Google alums raise $5M pre-seed for Sparkli: The First Multimodal AI-Native Learning Engine for children

Google alums raise $5M pre-seed for Sparkli: The First Multimodal AI-Native Learning Engine for children

Zurich-based startup emerges from stealth to turn screen time into active learning expeditions that foster agency, curiosity, and future-ready skills.

Zurich, Jan. 22, 2026 (GLOBE NEWSWIRE) — Children today have an unprecedented ability to explore ideas, yet their digital world gives them so few ways to do it. When an eight-year-old asks how to build a city on Mars, the answer should ignite imagination, not flatten it into a wall of text. Built for this moment, Sparkli is launching a new model of learning shaped for the developing brain, using real-time multimodal AI that gives children the agency to build their own interactive learning expeditions on any topic in minutes. Sparkli transforms these inquiries into multi-disciplinary, real-life journeys that foster future-ready skills, including technology, design thinking, sustainability, financial literacy, entrepreneurship, emotional intelligence, and global awareness.The Zurich-based company has raised a $5 million pre-seed round to bring its multimodal learning engine to families and schools around the world.

Sparkli founders: (L to R) Mynseok Kang, Lax Poojary and Lucie Marchand.

The pre-seed round will allow Sparkli to scale its generative learning engine and prepare for a private beta launch in January 2026. The company is currently validating its platform through a strategic pilot with one of the world’s largest private school groups. This partnership provides Sparkli with a powerful testing ground across a network of more than 100 schools and over 100,000 students.

