Category Archives: Blockchain News

#Blockchain An In-Depth Look at Ethereum’s Maker and Dai Stablecoin

Since tether (USDT) bolstered the idea of a working stablecoin over the last few years, there’s been a variety of different types of stable cryptocurrencies that are usually pegged to the U.S. dollar. However, there’s one particular stablecoin that’s been a hot topic of discussion lately called dai, a coin that’s backed by ethereum locked into a smart contract.

Also read: Payglobal Provides Cryptocurrency to Fiat Transfers With Existing Bank Cards

Maker and Dai

The following is an overview of how dais are created within a network called the Maker DAO and why some cryptocurrency enthusiasts seem to like the concept better than its fiat alternatives. But there’s also a slew of critics who dislike the Maker project for a multitude of reasons that could theoretically hurt a few individuals’ dreams of the perfect stablecoin backed by crypto assets.

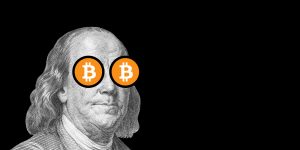

The Ethereum network has a popular decentralized autonomous organization (DAO) called Maker, which is now well known for creating a cryptocurrency-backed stablecoin called dai. The Single-Collateral Dai (SCD) system, launched in December 2017, allows anyone to leverage their ETH in order to create a stablecoin that keeps price valuation down to around $1 most of the time. Over the last 14 months of operation, the Maker DAO has become the most popular Ethereum-based system in 2019. At the time of publication, there’s more than 1 percent of the entire ETH supply in circulation locked up into the Maker system as there’s 2.1 million ETH used as collateral.

The Maker team consists of CEO Rune Christensen, CTO Andy Milenius, President Steven Becker and roughly 18 other leaders. The community is relatively small but has been growing since the project’s inception. Maker and the stablecoin dai community have a blog, a chat forum, and its own subreddit where individuals discuss the nascent ecosystem. At press time, dai is ahead of the stablecoin GUSD with the 55th largest market capitalization of around $89.3 million.

There are two fundamental differences between Maker’s dai and other stablecoins like USDC, GUSD, and USDT. For one, dai is not backed by fiat reserves held in a bank like a great majority of its stablecoin peers. The other difference is that fiat systems are collateralized by the company’s word and third-party audits while the transparency of dai can be seen onchain at all times. Basically, dai holds stability because ETH is locked into a contract used in a system called a Collateralized Debt Position (CDP). A user wanting to acquire dai sends the ETH to a CDP and can withdraw dai from there.

However, the collateralization ratio uses a method called overcollateralization (OC), which helps lower the system’s exposure to risk and keeps the credit (dai) through Maker’s autonomous feedback mechanisms. OC requires more funds than a typical dollar for dollar trade in order to obtain dai. The ratio of ETH collateral needed in order to acquire dai is fixed at 1.5:1 at all times, but users can purchase dai on the open market too.

Critics of Maker, Overcollateralization, and a Stablecoin Unmediated by the Legal System

Maker and dai have become a popular subject among cryptocurrency supporters largely because some people like the concept of a liquid stablecoin for certain use cases as well as the idea dai is backed by crypto. However, there are some critics of the Maker protocol and the dai stablecoin it produces. Some skeptics believe the project could fall victim to the same scenario that happened to the Ethereum network’s first DAO which saw the loss of $50 million in June 2016. At the time, users exploited the DAO’s code enabling them to take one-third of the DAO’s funds to a subsidiary account. Another critique of Maker DAO explains that the OC scheme and paying the contract back with the equivalent amount of dai is well known. However, what the organization hasn’t explained yet “is that you also need to pay a stability fee in MKR,” Bennett Tomlin said last June.

“Also [dai] cannot always be collateralized in excess, because if there is a black swan event that destroys the value of ethereum that is no longer true,” Tomlin’s research details.

Tomlin’s study called a “Deep Look at Maker DAO and Dai and MKR” adds that the Maker’s creators explain in the white paper that in the event of a “black swan” crash the organization will dilute the “pooled ether.” The author’s post explains, “Why someone would trust this, I do not know — The developers are obviously aware of this risk, but it seems to be ignored.” Tomlin’s report also details that the biggest hurdle for the Maker team is the government-specific entities that regulate the U.S. financial activities. “Better watch out for the SEC, the CFTC, and the rest of the alphabet soup,” Tomlin warned.

A Multi-Collateral Dai and Other Chain’s Creating a Stablecoin

Despite some concerns, the Maker DAO continues to rake in lots of ethereum in order to create the world’s first working consumer-grade stablecoin based on the collateralized crypto assets. The project’s roadmap calls for a Multi-Collateral Dai system which will at some point be able to collateralize the dai stablecoin with other cryptocurrencies. On Nov. 6, 2018, the development team detailed that the code for Multi-Collateral Dai was published and contracts have been deployed to the system’s testnet.

Additionally, there has been talk of other cryptocurrencies following suit with the dai idea. Just recently the Bitcoin Cash (BCH) community discussed the creation of a stablecoin built on the BCH chain. The BCH network has been recently experimenting with token creation but something like dai on BCH would require some different elements. By and large, the Ethereum community seems to appreciate the Maker protocol and dai stablecoin and so far it has brought some more traction toward that ecosystem.

What do you think about the Maker protocol and the dai stablecoin? Let us know your thoughts on this subject in the comments section below.

Disclaimer: This article is for informational purposes only. Bitcoin.com does not endorse the Maker DAO or dai stablecoin. Readers should do their own due diligence before taking any actions related to the mentioned companies, creators, associates, or any of its affiliates or services. Bitcoin.com and the author are not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image credits: Shutterstock, Maker DAO, Dai, Makerscan.io, and Pixabay.

Need to calculate your bitcoin holdings? Check our tools section.

The post An In-Depth Look at Ethereum’s Maker and Dai Stablecoin appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2NGlu3t An In-Depth Look at Ethereum’s Maker and Dai Stablecoin

#Blockchain Venezuela Starts Regulating Cryptocurrency Remittances

The Venezuelan government has begun regulating cryptocurrency remittances. The regulator has set a monthly limit and will be collecting commissions of up to 15 percent of the transaction amount. Additionally, new details of its comprehensive registry of crypto service providers have been announced.

