Vietnam’s Crypto Pilot: Resolution 05’s Regulatory Framework

Vietnam’s Crypto Pilot: Resolution 05’s Regulatory Framework

$100 billion annually — this staggering figure represents the crypto trading volume flowing from Vietnam to offshore exchanges. While many nations have established clear regulatory frameworks for digital assets, Vietnam has operated in a regulatory gray area for years.

The narrative is shifting. Resolution 05, which pilots a regulated crypto market framework, has just been approved by the Vietnamese government, promising to bring this massive capital flow back onshore.

Is this the golden opportunity the market has been waiting for? Join us as we analyze insights from VinaCapital’s latest report and perspectives from experts at 5 Phút Crypto — Vietnam’s leading crypto community.

1. From Gray Market to Legitimacy

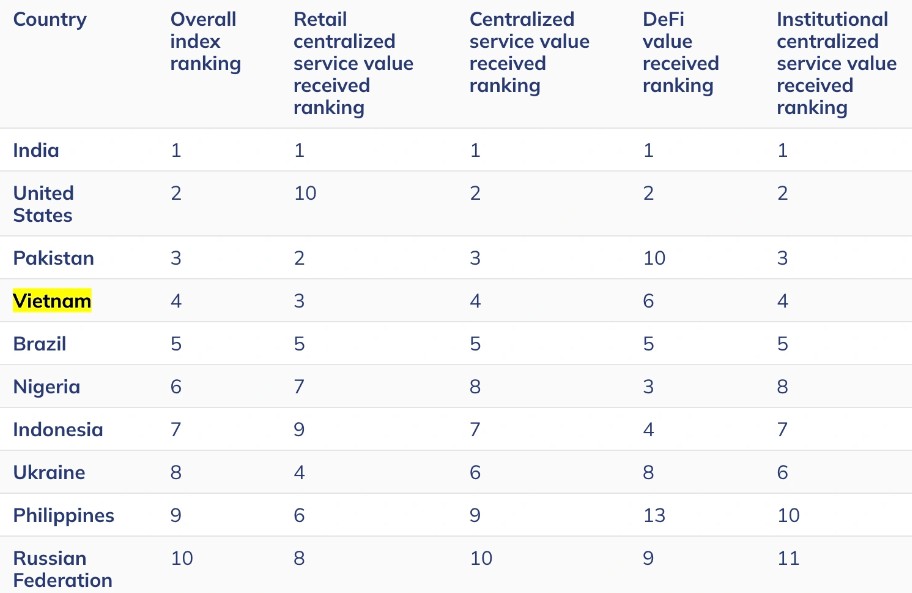

Currently, approximately 17 million Vietnamese are actively trading cryptocurrencies, with annual trading volumes exceeding $100 billion. To put this in perspective, one in every six Vietnamese adults is involved in crypto trading. This $100 billion figure surpasses the GDP of many nations worldwide.

Here’s the critical issue: virtually all of this massive capital is being traded on offshore exchanges like Binance, Bybit, and platforms based in Singapore and South Korea. The situation is analogous to Vietnamese citizens having to travel to Thailand or China just to purchase gold. Beyond the inconvenience, users lack legal protection under Vietnamese law when risks materialize.

September marked a historic turning point as the government issued Resolution 05, officially launching a 5-year pilot program for the crypto market. After years of deliberation, Vietnam has finally decided to open its doors to the digital asset market.

According to experts from 5 Phút Crypto, the Vietnamese government has clear objectives: transitioning the market from underground operations to transparent, regulated trading. When citizens trade on domestic exchanges, the state can collect taxes, monitor capital flows, and most importantly, protect investor interests. Rather than allowing $100 billion to flow offshore annually, the government aims to retain this capital within Vietnam’s financial system.

2. Government Actions and Future Plans

Resolution 05, issued by the government on September 9, 2025, marks the first official legal framework formally recognizing the crypto market in Vietnam. Notably, the government opted for a measured approach with a 5-year pilot program rather than full-scale implementation.

This approach resembles clinical trials for new pharmaceuticals before market release. The government will permit select exchanges to operate within defined parameters, closely monitoring all developments, learning from experience, and making necessary adjustments. This strategy proves far more prudent than the “all-in” approach that left some regional neighbors scrambling for solutions. South Korea and Thailand, for instance, had to tighten regulations after their markets experienced explosive growth accompanied by numerous fraud cases.

