Corintis raises $24M to target the next AI bottleneck, and collaborates with Microsoft for chip cooling breakthrough

Corintis raises $24M to target the next AI bottleneck, and collaborates with Microsoft for chip cooling breakthrough

Corintis ramps up to mass-production and targets the next AI bottleneck. Earlier this week, Microsoft announced that, in collaboration with Corintis, it achieved a landmark 3x chip cooling breakthrough.

Lausanne, Sept. 25, 2025 (GLOBE NEWSWIRE) — The growth of AI is hampered by computational power. Increasing demands for AI to become ever more powerful and ever more accessible have placed a requirement for there to be ever more powerful computer chips. However, increasingly powerful chips produce more heat, making cooling a key bottleneck.

The early versions of OpenAI’s ChatGPT were trained on NVIDIA chips, which used 400W of power. However, only 4 years later, new GPUs and AI accelerators are already looking to increase the power requirements by 10x, which requires liquid cooling. NVIDIA’s recent adoption of liquid cooling for its latest generations of data centre GPUs has highlighted this key demand.

Corintis founders: Sam Harrison and Remco van Erp.

Coming out of stealth mode, semiconductor cooling startup Corintis has today announced that it has raised a $24M Series A to address this problem. The round was led by BlueYard Capital with participation from Founderful, Acequia Capital, Celsius Industries, XTX Ventures, among others. Corintis also announces that it will be opening multiple US offices to better serve its American customers in addition to an Engineering office in Munich, Germany.

To date, the company has raised $33.4M in total. As part of this funding, Chairman of Walden International and Intel CEO Lip-Bu Tan has joined as a board director and investor prior to becoming Intel CEO, in addition to Geoff Lyon (former CEO & Founder of CoolIT), also joining the board. With this addition to the board, Corintis doubles down on building a bridge between the worlds of semiconductor design, manufacturing, and chip-cooling.

Lip-Bu Tan added: “Cooling is one of the biggest challenges for next-generation chips. Corintis is fast becoming the industry leader in advanced semiconductor cooling solutions to address the thermal bottleneck, as made evident by its growing customer list.”