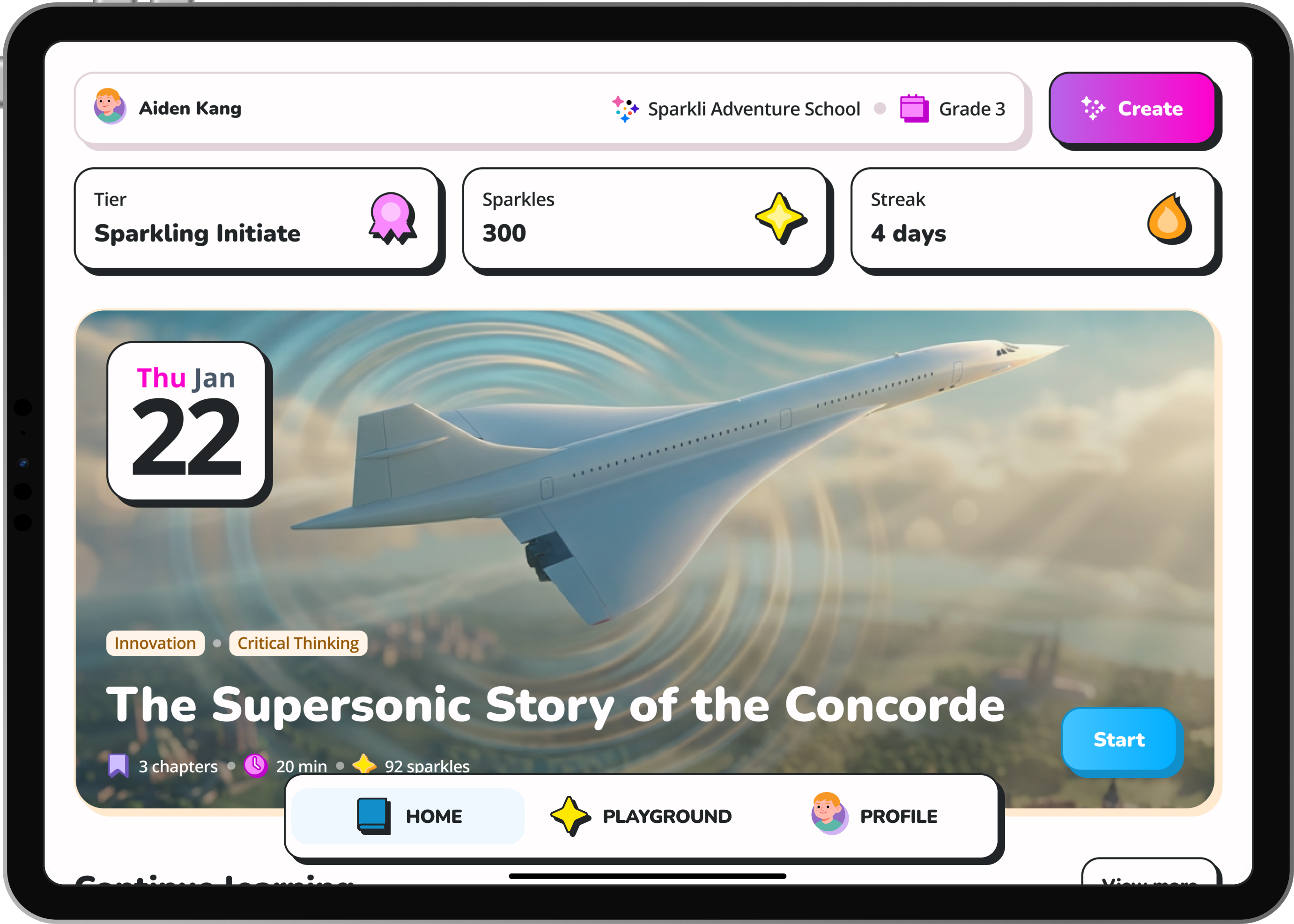

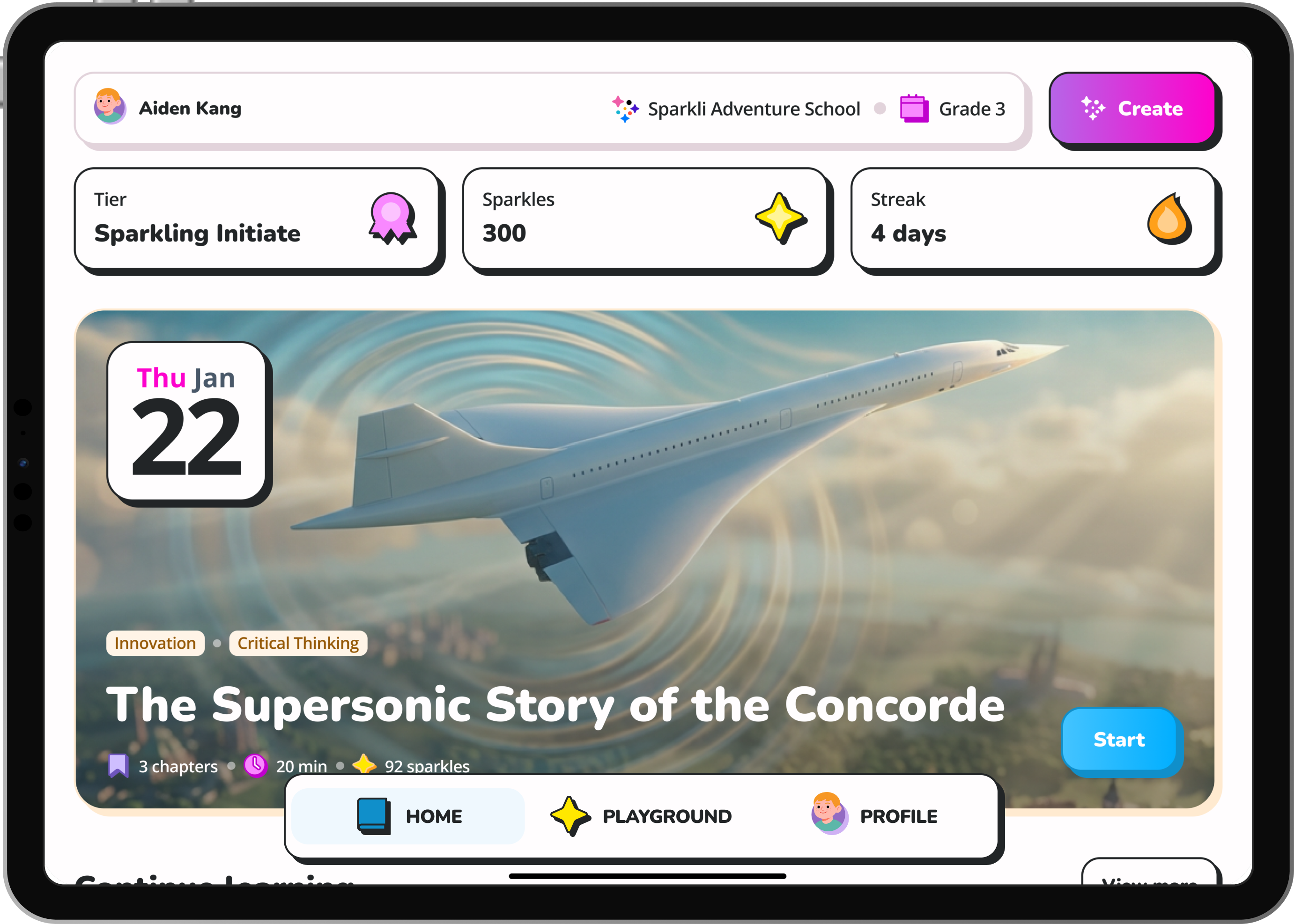

The Sparkli platform: currently in private beta with global school networks, with a consumer launch scheduled for June 2026.