For exchanges seeking to participate in the pilot program, the government has established three stringent requirements:

- First, minimum capital requirements of VND 10 trillion – approximately $400 million. This figure far exceeds the requirements for establishing securities firms (which need only a few hundred billion VND). This barrier ensures only financially robust institutions capable of safeguarding investor funds can participate.

- Second, all transactions must be conducted in Vietnamese dong. This means when purchasing Bitcoin, users must deposit VND to exchanges, not USD or EUR as on international platforms. When selling, they receive VND. This enables the State Bank to monitor capital flows and prevent “dollarization” of the economy.

- Third, from January 1, 2026, all exchanges operating in Vietnam must obtain official licenses. The era of underground or semi-legitimate operations ends. Unlicensed exchanges will face access blocks, similar to the government’s approach with online gambling.

VinaCapital’s report identifies three strategic objectives behind these regulations:

- Objective 1: Tax collection and budget revenue generation. With $100 billion in annual trading volume, even a 0.1% transaction tax would yield $100 million. This excludes capital gains taxes from 17 million investors.

- Objective 2: Deep integration with the financial system. Exchanges must connect with domestic banks for deposits and withdrawals. This creates opportunities for banks to offer custody services and crypto-backed lending – an entirely new “digital asset banking” model.

- Objective 3: Investor protection. Exchanges must comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations. All transactions require clear identity verification. When issues arise, authorities can intervene promptly, unlike the previous situation where defrauded investors had no recourse.

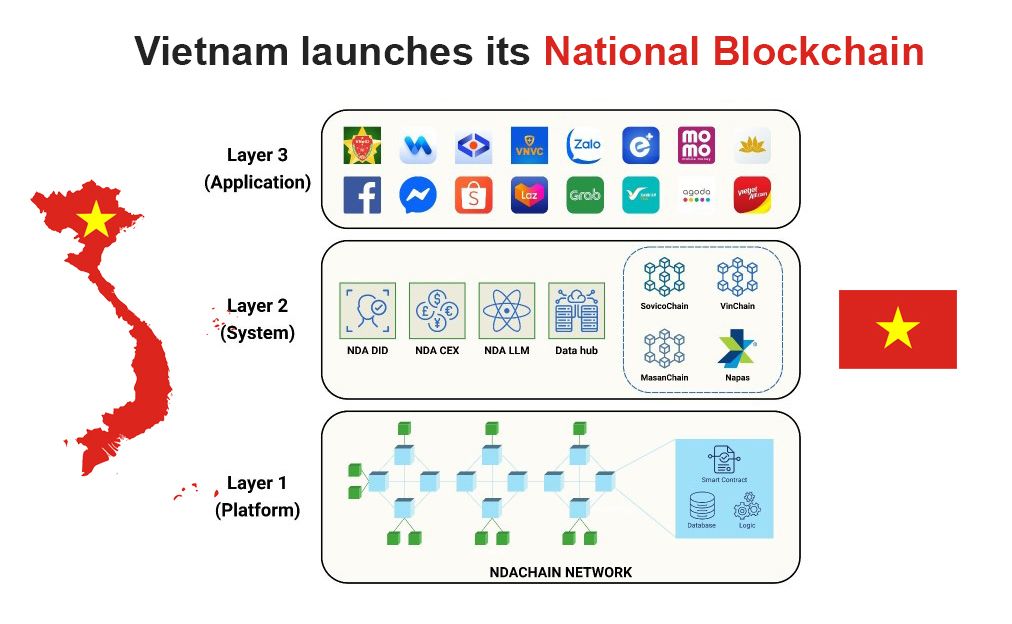

Earlier in July 2025, another significant milestone occurred: the government launched NDAChain – Vietnam’s first domestically-developed national blockchain platform. Built with a three-tier architecture, NDAChain serves not only crypto transactions but also VNeID (electronic citizen ID), inter-agency data exchange, and numerous other applications. It functions as a state-managed “information highway,” ensuring secure and controllable transactions.

3. Golden Opportunities for Market Participants

When a new market opens, early movers often secure the best positions. Vietnam’ s digital asset market is no exception, presenting once-in-a-lifetime opportunities for various stakeholders.