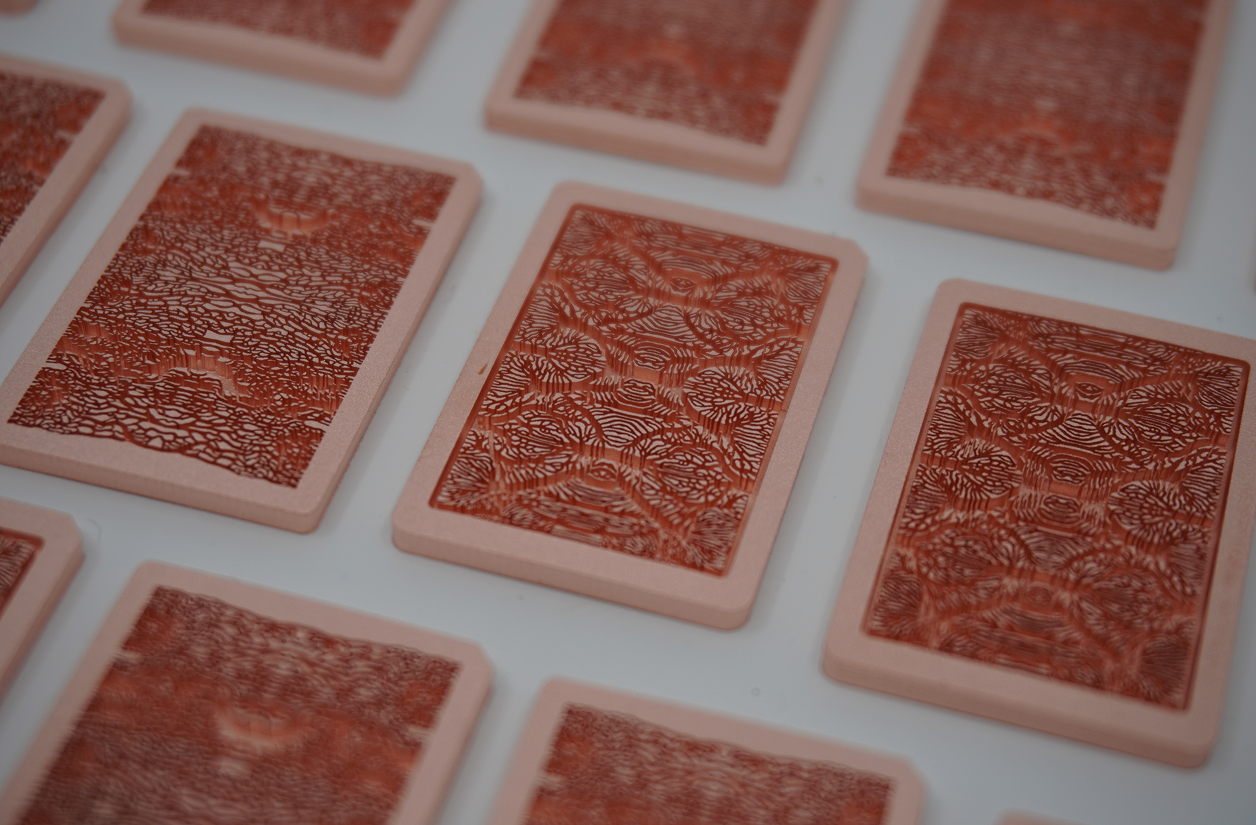

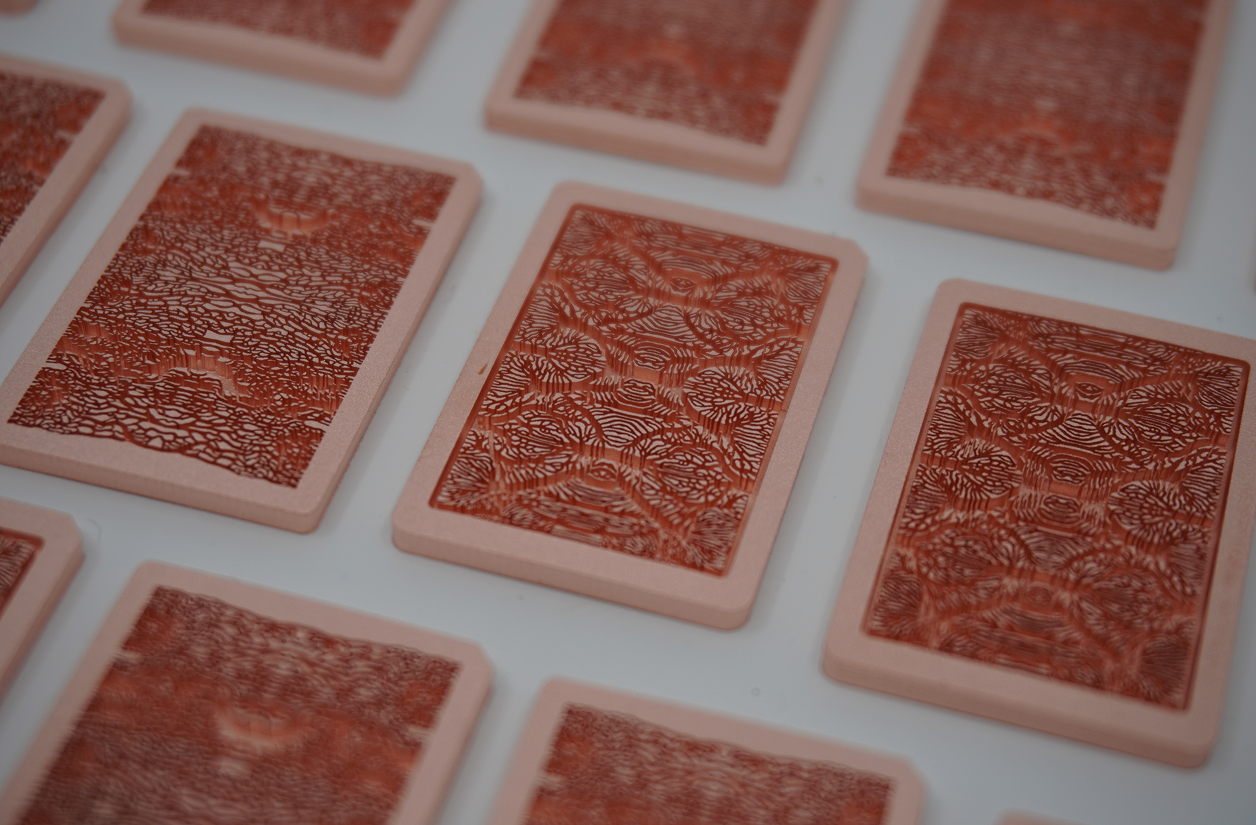

Microfluidic cores in chip design.

