//

For the first time, Uber will make contextual, personalized suggestions about the best way to get from point A to point B. The startup offers more than just cars now, and it’s starting to understand the tradeoffs between price, speed, convenience, and comfort amidst its multi-modal fleet. Most noticeably, you’ll now see JUMP bikes get premier billing right alongside Uber’s other vehicles. Going a short distance and there’s a charged up bike nearby? Uber will suggest you pedal. Might need extra room for luggage on your way to the airport? UberXL and SUV will appear. Always take cheap Pools? It won’t show you a pricier Black car.

Uber is finally getting smart. It has to if it’s going to make sense of its growing patchwork of ride types without overwhelming passengers with too many options. Uber’s algorithm can help them choose. “We think there’s a lot to be gained by being a one-stop shop to get somewhere” says Uber director of product Nundu Janakiram.

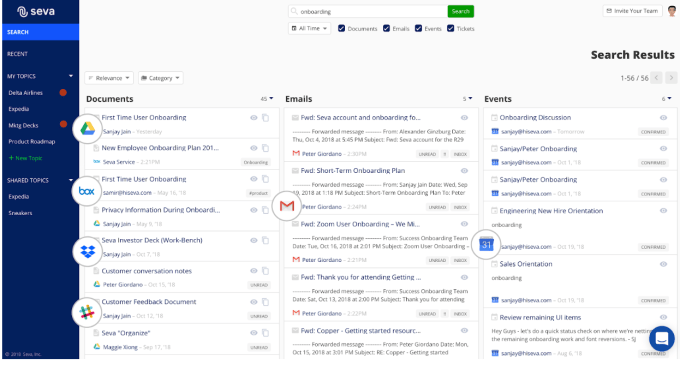

Uber now dynamically recommends different ride types

In particular, Uber could block disruption by scooter-specific startups like Spin, Bird, or Skip. If those apps have no vehicles nearby or you’re going to far, they’ve got nothing to offer. But Uber can provide a competitively priced Express Pool when there’s no open-air ride available, while convincing its existing UberX riders to try a bike or scooter for quick trips when congestion is thick thanks to its new in-house traffic estimates.

Uber Director Of Product Nundu Janakiram

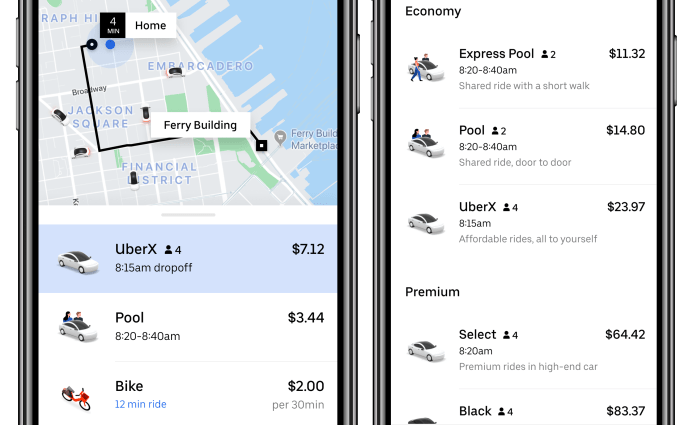

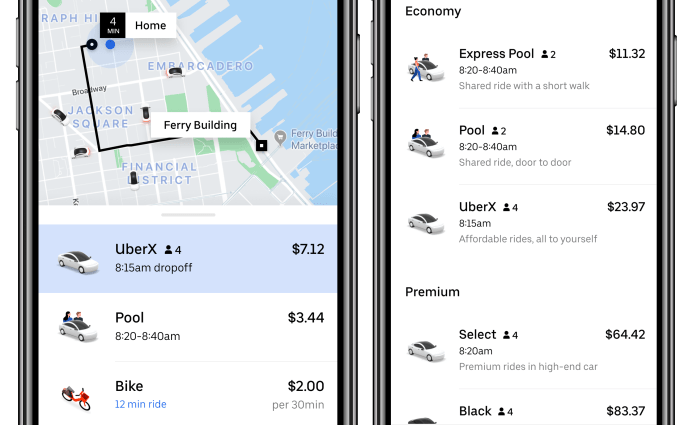

Previously, you’d get a static set of three ride options from the price class you booked from last, regardless of your destination. Meanwhile, bikes and scooters were buried in Uber’s hamburger menu sidebar or an awkward toggle at the top of the screen. The company hans’t done a good job of communicating the definition of Select (nicer normal-sized cars) or Express Pool (walk and wait for a discount) either.

Now Uber’s homescreen can cherry pick the most relevant ride suggestions from across all price classes and vehicle types based on your trip length, destination type, and your personal ride history. Along with better explanations of the different options, this could get users experimenting with modes they’d never tried before.

To make room for more recommendations, the Uber Pool option will unfold to offer both Pools and Express Pools. Uber will even point you to nicer vehicles like Black cars or XLs if UberX is surging to the point that their prices are similar. If you want to compare all the options manually, you can tap to see a list with all the specs and prices lined up.