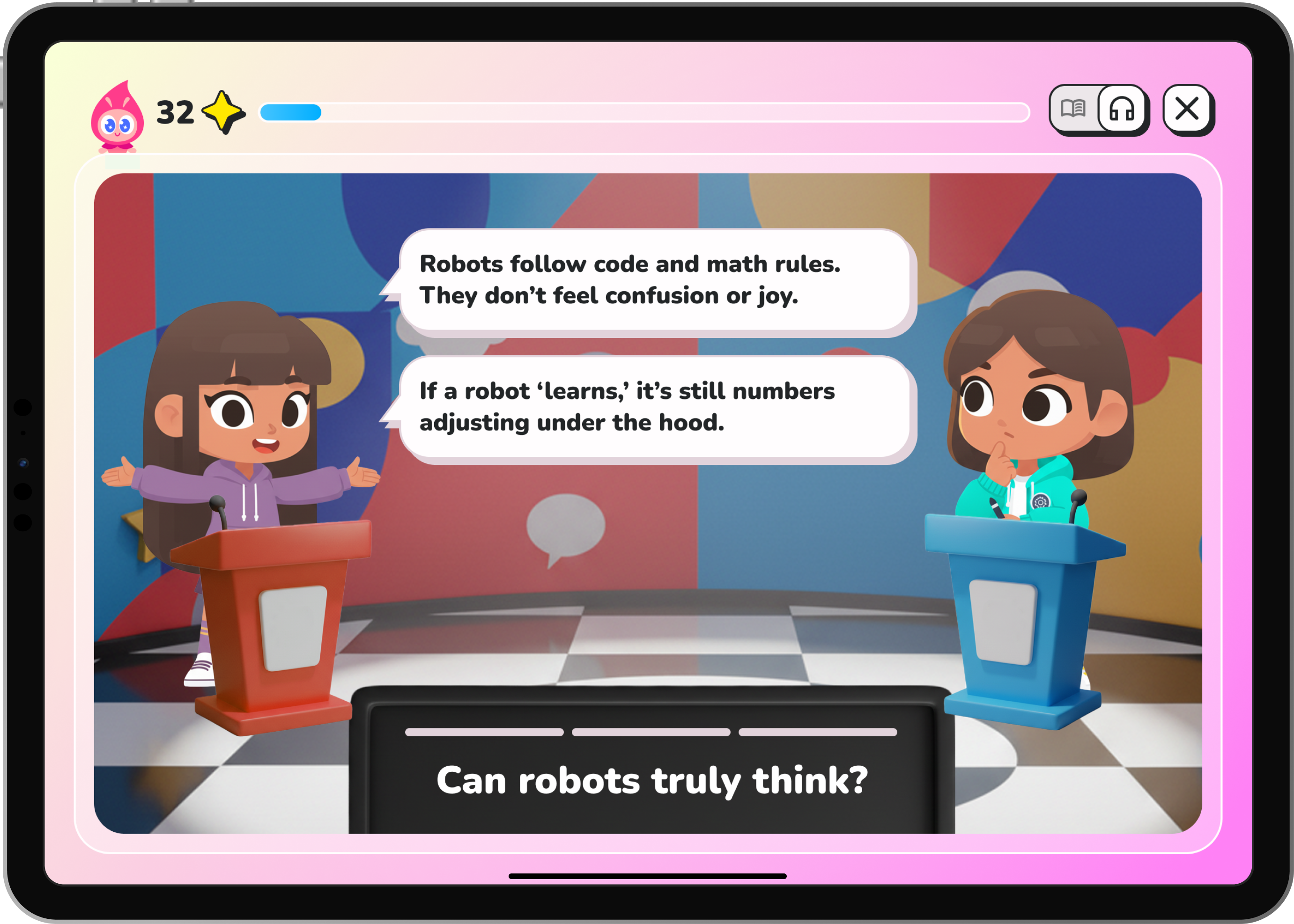

Sparkli’s approach is shaped by three shifts essential for modern childhood education, a strategy designed to solve the ‘Agency and Curiosity Gap’. First, it forces a Velocity Shift by moving away from static curriculums to real-time relevance where children explore new topics the moment they emerge. Second, it drives an Engagement Shift by replacing the dry ‘AI chatbot wall of text’ and passive screen time (watching videos, playing video games) with a multimodal playground of visuals, voice, and playable simulations. This turns consumption into active, gamified inquiry rooted in educational value. Finally, Sparkli prioritizes a Skills Shift that focuses on capabilities such as creativity and complex problem solving rather than memorization.

Underpinning these interactions is a system that builds an interest and knowledge graph for every child over time, enabling the platform to deliver truly personalized and adaptive learning.In practice, this means if a child asks to build a city on Mars, Sparkli doesn’t just list facts but instantly generates an interactive expedition where they learn age-appropriate physics, simulate the environment, and build their own city. As they design the infrastructure and explore logistics, the platform challenges them to engage in debates, make strategic choices based on real arguments, and ultimately reflect on and defend their decisions.

Sparkli is building the first multimodal learning engine for children aged 5-12.

“Our goal is to build agency in the next generation,” said Lax Poojary, CEO and founder of Sparkli. “Children learn by exploring, making choices, asking questions, and discovering what inspires them. Sparkli turns screen time into a place where curiosity grows rather than fades.”

Sparkli’s early pilots illustrate these shifts in action. In one classroom, eight-year-olds used the platform to simulate building their own mini food cart businesses, where teachers observed students debating concepts like budgeting and customer experience. In another pilot, students took control during an unstructured ‘Freedom Friday’ session, initiating their own expeditions into topics ranging from game design to the Big Bang. Parents testing the consumer version described a notable difference in the quality of their children’s screen time, with one parent remarking that their son returned from a session eager to outline his sustainability plan if he were Mayor for a day.

Sparkli launch at Bett Conference, the largest education conference in the world.