Corintis’s technology focuses on microfluidic cooling: Optimised micro-scale liquid cooling for computer chips in data centres, which are used for advanced computation, including for generative AI. Earlier this week, Microsoft announced that in collaboration with Corintis, it has successfully achieved a breakthrough by developing an in-chip microfluidic cooling system that can effectively cool a server running core services. Tests showed that microfluidic cooling embedded inside the chip removed heat a staggering three times better than the most advanced technology commonly used today.

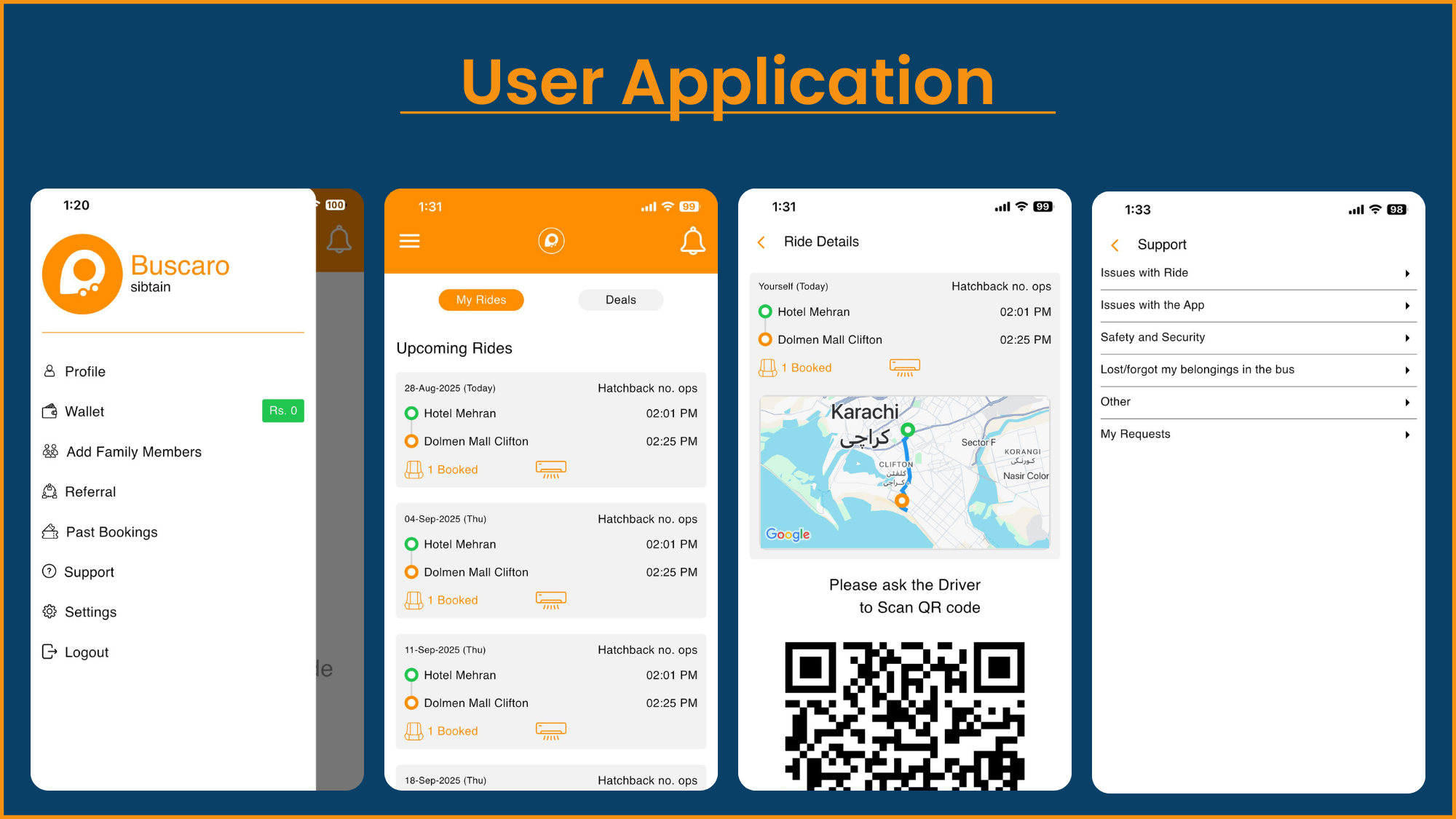

Corintis products (Therminator with cold plates).