Also read: Indian Supreme Court Moves Crypto Hearing, Community Calls for Positive Regulations

Regulating Crypto Remittances

The National Superintendency of Crypto Assets and Related Activities (Sunacrip), the regulator of all crypto activities in Venezuela, announced on Friday that the new regulation for remittances using cryptocurrencies has entered into force. The decree enacting this regulation was published in the country’s Official Gazette No. 41.581.

The decree establishes “the requirements and procedures for the sending and receiving of remittances in crypto assets to natural persons in the territory of the Bolivarian Republic of Venezuela,” Sunacrip explained.

According to the decree:

The sender of the remittances referred to in this ruling is obliged to pay a financial commission in favor of Sunacrip up to a maximum amount of 15% calculated on the total of the remittance.

The minimum commission Sunacrip charges is “equivalent to 0.25 euros [~$0.28] per transaction,” the gazette reads.

According to the text of the regulation, Sunacrip now has the power to establish the remittance limits, set values of cryptocurrencies in sovereign bolivars, specify tariffs, and request data from the issuers and receivers involved in the transactions, local news outlet Criptonoticias reported.

The monthly limit for sending remittances is equivalent to 10 petros (PTR), Venezuela’s national currency that the government claims to be a cryptocurrency backed by oil, gold, diamond and other natural resources. “This cap translates into US $600 per month, according to the quote set for the PTR. Any amount that exceeds this limit will require the Sunacrip endorsement, which will authorize up to a maximum of 50 PTR ($3,000),” the publication elaborated.

Following Sunacrip’s announcement, some people took to Twitter to voice their opinions about the new rules. One user commented that these rules are “the most absurd thing I’ve seen.” Another user tweeted, “An absurd regulatory framework. Instead of promoting the adoption of crypto assets, [they] are trying to centralize something that its genesis is the opposite.”

Crypto Service Registry

Following the initial enforcement of crypto regulation in Venezuela on Jan. 31 with the publication of Official Gazette Number 41.575, the government has proceeded to enact rules specific to the cryptocurrency service registry.

The Superintendent of Sunacrip, Ramirez Joselit, announced on Feb. 5 that the regulation for the “Integral Registry of Services in Crypto Assets [Risec]” has entered into force with its publication in Official Gazette Number 41.578.

The Ministry of Popular Power for Communication and Information explained that “Natural, legal, public and private persons, communal councils and other organizations of the People’s Power that intend to carry out activities related to the Integral System of Crypto Assets may be registered.”

According to the decree, Sunacrip is in charge of Risec “which will systematize the information related to the identity and other recurrent data of the user of the Integral System of Crypto Assets and related activities.” The regulator will designate a unit “responsible for the control, monitoring and verification of updating of the data contained in the Risec.”

What do you think of Venezuela regulating crypto remittances and keeping a registry of crypto service providers? Let us know in the comments section below.

Images courtesy of Shutterstock and the Venezuelan government.

Need to calculate your bitcoin holdings? Check our tools section.

The post Venezuela Starts Regulating Cryptocurrency Remittances appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2DvRouD Venezuela Starts Regulating Cryptocurrency Remittances

#Blockchain BCH Avalanche Transactions Show Finality Speeds 10x Faster Than Ethereum

Over the last few weeks, Bitcoin Cash (BCH) developers and community members have been discussing a pre-consensus method called Avalanche. Now BCH proponents have begun to notice the protocol has been applied to the Bchd full node implementation and the proof of concept officially running on the BCH mainnet.

Also read: Mt. Gox Creditors Neither Need nor Deserve This Kind of ‘Hero’

The Benefits of Avalanche and PoW Running in Parallel

The Avalanche proof-of-concept is a consensus algorithm that adds Byzantine fault tolerant proofs to a blockchain network so nodes can differentiate between two conflicting transactions. The protocol communicates with nodes in real time in order to bring consensus in a more efficient manner. This is because Avalanche queries the network of nodes and asks them to come to pre-consensus on which of the two conflicting transactions are preferred.

People are often confused with Avalanche being applied to BCH because it’s also being used in a proof-of-stake (PoS) project designed by Cornell Professor Emin Gün Sirer. On the BCH chain, Avalanche is only being used for pre-consensus and runs parallel with the original proof-of-work consensus mechanism. A number of BCH developers and proponents believe Avalanche will make the BCH network far more robust.

