Asia-Pacific Crowdfunding Market Forecast Report 2025-2033 | Fueling Entrepreneurial Growth Amid Rising Investor Interest and Digital Access

Asia-Pacific Crowdfunding Market Forecast Report 2025-2033 | Fueling Entrepreneurial Growth Amid Rising Investor Interest and Digital Access

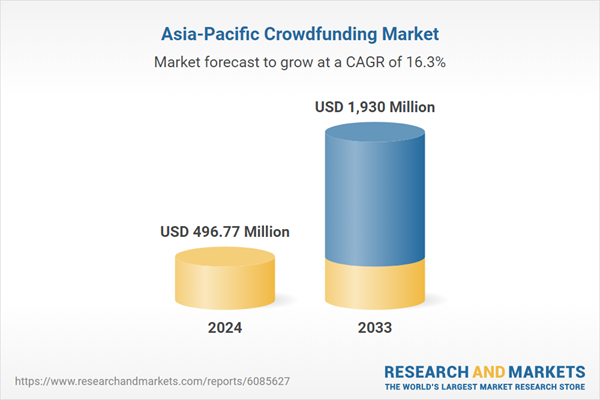

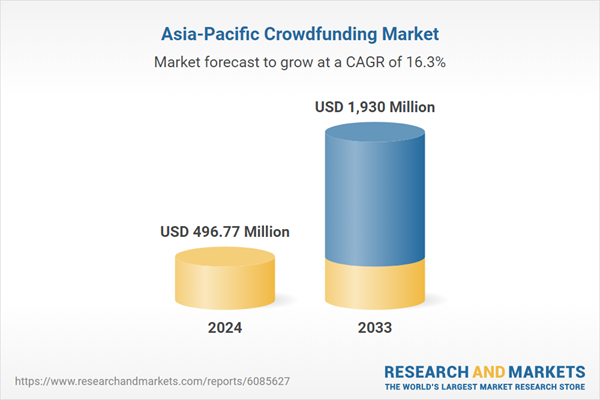

The Asia-Pacific Crowdfunding Market is poised to grow from USD 496.77 million in 2024 to USD 1.93 billion by 2033, at a CAGR of 16.33%. Driven by digital penetration, regulatory support, and alternative fundraising acceptance, crowdfunding platforms are thriving. China, Japan, India, and South Korea emerge as significant players, each addressing unique regulatory challenges and market dynamics. Platforms leverage technology to democratize financing, but face hurdles like trust issues and cybersecurity risks. Key players in the market include Alibaba, Kickstarter, and Indiegogo. As regulations evolve, the market promises further growth and innovation.

Dublin, July 01, 2025 (GLOBE NEWSWIRE) — The “Asia-Pacific Crowdfunding Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

The Asia-Pacific Crowdfunding Market is expected to reach US$ 1.93 billion by 2033 from US$ 496.77 million in 2024, with a CAGR of 16.33% from 2025 to 2033. With major platforms using technology to streamline donation, reward, debt, and equity-based crowdfunding across a variety of sectors, the market is growing quickly due to rising digital penetration, regulatory support, and growing acceptance of alternative fundraising for social, creative, and entrepreneurial endeavors.

A thriving entrepreneurial climate, rising interest in alternative finance models, and higher digital penetration are all contributing to the robust expansion of the Asia-Pacific crowdfunding market. Crowdfunding has become a feasible option for entrepreneurs and creative endeavors looking for flexible funding choices in a variety of industries, such as consumer goods, social impact, and technology. People and small enterprises can now more easily interact with potential backers because to the availability of mobile-based platforms and increased internet penetration, which democratizes access to finance and promotes innovation in both urban and rural locations.

Numerous crowdfunding methods, including reward-based, debt, equity, and donation-based crowdsourcing, are becoming more and more well-liked throughout the region. Platform development and involvement are on the rise in nations with vibrant startup cultures. Market maturity is nevertheless hampered by concerns such disparate regulatory frameworks, problems with trust and transparency, and low investor awareness. The sector must concentrate on boosting user education, creating clear regulatory frameworks, and raising platform trustworthiness if it hopes to maintain long-term growth. Crowdfunding is on the verge of becoming a crucial component of the financial ecosystem in Asia-Pacific as more stakeholders realize its potential.

The crowdfunding industry outlook for India is based mostly on incentive and donation-based crowdfunding, but it also indicates that small and startup enterprises are becoming more interested in equity and debt-based crowdfunding. Accordingly, due to the growing restrictions on traditional bank loans and venture capital investment, companies are turning to crowdsourcing as their new source of finance. Additionally, in order to create a standardized platform that benefits investors, the Securities and Exchange Board of India (SEBI) does regulatory evaluations for equity crowdfunding. For example, SEBI recommended in November 2024 to increase the investment range for angel funds from ?2.5 million to ?100 million to between ?1 million and ?250 million.

Startups can now obtain micro-investor cash through the distribution of small equity shares thanks to the new funding model. Platforms like Faircent and Lendbox, which serve as substitutes for conventional bank borrowing options, are also present in the P2P lending sector. Furthermore, achieving broad adoption of this funding technique is significantly hampered by the persistent regulatory uncertainties. As a result, when SEBI formally establishes regulations for equity crowdfunding, more companies will be able to access capital through decentralized investments within a democratic framework, and continuous innovation will increase.

