Category Archives: Startup of the Day

Hitflow – surveiller la disponibilité de vos sites web et services

Airsaas, le moteur de recherche startup gratuit

Fastmag, éditeur de logiciel de caisse

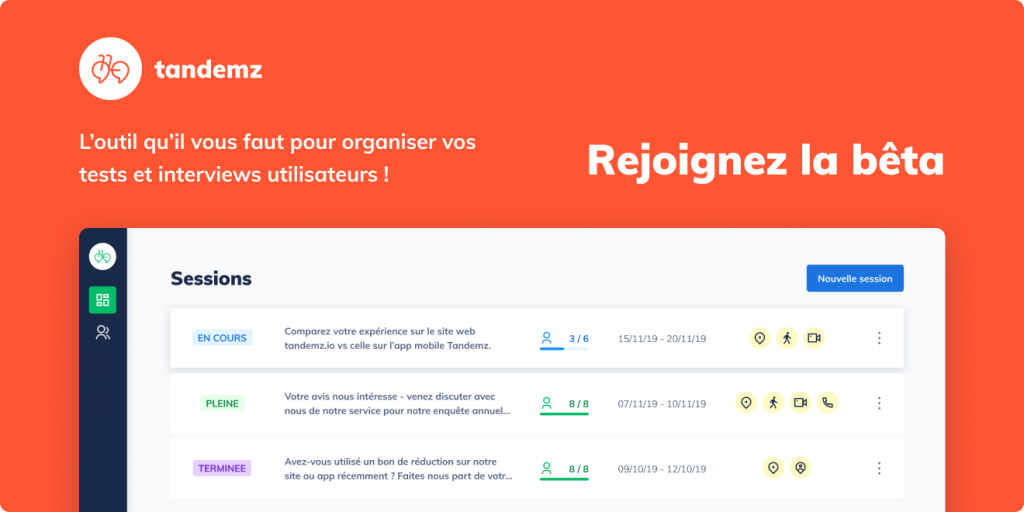

Tandemz – la plateforme qui simplifie l’organisation de vos tests et interviews utilisateurs

MicroDesk – logiciel de gestion spécialement conçu pour les micro-entreprises

Livli – expert comptable en ligne

Khatabook raises $25M to help businesses in India record financial transactions digitally and accept online payments

European early-stage VC firm ‘Project A’ on Europe’s startup scene taking the next step

//

Project A, the Berlin-based VC, just raised a new $200 million fund (€180 million) to continue backing European startups at Seed and Series A stage.

In addition, the firm — whose investments include WorldRemit, Catawiki, Voi and Uberall — announced it will now have a presence in London and Stockholm in order to put people on the ground in what it says are “two of its favorite ecosystems.”

What better time, therefore, to catch up with the team at Project A, where we talked investment thesis, why Stockholm and London, and the increasing interest in Europe from U.S. LPs and VCs. Other subjects we touched on include diversity in venture, and, of course, Brexit!

TechCrunch: You last raised a fund in 2016, totaling €140 million, what changes have you noticed since then with regards to the types of companies you are seeing and the European ecosystem as a whole?

Uwe Horstmann: Entrepreneurs definitely matured a lot over the last few years. We see more and more of serial founders who combine drive with experience delivering great results. We also noticed an increase in more tech / product-centric and in B2B models.

This doesn’t come as a surprise as the market for consumer-oriented models started developing much earlier and is now reaching its limits after a few years. Many entrepreneurs gained experience in the Old Economy or have been consulting companies for a few years, learned about the struggle with products and processes first-hand and developed solutions specifically tailored to the industry’s needs.

We also notice a rise in professionalism in company setups and a higher ambition level in founding teams. This is probably also due to a more professional angel and micro fund scene that has developed in Europe.

TC: I note that you have U.S. LPs in the new fund, which I think is a first for Project A, and more broadly we are seeing a lot more interest from U.S. VCs in Europe these days. Why do you think that is, and how does this change the competitive landscape for deal-flow and the ambition of European founders?

Thies Sander: Having our first U.S. LPs on board makes us proud. LPs have noticed that European VC returns have really picked up during recent fund cohorts.

from Startups – TechCrunch https://ift.tt/2neokUm

Amboss, the knowledge platform for medical professionals, scores €30M Series B

//

Amboss, the Berlin-based ‘medtech’ startup that originally offered a learning app for students but has since pivoted to a knowledge platform for medical professionals, has raised €30 million in Series B funding.

The round is led by Partech’s growth fund, with Target Global acting as a co-investor. Existing investors, Cherry Ventures, Wellington Partners and Holtzbrinck Digital, also participated.

Launched in 2014 as a study platform for medical students, Amboss has since evolved to offer what it claims is the “most comprehensive and technologically-advanced” knowledge platform for medical professionals. It has been developed by a group of 70 doctors and 40 software engineers who work together in small cross functional teams.

“Medical Knowledge does not find its way into practice efficiently,” argues Amboss co-CEO Benedikt Hochkirchen. “This has two main root causes: the way we educate doctors is outdated, and the way doctors access knowledge is inefficient”.

Specifically, he says that medical students are still taught to memorize facts, which become outdated quickly, and there isn’t enough emphasis on understanding and application. In contract, Amboss’ “smart learning” technology claims to not only help students achieve higher scores in their medical exams but furthers their contextual understanding and therefore lays the foundation “to be better prepared for clinical practice”.

“In clinical practice, doctors would adapt 50% of their decisions if they had the latest and precise knowledge at hand,” says Hochkirchen. “In real life on the wards, doctors lack the time to research and find the relevant knowledge. For them, Amboss’ smart guidance app is there to provide instant, convenient and reliable medical knowledge to carry out the best possible care”.

The end result, says the Amboss co-CEO, is that the startup’s app reduces the average research time needed for doctors to make a clinical decision from 30 minutes to 30 seconds. Crucially, its knowledge base contains the most recent medical facts and guidelines “in every single case”.

“Young doctors have to take over a lot of responsibility early in their career,” adds Hochkirchen. “Career starters are regularly the first touch point with a doctor when a patient enters a hospital. Often young doctors do not feel properly prepared for the real life challenges in those situations. Amboss is the source of choice to master those decisions e.g. with emergency algorithms and lead symptoms”.

Likewise, more experienced and specialised doctors can also find utility in Amboss, as guidelines and therapies of choice are constantly changing. “It is almost impossible for the doctor to stay up to date for every possible indication,” he says. “Amboss provides them with precise knowledge based on latest guidelines to ensure doctors choose the best therapy possible”.

Or, put a another way, Amboss is attempting to build a “Google for medicine”. “They are tackling a very exciting space which will have a positive impact on society, bringing knowledge levels and skillsets of medical doctors to a higher level,” Cherry Ventures’ Christian Meermann tells me.

Meanwhile, armed with new capital, Amboss says it will accelerate the global rollout of its product with a focus on the U.S. In addition, the startup will further develop its product, for both generalist and specialist doctors, “to help improve their daily clinical decision-making”.

from Startups – TechCrunch https://ift.tt/2mOS5v7