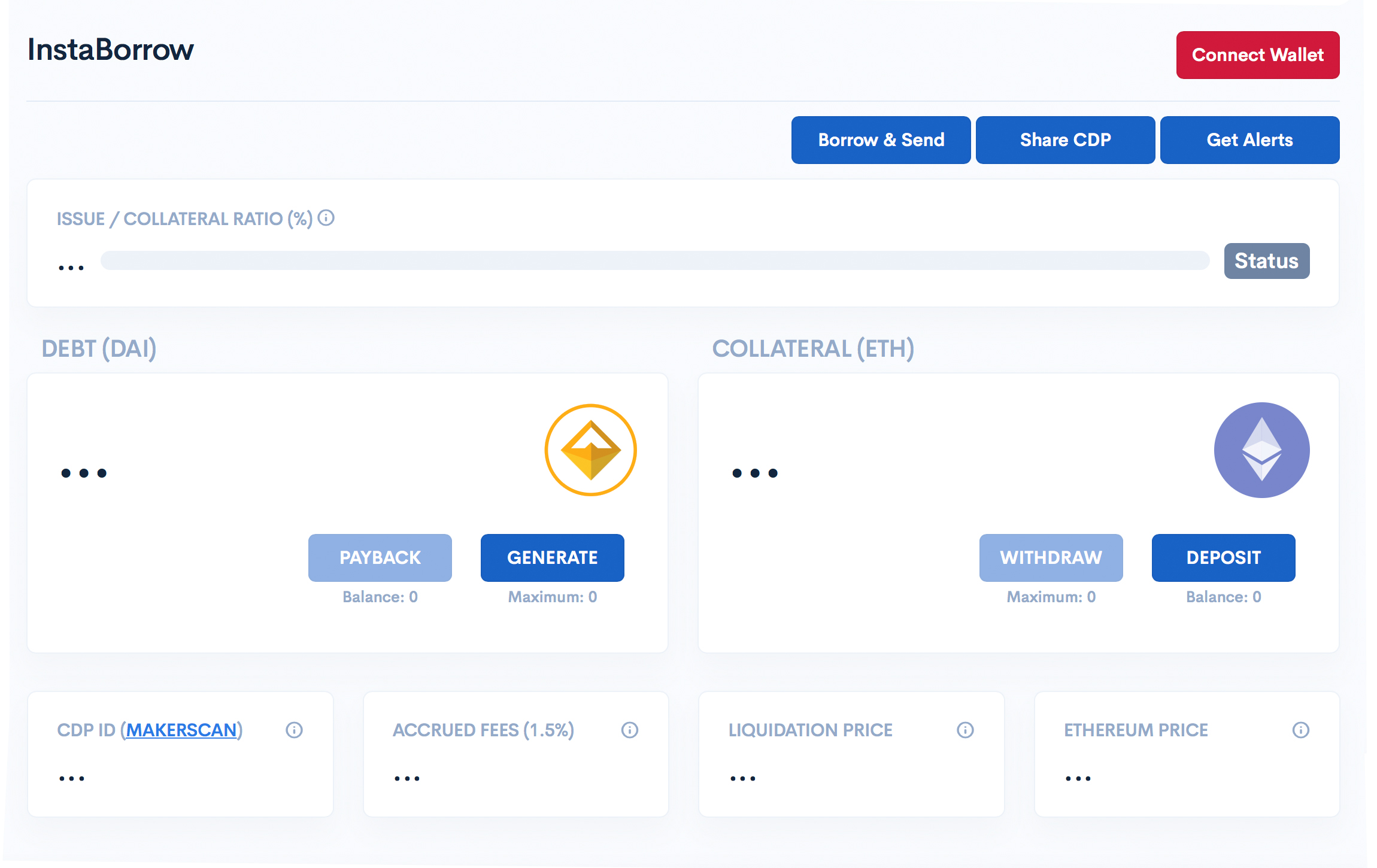

Avalanche discussions have increased over the last week since the protocol is now running on the main network. “Ok, the Avalanche proof of concept is officially running on mainnet,” explained Bchd developer Chris Pacia on Feb. 7. The programmer also left a link to the protocol’s Github repository which gives developers a gist of the Avalanche pre-consensus specification implemented in the Bchd branch.

The Bchd version of Avalanche Github repository states:

[The following specification] is not intended to be a final spec and is likely not compatible with the implementation being developed by Bitcoin ABC — The primary purpose is to give other developers something tangible to look at, think about, and discuss.

Irreversible Transactions in Seconds

In addition to the experimentation on the main BCH chain, Bchd developers have published an Avalanche transaction explorer as well. The speed at which BCH transactions are processed shows the transaction’s finality is typically 2-3 seconds or less. Essentially this means the transaction (tx) listed on the Avalanche explorer has reached a point at which it can no longer be reversed by a double spend, even though the tx is unconfirmed by miners.

“If used this way, it would give Bitcoin Cash the equivalent of nearly instantaneous confirmations while improving mempool synchronization and reducing the financial incentive to 51% attack,” the Avalanche blockchain explorer details. “As you can see, at present most transactions become irreversible after just a couple seconds — To take this from proof-of-concept to an actual consensus rule will require lots of testing, experimentation, data collection, code review, and soft fork activation rules.”

10x Faster Than ETH and Reorganization Protection

Over the last few days, BCH supporters have also discussed how the transaction finality speeds have been 6-10x faster than the Ethereum network. “Transaction finalized in 1.559723305 seconds — That’s 10x faster than ETH — A serious game changer,” explained BCH developer and Bitbox founder Gabriel Cardona on Twitter. Bitcoin ABC developers have also been discussing Avalanche and the protocol is on the roadmap according to the BCH development statistics page on Coin Dance.

In the past, Bitcoin ABC developer Amaury Sechet has said the protocol can make synchronization far more efficient. The ABC developer discussed the benefits of Avalanche at the Satoshi’s Vision Conference in Italy last October. There are more advantages explained in a post written by the ABC developer Mengerian, who says not only is transaction finality fast, but the Avalanche protocol “provides a good mechanism for post-consensus defense against blockchain reorganization attacks.” It seems that the proof-of-concept Avalanche is making headway within the BCH ecosystem and the results have been positive so far.

What do you think about the Avalanche pre-consensus model? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Avalanche Transaction Explorer, Bchd website, and Github.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH, and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post BCH Avalanche Transactions Show Finality Speeds 10x Faster Than Ethereum appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2WQkSMO BCH Avalanche Transactions Show Finality Speeds 10x Faster Than Ethereum

#Blockchain Localbitcoins to Introduce New User Verification Rules

Peer-to-peer crypto exchange Localbitcoins is preparing to implement updated requirements for the identity verification of its users. The company recently revealed it’s cooperating with regulatory agencies in Finland on the implementation of the latest EU anti-money laundering rules.

Also read: 3 Technical Proposals for Increasing Bitcoin’s Privacy

P2P Exchange Localbitcoins Advising Finnish Regulators

In a statement published on its website this week, the popular P2P coin trading platform Localbitcoins explained why the upcoming changes are necessary. The new 5th Anti-Money Laundering Directive (5AMLD), which was enforced by the European Commission in July 2018, covers virtual currencies. 5AMLD, or Directive 2018/843 of the European Union, also includes cryptocurrency exchange services and custodian wallet providers in its scope, Localbitcoins noted.

EU member states now have until January 2020 to transpose the new 5AMLD requirements into their national legal frameworks. Finland, where Localbitcoins is based, has already drafted new legislation concerning digital currency services that amends the country’s Anti-Money Laundering Act in accordance with the European directive.

According to the announcement, Localbitcoins has been a pioneer in advising Finnish regulatory agencies in this process and adapting to the new standards of compliance relevant to the cryptocurrency industry. The Helsinki-based company believes its mission is to “bring Bitcoin everywhere.” It says that “by being a reference in compliance, we also aim to promote trust, legitimacy and maturity in the Bitcoin ecosystem, while paving the way for it to become a more viable and widespread currency and combating criminal use of Bitcoin and its network.”

Changes to Affect Account Registration and Verification

The Localbitcoins team has also expressed confidence that the new measures will bring “significant benefits” to users by promoting a safer trading environment and preventing fraud. Although the exact legal requirements are still under preparation, the exchange notified clients that they will bring “major changes” to how crypto trading platforms operate. The company further detailed:

The most important changes concerning Localbitcoins’ users will be related to improving the registration of new accounts and the identity verification processes, introducing wallet withdrawal and trade volume-based verification tiers.

