The Colombian-based Panda Group has announced the launch of a cryptocurrency point of sale (PoS) terminal called Xeler that also acts as a portable digital currency automated teller machine (ATM). The hybrid solution installed in Bogotá, at the La Tortata sweet shop, allows customers to not only buy baked goods with cryptocurrencies but can also dispense BCH, BTC, and DAI in exchange for Colombian pesos.

Also read: Florida Appeals Court Defines Bitcoin as Money as Espinoza Ruling Reversed

Panda Group Deploys Crypto Payment Terminal That Also Acts as an ATM

Panda Group, a company that operates the cryptocurrency trading platform Panda Exchange, has announced the creation of a new brick and mortar digital currency service. On Jan. 22, Panda installed a new portable point of sale device that allows merchants to accept cryptocurrencies with ease. The company’s first installed Xeler device was deployed at the La Tortata sweet shop in Bogotá, so customers can purchase baked goods with their digital assets. Moreover, the machine also allows visitors to conveniently purchase and sell BCH, BTC, and DAI through its integration with the Colombian exchange. Speaking with news.Bitcoin.com, Panda Group’s founder Arley Lozano explained that the machine’s first sale was settled in bitcoin cash (BCH).

Lozano further detailed that the company plans to deploy 20 more Xeler devices throughout the region, due to a recent partnership with a well-known chain of pharmacies. The Panda CEO also told news.Bitcoin.com that the firm is ready to launch 100 hybrid crypto PoS/ATM devices around Colombia and send some to Venezuela as well. As far as commissions, merchants will only be charged for the use of processing sales and the fees are equivalent to alternative payment processor terminals. The device references cryptocurrency exchange rates from the spot market prices in Colombian pesos and Localbitcoins rates.

Tailored to Meet the Needs of the Latin American Market

The company explained that the Xeler machine is a noncustodial system and merchants are always in charge of their funds. Lozano noted that the Panda team calls the device a “BTM” or a “CTM (crypto teller machine).”

“The Xeler BTM is a device that has the ability to buy and sell cryptocurrencies, in addition to processing payments for products purchased with crypto,” Panda Group explained to news.Bitcoin.com. “This makes the point of sale process quick and intuitive for both the user and operator, but above all, the system is secure since the interface is built and designed for the safe and reliable handling of cryptocurrencies.”

The company also said it will be adding more digital currencies to the platform interface in the future. Moreover, with Xeler’s Xpay payment processor system, businesses can settle a percentage of sales in fiat if they do not wish to experience the volatility of crypto prices. Visitors who want to buy or sell cryptocurrencies must undergo a simple registration process, which is performed directly on the device. After the registration is complete, Xeler users won’t have to register again and they can interact with all Xeler devices in the region. Once a purchase is processed, the cryptocurrencies are sent to the customer’s wallet or if they don’t have a wallet, they can obtain a printed voucher for redemption at a later date.

“Merging these two products (PoS/ATM) is a significant achievement for Panda’s operations,” the company noted. “Panda Group is thinking about the needs that exist in the Latin American market, because the ability to buy or sell cryptocurrencies makes it easier for those people who want to begin their voyage into the crypto world — They don’t usually do it because they think they should invest a lot of money but the minimum default amount for using the Xeler device is 50,000 COP ($15).”

What do you think about the Xeler device that allows merchants to sell products for cryptocurrencies but also works as an ATM? Let us know what you think about this subject in the comments section below.

Images credits: Arley Lozano, Panda Group, Xeler, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Panda Exchange Deploys Hybrid Point of Sale and Crypto ATM in Bogota appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2Gdtzea Panda Exchange Deploys Hybrid Point of Sale and Crypto ATM in Bogota

In traditional finance ther

In traditional finance ther

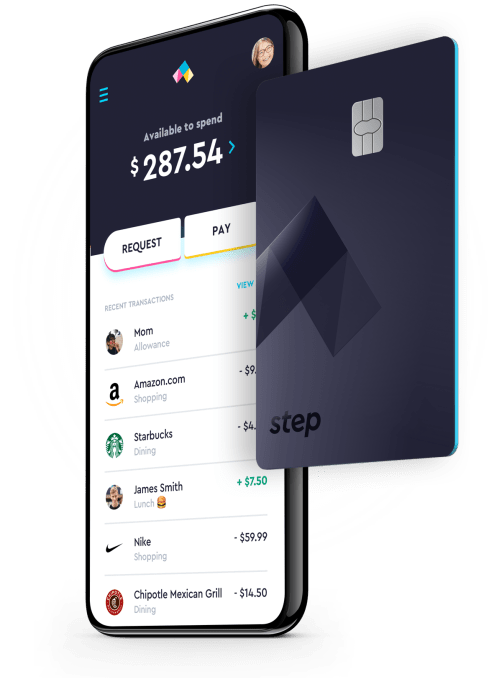

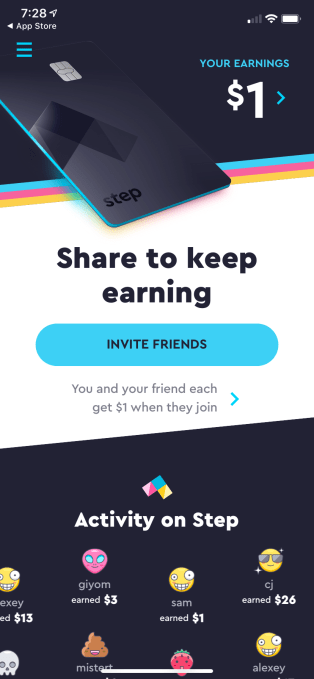

Step’s focus on this younger demographic puts it in a different space, where there are fewer competitors. Its more direct rivals are not the bigger mobile banks, but rather startups like

Step’s focus on this younger demographic puts it in a different space, where there are fewer competitors. Its more direct rivals are not the bigger mobile banks, but rather startups like The company pays a 2.5 percent interest rate on deposits, offers a round-up savings feature and a range of budgeting tools and supports free instant transfers between Step accounts. It also provides access to a network of 35,000 ATMs with no fees.

The company pays a 2.5 percent interest rate on deposits, offers a round-up savings feature and a range of budgeting tools and supports free instant transfers between Step accounts. It also provides access to a network of 35,000 ATMs with no fees.