For exchanges, this represents a transformative opportunity. Consider that 17 million Vietnamese currently trade on offshore platforms, generating over $100 billion annually. The first licensed exchanges will act as magnets, attracting this massive capital flow back onshore. According to VinaCapital’s report, pioneering exchanges will not only earn trading fees (estimated at 0.1% per transaction) but also capture invaluable market data. With such enormous volumes, capturing just 10% market share would mean processing $10 billion in annual transactions.

Banks are facing a historic opportunity with an entirely new model: “digital asset banking.” Previously, banks only held cash, gold, and property titles for customers. Now they can provide custody services for Bitcoin, Ethereum, and other digital assets. This explains why shares of banks expected to benefit from the new policies have surged recently.

Domestic investment funds are also entering the arena. For the first time, they can officially establish Bitcoin funds and digital asset funds to serve large institutions like insurance companies and pension funds. With a clear regulatory framework, institutions can allocate portions of their portfolios to digital assets, similar to their current equity and bond investments.

Tokenization opportunities are perhaps the most intriguing. Imagine owning a property worth VND 10 billion. Instead of selling the entire property, you could fractionally divide ownership into 10,000 tokens, each worth VND 1 million, and issue them on the blockchain. Others could purchase fractions to own small portions of your property.

Experts from 5 Phút Crypto observe that integrating digital assets into the financial system will transform how the entire economy operates. Rather than limiting real estate and major project investments to the wealthy, ordinary citizens with just a few million VND can now participate. This represents true “democratization” of investment.

4. Beyond Crypto – A Comprehensive Digital Economy Vision

Many assume Vietnam is simply permitting Bitcoin or Ethereum trading. However, the government’s vision extends far beyond. If the crypto market is a single tree, Vietnam is cultivating an entire digital economy forest.

NDAChain – the national blockchain platform recently launched by the government – exemplifies this broader vision. According to VinaCapital, NDAChain’s three-tier architecture serves more than just crypto transactions. The platform also provides infrastructure for VNeID (electronic citizen ID), inter-agency data exchange, and numerous other applications.

- In healthcare, imagine your medical records stored on blockchain. Whether transferring between hospitals or traveling from Hanoi to Saigon, doctors can access your complete medical history. No more lost records or redundant testing. This demonstrates blockchain’s transformative potential in healthcare.

- In supply chain management, blockchain enables transparent product traceability. When purchasing milk, a simple QR scan reveals where the cow was raised, when the milk was collected, and its journey to your hands. This proves especially crucial for Vietnam’s exports. Clear product origin verification builds international consumer trust and commands premium prices.

- Renewable energy represents another major beneficiary. Households with solar panels can sell excess power to neighbors through blockchain smart contracts. Transactions occur automatically without intermediaries. This incentivizes clean energy investment, contributing to national carbon reduction goals.

Vietnam has chosen a prudent approach: building technology infrastructure (NDAChain) first, establishing clear regulatory frameworks, then permitting pilot operations. While slower, this strategy proves more sustainable, avoiding mistakes made by other nations. Experts from 5 Phút Crypto assess this as a wise strategy, aligning with Vietnam’s characteristics – a developing economy highly sensitive to financial risks.

5. Challenges Ahead

Despite bright prospects, the road ahead isn’t without obstacles. Vietnam faces significant challenges in perfecting its regulatory framework.

- The greatest challenge may be investor education. Among 17 million market participants, how many truly understand crypto? The government and exchanges need comprehensive training programs helping citizens understand digital assets’ nature, opportunities, and risks.

- Building trust presents an equally important challenge. After numerous exchange collapses and crypto-related pyramid schemes, public trust has eroded. When licensed exchanges launch, how can they convince users to abandon familiar international platforms like Binance and Bybit for domestic alternatives?

- Competition with international exchanges poses a massive challenge. Binance processes tens of billions daily with extremely high liquidity and low trading fees. How can Vietnamese exchanges compete? Domestic platforms need unique advantages – perhaps Vietnamese-language customer service, rapid support, or exclusive products for the Vietnamese market.

However, overall, Vietnam is heading in the right direction. Rather than rushing to open markets then scrambling to fix problems like some neighbors, Vietnam chooses a measured but certain path. The 5-year pilot provides reasonable time to learn from experience and adjust policies to match reality.

The post Vietnam’s Crypto Pilot: Resolution 05’s Regulatory Framework appeared first on Ventureburn.