The Finnish company also said it’s working to smoothen the transition for those customers who make legitimate use of its services and already comply with their terms. For years, Localbitcoins has been a benchmark platform among peer-to-peer cryptocurrency exchanges. It connects buyers and sellers of digital coins around the world on geographical basis allowing crypto purchases through an escrow system.

A Benchmark Exchange and Its Alternatives

Localbitcoins was founded in the summer of 2012 and gained popularity among crypto traders who were able to exchange digital currencies in a relatively anonymous manner. However, a few years ago the company introduced a feature allowing users to voluntarily upload their IDs.

Later, those who traded large amounts of bitcoin were reportedly asked to upload a copy of an ID document. Last spring, the platform updated its terms of service due to new EU regulations and included identification requirements in certain situations, as news.Bitcoin.com reported.

A number of other peer-to-peer and decentralized crypto exchanges have emerged over the years. These include platforms such as Paxful, Bisq, Bitsquare, Coinffeine, and Hodl Hodl. New companies continue to create similar exchanges. In November, a startup from Norway announced the launch of a peer-to-peer cryptocurrency marketplace called Bitruption.

Are you using the services of Localbitcoins or any of the other P2P exchanges? Tell us in the comments section below.

Images courtesy of Shutterstock.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post Localbitcoins to Introduce New User Verification Rules appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2SM1QYC Localbitcoins to Introduce New User Verification Rules

#Blockchain These Video Sharing Sites Pay Content Creators in Bitcoin Cash

On Feb. 4, Bitcoin Cash (BCH) supporters caught a sneak peek at two new video platforms dedicated to the BCH ecosystem. Porn.cash and Cinema.cash give content creators the ability to publish videos and get paid in cryptocurrency.

Also read: Indian Supreme Court Moves Crypto Hearing, Community Calls for Positive Regulations

