and 30 of its employees, a majority of which are engineers.

ShopRunner did not take on all of Spring’s employees. Why? Yagan said it was because the two were similar companies and there wasn’t a need for Spring’s entire team. As a result, Spring’s remaining employees, a mix of engineers and otherwise, are joining real estate tech startup Compass as part of a separate transaction, Spring’s CEO Alan Tisch confirmed to TechCrunch.

Backed with $105 million in VC funding, Spring had reportedly struggled to scale and had drifted from the mobile-first strategy it touted right out of the gate. TechCrunch’s Ingrid Lunden has more on this and Compass’ acquihire.

ShopRunner and Spring had some preexisting ties. Recode reports that Michael Rubin, the billionaire owner of ShopRunner via Kynetic, ShopRunner’s parent company, is close friends with Alan. Moving forward, Alan is serving as an advisor to ShopRunner, while Spring’s president Marshall Porter will continue to lead the startup.

“Shopping on your phone isn’t fun and it’s not easy,” Alan told TechCrunch. “And many of the brands that people love and shop every day you can’t find on Amazon. We wanted to create an experience that was as fun and easy as walking into a great store. We still don’t feel today that the dream has been fully realized but we think combining the scale of ShopRunner and the product Spring has really puts us in the position to make that happen.”

By pairing up with Spring, ShopRunner is multiplying the number of brands available to its paying members by 10 and offering, for the first time, an actual marketplace where customers can gain access to hundreds of those brands at once.

For now, both companies will continue to operate independently, but Yagan says they will revisit whether to fully merge the platforms in 2019.

Spring is ShopRunner’s first major M&A deal, but won’t be its last. Yagan said they have their eyes peeled for any-point solutions that help retailers take on Jeff Bezos, or that have large member bases and provide a great shopping experience.

Finally, according to sources familiar with the company, ShopRunner is planning to unveil a major update to its mobile app in November. Historically, users weren’t able to access ShopRunner brands via its app, making it an essentially useless piece of the company’s product. The update, coupled with the acquisition of Spring, will put ShopRunner on the path toward creating a digital mall with frictionless payments, a necessary step forward for the aspiring Amazon competitor.

from Startups – TechCrunch https://ift.tt/2PWGbZe

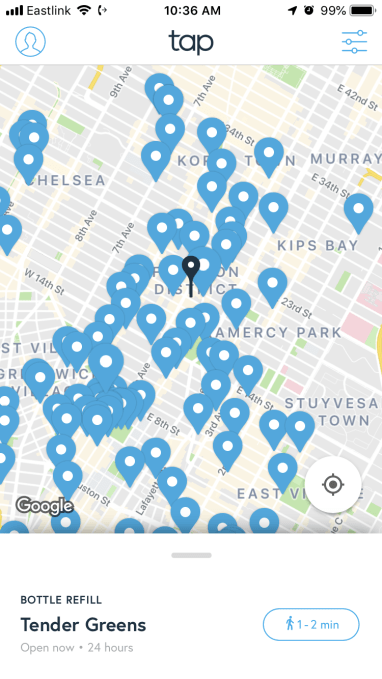

Some people have switched over to reusable water bottles and canteens, but once they do, there is no way to search for water fountains or sources of drinking water. That’s where Tap comes in.

Some people have switched over to reusable water bottles and canteens, but once they do, there is no way to search for water fountains or sources of drinking water. That’s where Tap comes in.