Based on research conducted at the Federal Institute of Technology in Lausanne (EPFL) in Switzerland, Corintis was co-founded by Dr Remco van Erp (CEO), Sam Harrison (COO) & Prof Elison Matioli (Scientific Adviser).

Based on research conducted at the Federal Institute of Technology in Lausanne (EPFL) in Switzerland, Corintis was co-founded by Dr Remco van Erp (CEO), Sam Harrison (COO) & Prof Elison Matioli (Scientific Adviser).

Remco van Erp, Co-Founder & CEO of Corintis, said: “Every chip is unique. It’s like a cityscape with hundreds of billions of transistors, connected by countless wires. Cooling today is not adapted to the chip, relying on simplistic designs where several parallel fins are carved into a block of copper with a blade. But just like in nature, the optimal design for each chip is a complex network of precisely shaped micro-scale channels that are adapted to the chip and guide coolant to the most critical regions. Finding the right design per chip to create increasingly better cooling systems under short timelines is a challenge that will only get harder.”

“Thermal engineers need to pull a rabbit out of a hat on a daily basis to make sure chips don’t overheat and break, and that’s where Corintis comes in. Our mission is to unlock 10x better cooling to enable the future of compute, in a short cycle time, and while leveraging the existing infrastructure investments in a data center today. As our recent collaboration with Microsoft highlights, there’s an industry-wide push to advance the limits of cooling to enable a future of compute that’s not limited by heat.”

Corintis’ solution relies on two main elements to achieve its mission of 10x better cooling: Firstly, “co-designed microfluidic cooling”. Corintis develops best-in-class simulation and optimization software and new manufacturing methods to design micro-scale optimized liquid cooling, or Microfluidic cooling, that is adapted to the chip to bring the right liquid to the right location. This can be supplied as either a drop-in replacement to any liquid cooling system today, or integrated together with the chip, as “co-packaged cooling”, to reach up to an order of magnitude increase in cooling performance. Their technology also enables data centers to reduce their water consumption, a key ecological concern of AI technologies.

The Corintis team in Lausanne, Switzerland.

Corintis’ platform builds a bridge between chip and cooling design, enabling chip designers to build the next generation of AI chips with superior thermal performance. The technology platforms the company has already developed include Glacierware, to help automate the design of cooling systems, a copper microfluidic manufacturing facility to manufacture cold plates with features as small as a human hair in high volume, and its Therminator platform, allowing chip companies to physically emulate next-gen chips with millimetre accuracy on silicon test chips before production to validate their cooling solution ahead of time.

David Byrd, general partner at BlueYard Capital added: “AI’s insatiable demand for compute is pushing chips to unprecedented power densities — Corintis is unlocking the next wave of performance by making cooling a design feature, not an afterthought.”

Corintis has already manufactured over ten thousand cooling systems, with deployments running in data centers on leading-edge AI chips. With new funding, the company looks to scale its team and ramp up its manufacturing footprint even further. With this scale, Corintis is ready to play a decisive role in the advancement of computational and AI power.

Media images can be found here.

About Corintis

Co-founded by Dr. Remco van Erp, Sam Harrison, and Prof. Elison Matioli, Corintis is helping address one of the key problems in delivering ever greater computer power, ever more accessible: managing the heat produced by increasingly powerful computer chips. Founded on research undertaken at EPFL in Switzerland, the company is helping address the next bottleneck for the future of compute, to accelerate the power of AI, modelling climate change, and drug discovery. ery.

About BlueYard Capital

BlueYard Capital invests in founders building companies at the edges of technology and science—across computing, defense, biology, and crypto. The firm backs n-of-1 companies that often look unconventional at the start but define new markets over time. Founded in 2016, BlueYard is a small and equal partnership based in the US and Europe, managing $500M across three funds and investing $500K–$5M in pre-seed to Series A rounds as a lead or co-lead. Portfolio companies include Castelion, Filecoin, Flashbots, and Privy.

CONTACT: For further information, please contact the Corintis press office on press@corintis.com

![]()

![]()