Video Publishers and Content Creators Get Paid in BCH at Cinema Cash

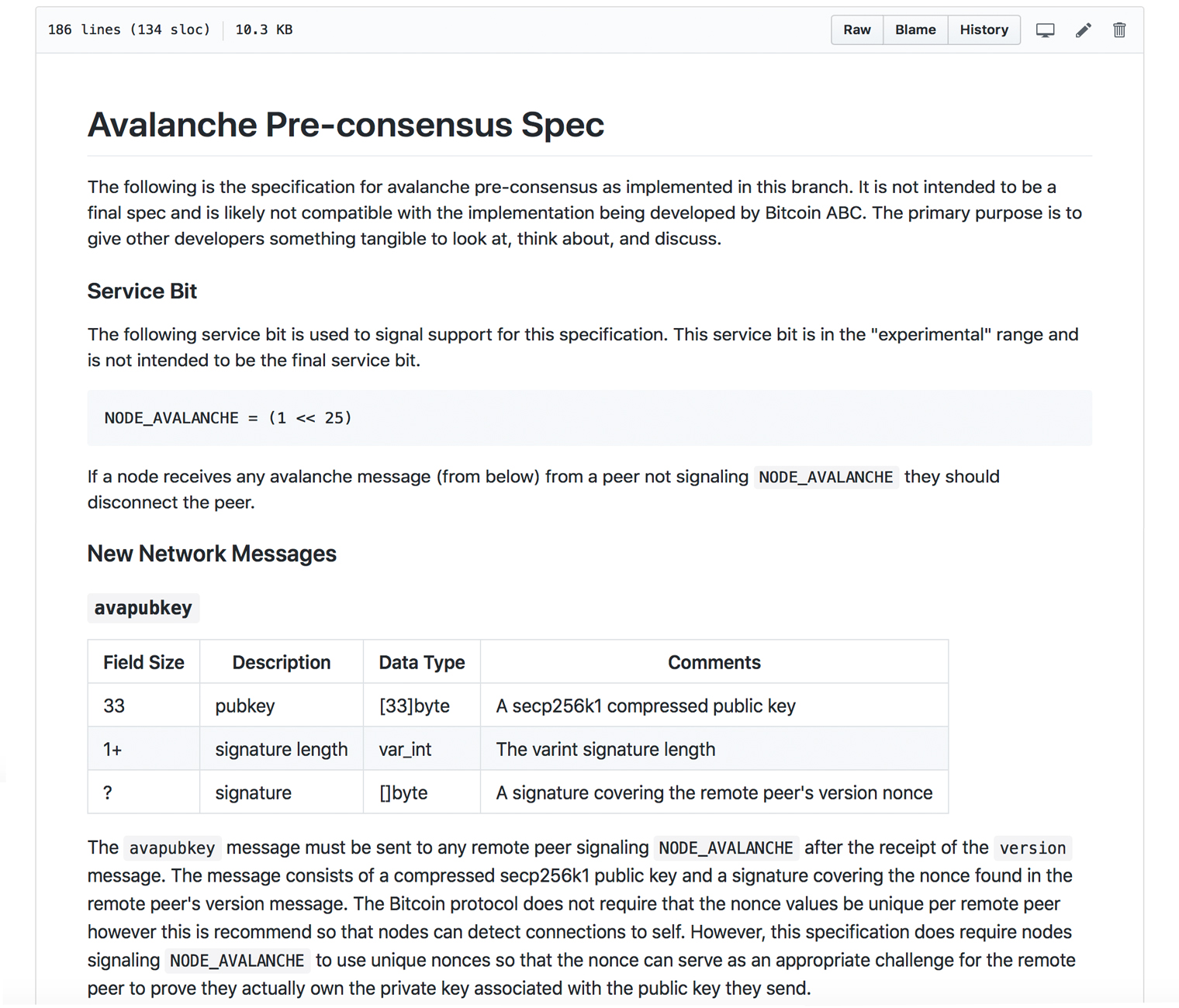

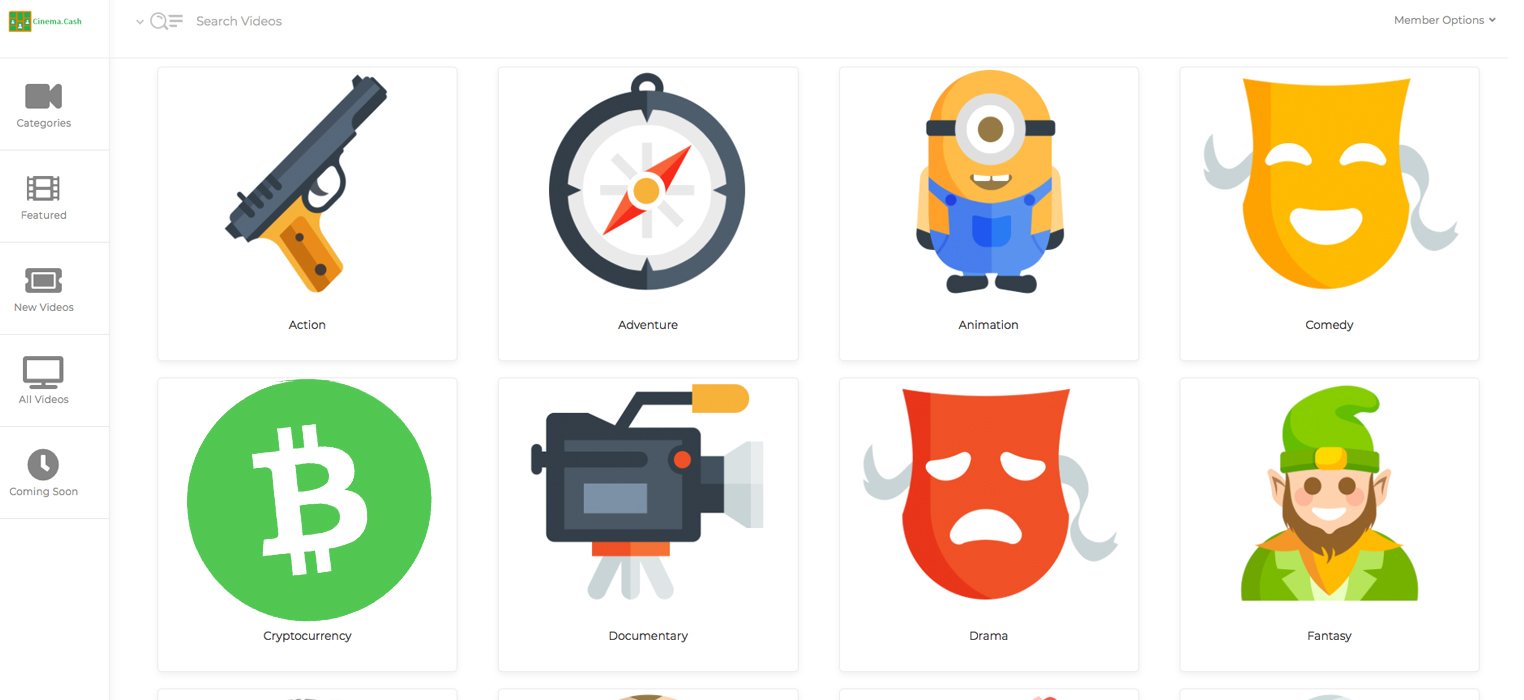

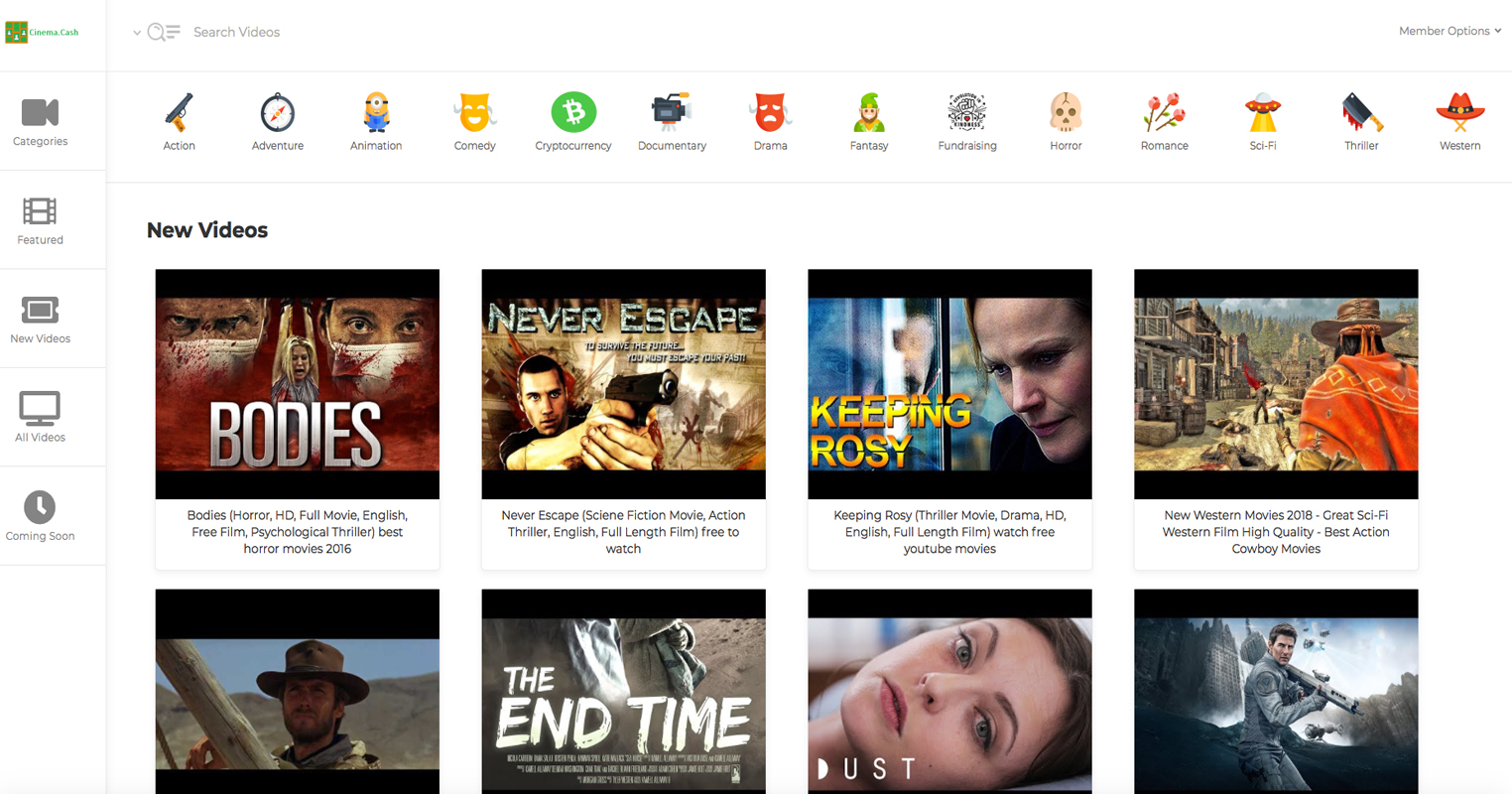

There’s a new BCH-fueled video service called Cinema.cash that allows users to upload content and be rewarded for posts. There are two types of revenue streams that content creators can utilize in order to get paid in crypto – tips and pay-per-view sessions. Tipping is set to default for all videos, and with pay-per-view, users have to pay beforehand to watch the content. Registering is fairly straightforward as users don’t need to use an email or verify their identity.