Realizing the potential to reimagine this learning experience, CEO Lax Poojary and his co-founders, who are veterans of Google Area 120, Search, and YouTube, assembled a team of engineers and designers, including experts from ETH and the education sector. Together, they are building a platform that fuses generative AI, pedagogy, motion design, and game mechanics to address a fundamental failure in how content is delivered. Existing systems are often slow, standardized, and unable to keep pace with discovery. Textbooks take years to update, traditional edtech depends on static libraries and drills, and open-ended AI tools and chatbots, though powerful for adults, are unsafe or overwhelming for young users. This growing gap creates a major market opportunity for Sparkli to deliver a capable yet safe platform that pairs modern generative technology with strong guardrails and age-sensitive design.

By solving this, Sparkli positions itself to disrupt the $7 trillion global education market, a sector widely predicted to be one of the most significant use cases for artificial intelligence. While Duolingo has built the largest consumer EdTech business to date by digitizing rigid language drills, Sparkli targets a significantly larger addressable market by reimagining how the next generation acquires knowledge

“Sparkli represents a step change in how children can interact with knowledge,” said Lukas Weder, Partner at Founderful. “The team is applying high caliber engineering and thoughtful pedagogy to a space that desperately needs innovation. Their traction with schools shows a real appetite for tools that foster curiosity and agency rather than passive consumption.”

Sparkli’s vision is to become the AI-native operating system for childhood development. The company plans to extend its platform from curiosity into creation, giving children tools to build and prototype projects directly inside Sparkli. It seeks to connect classroom learning with home exploration and ultimately support learners as they grow into adolescence and beyond. The long-term goal is to give every child a lifelong AI companion that remembers what they cared about at age six and helps them develop those passions at seventeen.

Media images can be found here.

About Sparkli

Sparkli is a Zurich-based AI company building the first multimodal learning engine for children aged 5-12. Founded by veterans of Google Area 120, YouTube, and Search, Sparkli combines Swiss engineering precision with consumer-scale technology to foster curiosity, agency, and critical thinking. The platform is currently in private beta with global school networks, with a consumer launch scheduled for June 2026. For more information, visit sparkli.ai and join early access here: https://go.sparkli.ai/early-access