Growth Drivers for the Asia-Pacific Crowdfunding Market

Growing Digital Penetration

The Asia-Pacific crowdfunding market has grown significantly due in large part to digital adoption. Both investors and fundraisers now face much reduced entry barriers thanks to the rapid growth of mobile technology and the ubiquitous availability of internet access. Crowdfunding platforms are now widely accessible to individuals and small businesses through computers or cellphones, which makes it easier to start campaigns and reach a large audience.

Digital marketing tools and social media further increase awareness, enabling initiatives to gain international backing and go viral. By enabling innovators, entrepreneurs, and social causes to interact with a wider range of possible supporters, digital accessibility has democratized the fundraising process and promoted a more inclusive financial environment in both urban and rural locations.

Shifting Investor Mindset

The growth of crowdfunding is being greatly aided by the changing attitudes of investors in the Asia-Pacific area. Many investors today are looking for investments that fit with their personal values, social impact objectives, or interest in specialized industries rather than just financial rewards. Platforms for crowdfunding offer a clear and direct way to fund innovative enterprises, social projects, and creative endeavors that might not otherwise be able to draw in traditional venture capital.

This shift in viewpoint has made it possible for underrepresented entrepreneurs and a variety of concepts to acquire momentum. Backers value the chance to participate in a project’s development from the start and frequently develop strong emotional bonds with the causes they fund. Crowdfunding is becoming more powerful and significant than ever before due to the increased appetite for intentional investment.

Cost-Effective Capital Raising

For startups, entrepreneurs, and creators in the Asia-Pacific area, crowdfunding is a desirable alternative to traditional fundraising techniques because it is accessible and reasonably priced. Crowdfunding allows people and small businesses to raise money directly from the public with little up-front expense, in contrast to traditional financing, which frequently entails drawn-out application procedures, stringent eligibility requirements, and expensive middleman fees.

On digital platforms, campaigns may be started fast, giving fundraisers the opportunity to reach a large audience and get speedy feedback. This strategy not only lessens administrative and budgetary strains but also increases brand recognition and early community support. Crowdfunding enables a wider spectrum of individuals to realize ideas without exclusively depending on banks, investors, or venture capital firms by reducing the barriers to entry.

Challenges in the Asia-Pacific Crowdfunding Market

Trust and Transparency Issues

Although trust and openness are essential to crowdfunding’s success, they continue to be major obstacles in the Asia-Pacific sector. Potential backers’ and campaign designers’ trust might be damaged by worries about dishonest campaigns, misrepresenting project objectives, and misusing funds. Backers may be reluctant to support projects without rigorous monitoring or verification procedures because they worry, they won’t see a return on their investment or receive the promised rewards.

In a similar vein, if public confidence in platforms is poor, reputable fundraisers can find it difficult to acquire traction. Establishing credibility requires open communication, frequent project updates, and transparency in the way funds are handled. Restoring trust and promoting wider involvement in the crowdfunding market can be achieved by strengthening accountability through platform laws and enhanced due diligence.

Rising Cybersecurity Risks

One of the biggest obstacles to crowdfunding platforms’ expansion in the Asia-Pacific area is cybersecurity threats. These platforms are popular targets for hackers because they manage a lot of sensitive user data, such as financial transactions and personal information. In addition to jeopardizing user privacy, data breaches, hacking, and fraudulent activity harm the platforms’ credibility and brand.

A single security breach can cause a large decline in user confidence, deterring investors and fundraisers from utilizing the platform. Crowdfunding platforms must use robust cybersecurity methods like encryption, multi-factor authentication, and frequent security audits to reduce these threats. Strong digital security is essential to preserving user trust and facilitating the crowdfunding ecosystem’s safe growth.

Key Players Analyzed: Overview, Key Persons, Recent Developments, Revenue

- Fundly

- Alibaba Group Holding Ltd

- Kickstarter, PBC

- Indiegogo, Inc.

- GoFundMe

- Fundable

- SeedInvest Technology, LLC

- Crowdcube

- Corteva Agriscience

Key Attributes:

| Report Attribute |

Details |

| No. of Pages |

200 |

| Forecast Period |

2024 – 2033 |

| Estimated Market Value (USD) in 2024 |

$496.77 Million |

| Forecasted Market Value (USD) by 2033 |

$1930 Million |

| Compound Annual Growth Rate |

16.3% |

| Regions Covered |

Asia Pacific |

Key Topics Covered:

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Asia-Pacific Crowdfunding Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Type

6.2 By Application

6.3 By Countries

7. Type

7.1 Reward-based

7.2 Equity-Based

7.3 Debt-Based

7.4 Donation-Based

7.5 Others

8. Application

8.1 Food & Beverage

8.2 Technology

8.3 Media

8.4 Real Estate

8.5 Healthcare

8.6 Others

9. Countries

9.1 China

9.2 Japan

9.3 India

9.4 South Korea

9.5 Thailand

9.6 Malaysia

9.7 Indonesia

9.8 Australia

9.9 New Zealand

9.10 Rest of Asia-Pacific

10. Porter’s Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

For more information about this report visit https://www.researchandmarkets.com/r/1cpo1x

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900