Only a username and password is required to sign up to both websites. Cinema Cash has a wide array of videos including subjects like action, documentary, comedy, cryptocurrencies, and science fiction. The creators also designed a fundraising section so users can publish videos in order to raise some money for an effort or someone in need. Porn.cash is the same exact setup as Cinema Cash but obviously the content is more adult themed.

While taking a gander at the websites, visitors can see that both platforms have a decent amount of videos so far. Users can publish Youtube videos alongside Twitch TV and Vimeo movies as well. The Cinema Cash team says that with the ease of publishing content, creators can have their own stage. In addition to using BCH, the creators of the websites plan to encourage tipping with a token called “Cash.”

“To incentivize tipping, we are also giving away chances to win Cash tokens for every tipping done,” explains the application developer. “Cash tokens holders are all entitled to a share of the platform profits based on the percentage of Cash tokens they hold — Essentially, we are giving the platform away to the Bitcoin Cash community.”

Tipping and Pay-Per-View

In the member’s options section users can see a few tabs that allow them to interact with the site’s content. For instance, there’s an “upload video” tab which allows you to link a video to the website with some characterization. There are two payment types to choose from when uploading content, “free” and “pay-per-view.” From here the user can add a video title, description, video URL, a screenshot, categories, and keywords. The application has a native wallet that only allows withdrawals. When tipping or paying for a movie, the platform will deploy a BCH address that can be copied and a QR code that can be scanned. The withdrawal section will display earnings statistics, and balances for both BCH and Cash tokens.

Overall the application has a decent amount of videos for such a new platform. Being basically a clone of Cinema Cash, the creator’s other project, Porn Cash, also has a lot of video material. The adult site has a whole lot more movies where members have to pay to watch and it’s likely the pay-per-view model performs better than on the ordinary site. On Reddit, BCH fans seem to be pleased with the two new video sites. The platform developer says there should be a more official announcement concerning the project development. Users should also note that both Cinema Cash and Porn Cash are currently in beta.

What do you think about the new bitcoin cash fueled video sites? Let us know in the comments section below.

Disclaimer: Readers should do their own due diligence before taking any actions related to the mentioned companies or any of its affiliates or services. Bitcoin.com and the author are not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Neither Bitcoin.com nor the author is responsible for any losses, mistakes, skipped steps or security measures not taken, as the ultimate decision-making process to do any of these things is solely the reader’s responsibility. This editorial is for informational purposes only.

Image credits: Shutterstock, Pixabay, Cinema.cash, and Porn.cash.

Have you seen our widget service? It allows anyone to embed informative Bitcoin.com widgets on their website. They’re pretty cool, and you can customize by size and color. The widgets include price-only, price and graph, price and news, and forum threads. There’s also a widget dedicated to our mining pool, displaying our hash power.

The post These Video Sharing Sites Pay Content Creators in Bitcoin Cash appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2RVlMUN These Video Sharing Sites Pay Content Creators in Bitcoin Cash

#Blockchain Heavy Borrowers and Near-Failed States Likely to Drive Hyperbitcoinization

A CIA World Factbook entry listing nations’ current account balances shows that big economies and near-failed states share something in common – massive debt. This liability making them strong cases for hyperbitcoinization, which could be exacerbated by an anticipated global economic slowdown.

Also read: Governmental Overreach in Developing Nations Will Hasten Hyperbitcoinization

Debt-Ridden Economies Prime Cases for Hyperbitcoinization

Hyberbitcoinization theorists have little faith in the fiat establishment. They believe that state authorities, who control national currencies, will erode them to a point where citizens will be forced to ditch them for bitcoin, resulting in entire countries being powered by peer-to-peer decentralized currency.

The hyperbitcoinization theory (H-theory), published by Daniel Krawisz of the Satoshi Nakamoto Institute in 2004, predicts that bitcoin will lead to demonetization of currencies that will lose value, as people settle for bitcoin as a superior option. Bitcoin will be attractive as it is not subject to capital controls, maintains value as fiat currencies erode, and is an inclusive financial instrument into other economies.

Though purely numeric, the CIA list, running up to 2017, details governments’ long-standing habits, from the heavy-borrowing, war-like giants at the bottom, to struggling ones in the middle and disciplined spenders at the top. “Current account balance compares a country’s net trade in goods and services, plus net earnings, and net transfers to and from the rest of the world during the period specified,” the agency explains in regards to the criterion of the list, which is calculated on an exchange rate basis.

The U.S. sits at the bottom of the intelligence agency’s list with a negative balance of -$466.2 billion, just beneath the U.K which is also wallowing in borrowed affluence with a balance of -$106.7 billion. India, Canada, Turkey, France and Australia make up the bottom eight with 11-digit negative balances.

Citizens commonly bank on their authorities to painlessly manage debt and forestall dramatic ripples in their own lifestyles. Governments, in turn, are given to their habits, from shoring up geopolitical hegemony and staging spectacles in endless wars, to printing money for bloated civil service payrolls and punishing the poorest citizens with austerity when the day of reckoning arrives.

Fiat Currency Overlords Leave Citizens Poorer

Since Jack Ma criticized the U.S. for blowing its fortune on war at Davos, the country has failed to sizeably reduce its military footprint and in fact gotten closer to confrontation with military giants like Russia, China and North Korea, with potential proxy battle zones like Venezuela emerging. The national debt incurred by the military-industrial complex is ultimately spread across households, with taxpayers on the hook for trillions of dollars of spending.

The U.S. is also notoriously oil-intensive, with 50 percent of its consumption going to oil imports. The value of the dollar is, therefore, tied to oil prices, and has depreciated as oil prices doubled between 2001 and 2006 and then went up 50 percent between 2006 and 2008, affecting domestic households through reduced purchase power. There is an upside to this however in that America’s status as one of the world’s most technologically advanced nations would work in its favor in the event of hyperbitcoinization occurring.

