The Feed is Dying. Social Network Series Hits 1M Messages by Changing How You Share Online.

The Feed is Dying. Social Network Series Hits 1M Messages by Changing How You Share Online.

New York, Dec. 22, 2025 (GLOBE NEWSWIRE) — From Facebook’s News Feed to Snapchat’s Stories, users have had no shortage of ways to share content online. But lately, people have grown hesitant to share their most authentic moments due to the stigma of current social media. A new social network on iMessage recently hit one million messages by reapproaching how we share content online.

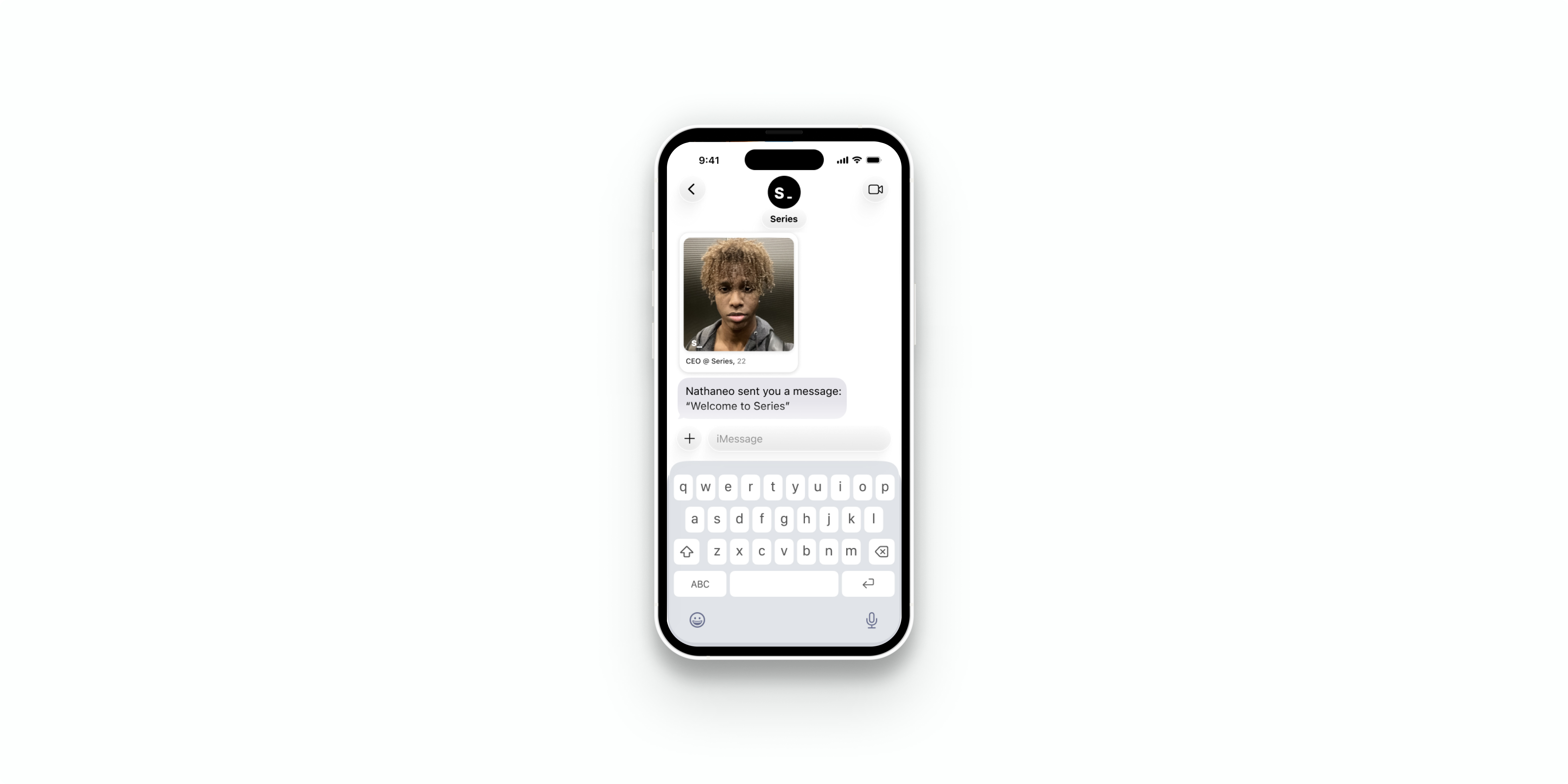

Series, the social network on iMessage, announced that today it has exchanged over 1 million messages while also reaching 10,000 daily active users – all without feeds, followers, or the anxiety that’s driven an entire generation away from public posting.

Series is the AI social network redefining human connection. Series operates directly in iMessage, calls, and other messaging platforms, and makes introductions based on users’ warm networks.

The milestone comes as social media faces an existential crisis. The head of instagram Adam Mosseri commented on a ‘paradigm shift’ away from public posting, with users increasingly retreating to direct messages and closed groups. For non-creators, the pressure to curate perfect content has made sharing feel like work rather than genuine human connection.

Series solves this by removing the concept of posting altogether. Users instead send a customizable message to a curated list of people within the platform, entirely on iMessage. The term series comes from the sequential approach the product takes to ensure a user’s message reaches the right people. Users have sent messages that have resulted in hired videographers, dates in Amsterdam and co-founding a business.