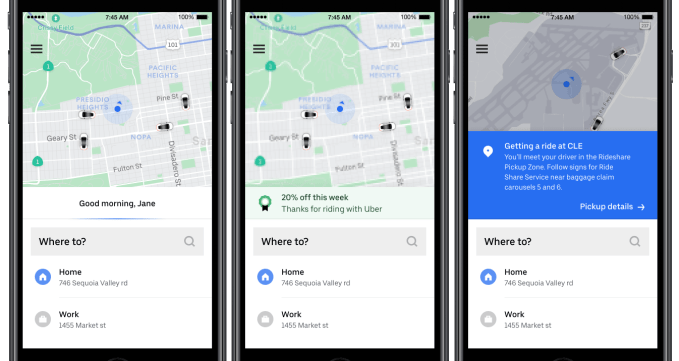

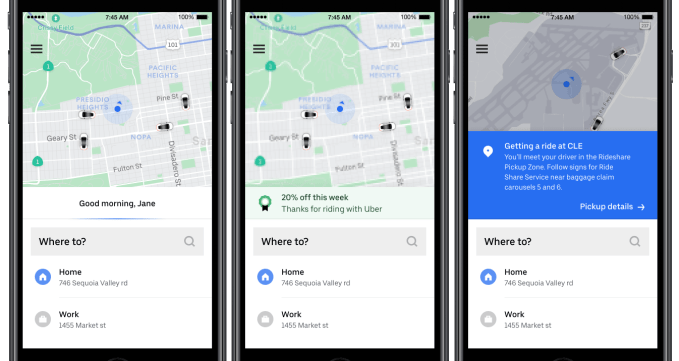

Beyond ride recommendations, Uber is moving the address bar to the bottom of the screen so its closer to your thumbs (which is great as phones keep getting bigger). Finally, in the coming weeks Uber will add a dynamic message bar to the center of the homescreen. Here depending on your pickup and drop off, it could show instructions for hailing from an airport, a discount offer, a birthday message, or just a friendly “Good Morning”.

Eventually, Uber hopes to integrate public transportation ticketing like through its partner Masabi, car rentals, and even multi-leg trips into its recommendations. Maybe a JUMP bike to the train, then an UberPool that’s waiting to take you to your final destination is quicker and cheaper than any one mode alone. If you’re looking at an hour-plus Uber, it might cost less to just rent a car through its partner GetAround and drive yourself. And if a scooter is by far the best ride for you but all of Ubers are rented out, it could recommend one from its partner Lime.

A new communication box is coming to the center of Uber’s homescreen

Uber’s data shows users are rapidly embracing the multi-modal future. A study found the introduction of JUMP bikes to one city led to a 15 percent increase in total Uber + JUMP trips, even though Uber use dropped 10 to 15 percent.

Even if Uber sometimes cannibalizes itself by recommending cheaper options, it’s a smart long-term strategy. Janakiram laughs that “If we wanted to optimize for revenue, we wouldn’t have shown UberX, Pool, and Express Pool first for every user for the last few years.” The lifetime value of ridesharing users is so high that’s worth losing a couple of bucks here or there to keep users from straying to multi-modal competitors like Lyft. Retention will be a key metric under scrutiny as it eyes a 2019 IPO at a potential $120 billion valuation.

“The big picture is that we want your phone to replace your personal car” Janakiram concludes. “If we want to be a true transportation platform, we need to be everywhere our riders need to be as well. The right ride for the right context, and what’s the right ride for you.”

[Disclosure: Uber’s Janakiram and I briefly lived in the same three-bedroom apartment 5 years ago, though I’d already agreed to write about the redesign when I found out he was involved.]

from Startups – TechCrunch https://ift.tt/2yoILAC

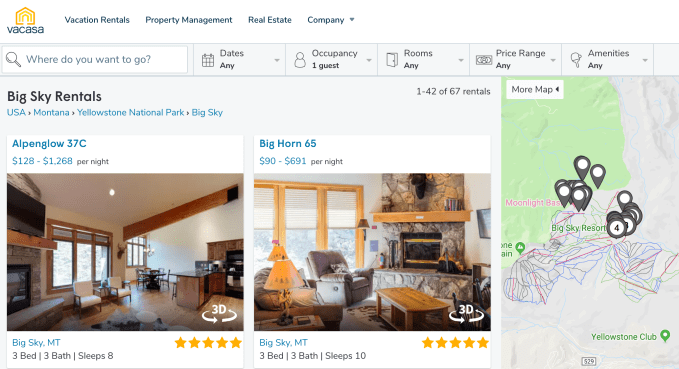

After years growing the business organically, Vacasa raised a $35 million series A from Level Equity in 2015, then $5 million more from Assurant. Then in fall of 2017, it raised an $103.5 million series B. Now it’s topping up that round with $64 million and a new valuation warranted by the startup’s growth this past year. That brings Vacasa to a total of $207.5 million in funding

After years growing the business organically, Vacasa raised a $35 million series A from Level Equity in 2015, then $5 million more from Assurant. Then in fall of 2017, it raised an $103.5 million series B. Now it’s topping up that round with $64 million and a new valuation warranted by the startup’s growth this past year. That brings Vacasa to a total of $207.5 million in funding