In countries like North Korea, military might takes primacy over the economic wellbeing of citizens. Countries like Zimbabwe are not known aggressors but military spending helps insulate the regime from economic discontent. Citizens have experienced central bank heists in two decades in which their savings were substantially eroded by questionable monetary policies.

In Venezuela, where a humanitarian breakdown is now coupled with political confrontation, citizens have resorted to bitcoin to keep their heads above the chaos. Zimbabwe has been slower to transition to bitcoin, but the perennial erosion of the currency is a strong case for cryptocurrency and an increasing number of students are redirecting.

Hyperbitcoinization in oil-rich Venezuela would be driven by cheap electricity which makes bitcoin mining ideal. The more affluent states on the list, particularly the U.K, are advanced in technology, making the penetration of cryptocurrency easier, whereas their counterparts in the global south will be affected by the divide. Some rural populations in the southern hemisphere lack reliable electricity and internet connectivity, placing crypto transactions out of reach.

Hyperbitcoinization is a dystopian bet. Having nurtured the infrastructure required to disrupt fiat hegemony, Bitcoin visionaries are waiting for state actors to torch their own world and drive citizens to cryptocurrency. Unlike fiat currencies which can be inflated from reserve bank printing presses, there is a finite amount of bitcoin that can ever enter circulation. Safe from capricious state authorities and free from central control, it is emergency money, on standby for any nation whose people need it.

What do you think about the concept of hyperbitcoinization and which countries are mostly likely to be affected by such an event? Let us know in the comments section below.

Images courtesy of Shutterstock.

Express yourself freely at Bitcoin.com’s user forums. We don’t censor on political grounds. Check forum.Bitcoin.com

The post Heavy Borrowers and Near-Failed States Likely to Drive Hyperbitcoinization appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2E2zl0O Heavy Borrowers and Near-Failed States Likely to Drive Hyperbitcoinization

#Blockchain In the Daily: Regulatory Developments in Italy, Mauritius, Malta

In this edition of The Daily we cover recent regulatory developments regarding the use of cryptocurrencies and their associated industries from all over the world. Lawmakers in Italy have approved a definitions mandate, Mauritius has created a crypto custody license, and Malta is set to provide cybersecurity guidance to crypto funds, exchanges and ICOs registered in the island.

Also Read: Abra Adds Stocks and ETF Investing to Its Crypto Exchange App

Lawmakers in Italy Approve Blockchain Bill

According to reports from Italy, the country’s legislators have approved a bill which has been described as Rome’s first attempt to legally regulate certain aspects of the industry built around cryptocurrencies. As we reported back in January when it was introduced, the bill creates legal definitions for terms associated with the crypto sector such as “smart contract” and “distributed ledger technology” and mandates that the country’s Agenzia per l’Italia Digitale must create specific technical standards these technologies will be expected to meet within a certain time period.

Mauritius Finalizes Crypto Custody Framework

The Financial Services Commission (FSC) of Mauritius announced on Feb. 8 that it has made significant progress in establishing the country as a digital assets technology hub “in and for, Africa.” The regulatory framework for the Custodian Services (Digital Asset) Licence has been finalized, which will soon allow approved companies to provide custody services for crypto assets.

The FSC explains that the framework was developed in reference to international consultations at the level of the Organisation for Economic Cooperation and Development (OECD) and that holders of the license will have to comply with the applicable framework for AML/CFT, “in line with international best practices.” This new regulatory framework will be effective as of March 1, 2019.

Pravind Kumar Jugnauth, Prime Minister of the Republic of Mauritius, stated: “In revolutionising the global fintech ecosystem through this regulatory framework for the custody of digital assets, my government reiterates its commitment to accelerating the country’s move to an age of digitally-enabled economic growth. As an African country, we look forward to fostering further innovation and bringing more prosperity to the region.”

The Chairman of the FSC, Dr Renganaden Padayachy, added that “The blueprint has identified a number of key opportunities that we have to tap into to foster further value-added activities in our jurisdiction. This new framework is in line with this strategy and we are confident that it is yet another addition that will increase the competitiveness of our jurisdiction.”

Malta to Provide Cybersecurity Guidance to Exchanges

The Malta Financial Services Authority (MFSA) presented to the public on Feb. 8 its proposed strategy on cybersecurity for companies operating in the country’s crypto assets sector. The regulator has launched a consultation regarding Guidance Notes on Cybersecurity, which will be applicable to companies legally defined as professional investor funds investing in virtual currencies, VFA agents, issuers and VFA service providers.

The proposals included are said to be based on a number of international initiatives, such as guidelines by the European Banking Authority. The consultation is open to the public until March 8, 2019 and industry participants are invited to send their responses by then.

MFSA Chief Executive Officer Joseph Cuschieri commented that “the MFSA’s objective is to provide increased certainty in a complex digital world. These guidance notes reflect the authority’s approach towards effective management of risks and the understanding of risk factors directly linked to an entity’s operation in the financial services landscape. Indeed, the newly launched MFSA Vision 2021 identifies the application of a risk based supervisory approach as one of the key pillars of this strategy.”

What do you think about today’s news tidbits? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post In the Daily: Regulatory Developments in Italy, Mauritius, Malta appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2SGQTaR In the Daily: Regulatory Developments in Italy, Mauritius, Malta

#Blockchain Mt. Gox Creditors Neither Need nor Deserve This Kind of ‘Hero’

Brock Pierce has launched his own bid for the civil rehabilitation of Mt. Gox, promising to pay out all current funds to creditors while also talking about issuing debt tokens or giving away equity in a resurrected Mt. Gox exchange. As noble as this may sound on the surface, there are strong reasons to question the credibility and motives of this proposal.

Also read: Crypto Investor Brock Pierce Is Attempting to Pull Mt. Gox From the Ashes

Let’s Be Clear

First, Pierce is basing this plan on a fresh assertion that he is the rightful owner of Mt. Gox, as a result of plans to purchase Mt. Gox from Tibanne immediately after the collapse in 2014, as well as claiming to have later purchased Jed McCaleb’s 12% stake.

Let’s be clear here: Pierce does not own Mt. Gox.

There exists a signed Letter of Intent (LOI) dated March 2014 between Sunlot and Tibanne for a planned handover of Mt. Gox. Into this letter Sunlot inserted language about “binding terms”, but it is clearly just drawing up the framework for an agreement yet to be closed. As an obvious example, no purchase sum is specified.