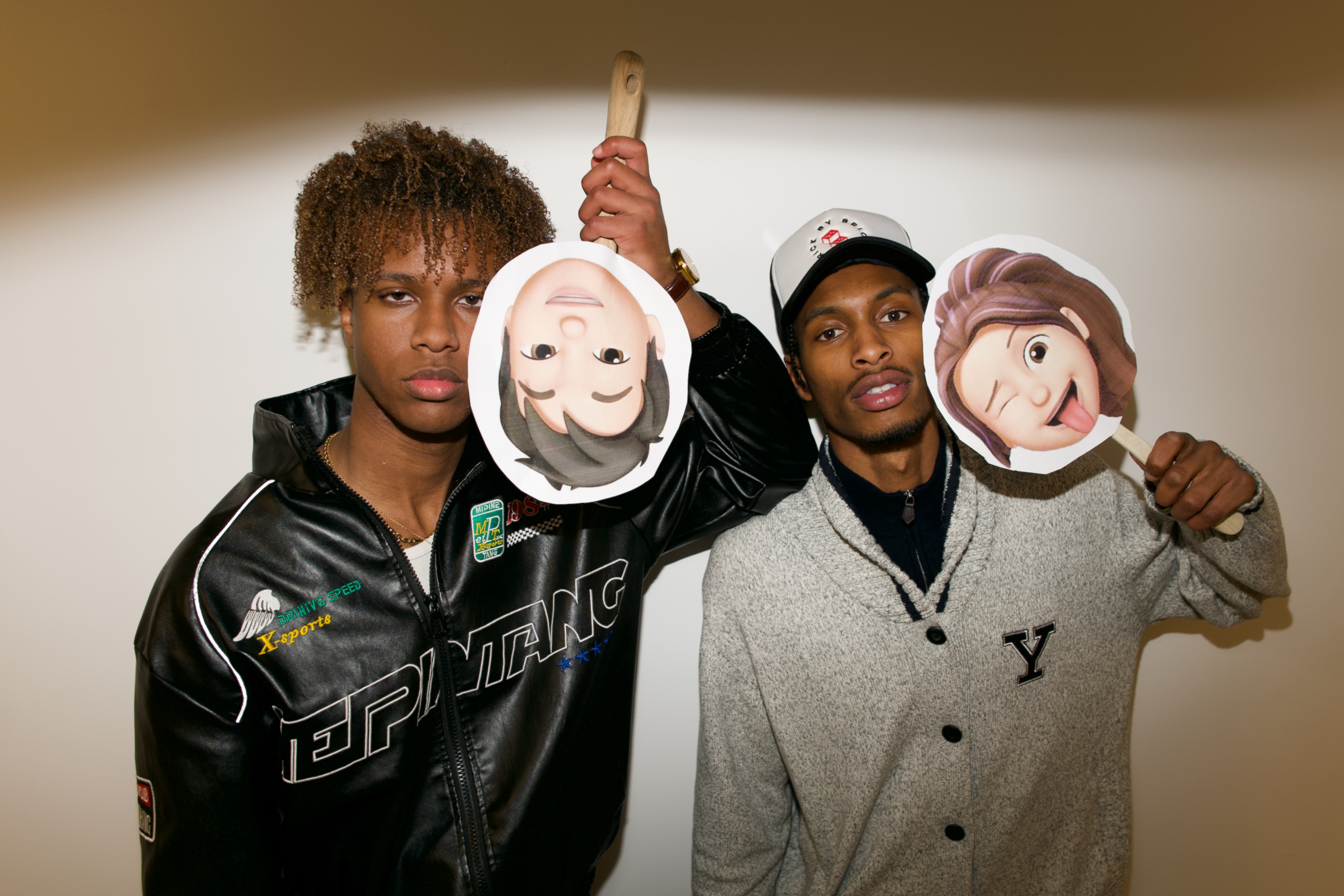

Series founders: Nathaneo Johnson and Sean Hargrow.

“Series emerged from the limitations of existing social platforms” says Nathaneo Johnson, CEO at Series. “We are all used to a feed where we express the best version of ourselves. But that rarely allows us to communicate our current state of expression – mainly due to the stigma of posting online. Series solves this by curating each interaction between your content and your audience to feel intimate and personal, something we couldn’t do before.”

Series embraces this “paradigm shift” rather than fighting it. By living within iMessage and focusing on private, one-to-one introductions rather than public broadcasting, the platform gives people what they actually want from social media: meaningful connections in a meaningful setting.

The approach represents a fundamental rethinking of what social networking means. Rather than optimizing for engagement metrics and time spent on the platform, Series optimizes for meeting the right person at the right time. The one million message milestone isn’t about content consumption – it’s about conversations had, introductions made, and long-term relationships explored.

Nathaneo Johnson and Sean Hargrow founded Series their junior year at Yale University after watching an entire generation grow exhausted by platforms designed for engagement over genuine connection. Both still attending Yale University, this duo has raised $5.1 million to date, has been featured on this year’s Forbes 30 under 30, and is now scaling what began as a college-first platform into a national movement.

For a generation raised on social media but exhausted by its demands, Series offers something different: connection without performance, community without curation, and social networking that doesn’t require you to be perfect – just human.

Media images can be found here.

About Series

Series is the AI social network redefining human connection. Series operates directly in iMessage, calls, and other messaging platforms, and makes introductions based on users’ warm networks. Series is hiring for a number of roles. Please visit https://series.so/ for more information or follow via LinkedIn.

CONTACT: For further information, please contact the Series press office on press@series.so