Crowdfunding Market Competitor Analysis Report 2025: Competitive Strategies, Platform Innovations, Funding Trends, and Revenue Forecast Insights to 2033

Crowdfunding Market Competitor Analysis Report 2025: Competitive Strategies, Platform Innovations, Funding Trends, and Revenue Forecast Insights to 2033

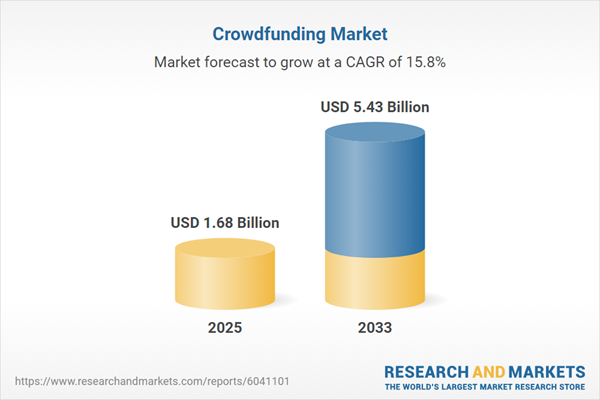

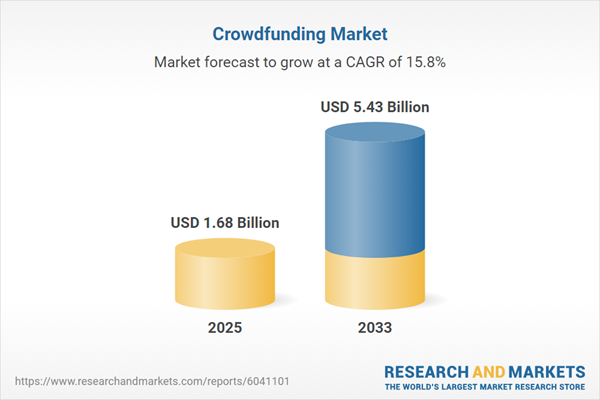

The crowdfunding market is poised for robust growth, projected to reach US$ 5.43 billion by 2033 from US$ 1.68 billion in 2025, at a CAGR of 15.82%. This alternative financing model leverages online platforms to connect individuals, startups, and organizations with global investors, utilizing donation-based, reward-based, equity, and debt models. Digital platforms and social media enhance crowdfunding’s reach, empowering entrepreneurs with global access and idea validation. Despite regulatory challenges, advancements in technology, such as blockchain and AI, are promoting transparency and trust within the evolving industry. Key players include Alibaba, Kickstarter, Indiegogo, and GoFundMe.

Dublin, Feb. 18, 2026 (GLOBE NEWSWIRE) — The “Crowdfunding Market Key Companies Analysis, Competitive Strategies, Platform Innovations, Funding Trends, and Revenue Forecast Insights” report has been added to ResearchAndMarkets.com’s offering.

The Crowdfunding industry is expected to expand lucratively to an estimated value of US$ 5.43 Billion by 2033, from US$ 1.68 Billion in 2025. This expansion reflects a compound annual growth rate (CAGR) of 15.82% between 2025 and 2033.

The Crowdfunding Market serves as a dynamic alternative financing model that enables individuals, startups, and organizations to raise funds directly from a large pool of investors or contributors through online platforms. It operates across various models, including donation-based, reward-based, equity, and debt crowdfunding, catering to different funding needs and risk appetites.

The rise of digital platforms and social media has significantly expanded the reach and accessibility of crowdfunding, empowering entrepreneurs to validate ideas and engage supporters globally. Increasing demand for innovative project financing and reduced dependence on traditional financial institutions continue to drive market growth. However, challenges such as regulatory uncertainty and investor protection remain. Despite these, the market is evolving rapidly with technological advancements, transparency measures, and integration of blockchain and AI, fostering trust and efficiency in the global crowdfunding ecosystem.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 200 |

| Forecast Period | 2025 – 2033 |

| Estimated Market Value (USD) in 2025 | $1.68 Billion |

| Forecasted Market Value (USD) by 2033 | $5.43 Billion |

| Compound Annual Growth Rate | 15.8% |

| Regions Covered | Global |

Key Topics Covered:

1. Crowdfunding Market

1.1 Historical Trends

1.2 Forecast Analysis

2. Market Share Analysis – Crowdfunding Market

3. Alibaba Group Holding Ltd

3.1 Overview

3.1.1 Company History and Mission

3.1.2 Business Model and Operations

3.1.3 Workforce

3.2 Key Persons

3.2.1 Executive Leadership

3.2.2 Operational Management

3.2.3 Division Leaders

3.2.4 Board Composition

3.3 Recent Development & Strategies

3.3.1 Mergers & Acquisitions

3.3.2 Partnerships

3.3.3 Investments

3.4 Sustainability Analysis

3.4.1 Renewable Energy Adoption

3.4.2 Energy-Efficient Infrastructure

3.4.3 Use of Sustainable Packaging Materials

3.4.4 Water Usage and Conservation Strategies

3.4.5 Waste Management and Circular Economy Initiatives

3.5 Product Analysis

3.5.1 Product Profile

3.5.2 Quality Standards

3.5.3 Product Pipeline

3.5.4 Product Benchmarking

3.6 Strategic Assessment: SWOT Analysis

3.6.1 Strengths

3.6.2 Weaknesses

3.6.3 Opportunities

3.6.4 Threats

3.7 Revenue Analysis

The above information will be provided for all the following companies:

- Kickstarter, PBC

- Indiegogo, Inc.

- GoFundMe

- Fundable

- Crowdcube

- SeedInvest Technology, LLC

- Fundly

- Patreon Inc.

- Wefunder Inc.

- CircleUp Network Inc.

- Fundrise LLC

- StartEngine Crowdfunding Inc.

- AngelList Holdings LLC

- Crowdfunder Inc.

- EquityNet

- GoGetFunding

- Seedrs Limited

- Ketto

- DreamWallets

For more information about this report visit https://www.researchandmarkets.com/r/ri9bea

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT:

CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900