Already Under Civil Rehabilitation

However, as Mt. Gox was already under civil rehabilitation at the time (and as the LOI states at the end next to “Court Approval”) no such agreement could be entered into without the court’s prior approval. Sunlot was sent a request to formally and mutually rescind the Letter of Intent in recognition of this overstep of authority in order to clear the way for restarted talks with the court’s blessing. He refused to sign it. Pierce is mischaracterizing this as Mark Karpeles backing out of a binding agreement, and seems to think that as long as he refuses to admit the truth, an alternate timeline where Sunlot closed the deal and legally acquired Mt. Gox will play out.

As for acquiring McCaleb’s 12% share, no matter what deal Pierce may have struck with him, no effort has been made to legally record any transfer of shares, and the Mt. Gox estate still recognizes McCaleb as the legal owner of those shares.

Pierce’s insistence on being the legitimate owner of Mt. Gox in the face of facts is already disqualifying. But he has further made it clear that he considers himself the rightful beneficiary of the “hundreds of millions of surplus assets” that were originally due to be paid out to Mt. Gox shareholders due to a cruel quirk of Japanese bankruptcy law. It is against this backdrop that he is offering to “gift” this money to creditors by promising to generously refrain from laying claim to it.

Veiled Threat

Do you think Pierce Brock’s claims are valid? Let us know in the comments section below.

Images courtesy of Shutterstock, Twitter

OP-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

The post Mt. Gox Creditors Neither Need nor Deserve This Kind of ‘Hero’ appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2tcW2sS Mt. Gox Creditors Neither Need nor Deserve This Kind of ‘Hero’

#Blockchain Anarchism: A Look at the Different Schools of Anarchic Thought

In mainstream culture, anarchy is often a dirty word, deployed as a pejorative to describe failed states or an insult by conservative news anchors to describe what could happen if a semi-radical government took charge. The reality is very different. Anarchy runs much deeper and actually goes hand in hand with bitcoin and the quest for a decentralized financial system.

Also Read: Bitcoin was Built to Incite Peaceful Anarchy

What Is Anarchy?

Bitcoin and other cryptocurrencies are well aligned with anarchy. Anarchy is, after all, a system which rejects state control and hierarchy. No matter how much Bitcoin is adopted by the mainstream, purists will always contend that the digital asset was created to undermine authority and to remove state control so people could ultimately gain their financial freedom.

There are many types of anarchic schools of thought but they all have overarching theme: to do away with the state and its authority. Despite the unified principle of no government, different strands of anarchy extol very different ideas on how a society should run, with philosophies incorporating everything from egalitarianism to free market economics.

Why Bitcoin and Anarchy Go Hand in Hand

Bitcoin can be thought of as an enabler for anarchic liberation. Governments have fiscally failed time and time again throughout history and punished their citizens by mismanaging the economy. By holding monopolies on minting coins, managing central banks that serve the needs of the few, and writing laws telling people what money they should use and how to use it, they have wielded ultimate control over the people. Bitcoin, which was created to avoid third parties such as banks, has the potential to end governmental control of money once and for all. Its very essence, the blockchain, works without a central authority. That is why Bitcoin can work with anarchy: if people have the power to be their own banks, and have economic freedom, then they can proceed to claim their freedom from governments in other domains, too. Here are some of the main schools of anarchic thought.

Anarcho-Capitalism

Often associated with the crypto community, anarcho-capitalism is a school of thought that believes a free market should take the place of the government and serve as the basis for a free and prosperous society. In this case, property rights would rule and things often provided by the state, such as prisons, courts, police or schools, would be taken care of by private companies competing in an open market. Anarcho-capitalists also believe that voluntary actions and charity are what is needed for a functioning and healthy state. Anarcho-capitalists see free market capitalism as the basis for a free and prosperous society.

Anarcho-capitalism draws from the Austrian School of Economics and anti-state libertarianism. Like other schools of anarchic thought, anarcho-capitalists argue that governments are inherently bad because they force people to pay taxes, force people to join the military, start wars or impose other restrictions and rules on people.

Crypto-Anarchism

Crypto-anarchism is a form of anarchy that goes hand-in-hand with Bitcoin. The essence of this school of thought holds that through the use of cryptographic software to avoid persecution, people can cultivate financial sovereignty, political freedom and privacy to overthrow the state. Born out of the cypherpunk movement of the 1980s, crypto-anarchism is opposed to state surveillance and argues that the use of cryptography is the main defense against such problems, an idea Julian Assange – perhaps the most well-known cypherpunk activist – has espoused.

Cypherpunk Timothy C. May, who published the Crypto-Anarchist Manifesto in 1988, said that the ability to communicate anonymously online would eventually lead to big changes in societies and governments.

“These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.”

After the arrival of Bitcoin in 2009, it seemed like May’s prediction was right and many crypto-anarchists had got what they were waiting for: a way to exchange payments in a way that was pseudonymous beyond the reach of governments.

Anarcho-Communism

Anarcho-communism argues that the state should be abolished and capitalism be replaced with common ownership or control of the means of production. Through a revolution, collective control can be established and people can be free from governmental domination and economic exploitation. This school of thought argues that social hierarchy and class distinctions come from unequal wealth distributions and should therefore be abolished, as well as private property and money. Society would control production and systems of production and distribution would be managed by their participants.

As with the typical communist school ideology, anarcho-communists argue that a revolution would be what leads society to abolish the state and take control of the means of production.

Anarcho-Syndicalism

Another type of anarchism on the left of the political spectrum, anarcho-syndicalism aims to create an industrial workers’ union movement which is rooted in anarchic ideas. Such anarchists argue that workers should group together through unions and then take control by overthrowing the state. This school of thought advocates people having control over the means of production by operating co-ops so workers can run their own workplaces.

Anarcho-syndicalists say that organization on a voluntary basis is what is needed to operate the means of production and public services and superior authorities and their taxes, armies, police or bureaucracies have no place in society. Ultimately, direct action – that is, action carried out by workers as opposed to indirect action, such as electing a representative to a government position – would allow workers to liberate themselves.

What do you think of the different schools of anarchic thought? Would any of them work? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Anarchism: A Look at the Different Schools of Anarchic Thought appeared first on Bitcoin News.

from Bitcoin News http://bit.ly/2tfOUMs Anarchism: A Look at the Different Schools of Anarchic Thought