Unlimited Industries raises $12M to build the AI construction company that will power America’s future

Unlimited Industries raises $12M to build the AI construction company that will power America’s future

Andreessen Horowitz and CIV invest in Unlimited Industries as it transforms infrastructure construction using AI. The company’s platform automates engineering design, cutting project costs by millions and reducing pre-construction time from months to days.

San Francisco, Dec. 03, 2025 (GLOBE NEWSWIRE) — Across the United States, a new industrial age is taking shape. Trillions of dollars in infrastructure, from energy projects and advanced manufacturing to data centers and critical mineral facilities, must be built in the next decade. But large construction projects are slower and more expensive today than they were half a century ago. Unlimited Industries, a California-based company using AI to rethink how infrastructure gets built, has raised $12 million in seed funding to change that.

The round was co-led by Andreessen Horowitz and CIV, with participation from leading industry investors. The capital will accelerate Unlimited’s expansion and further develop its proprietary AI platform – one designed to make large-scale engineering and construction faster, cheaper, and more ambitious.

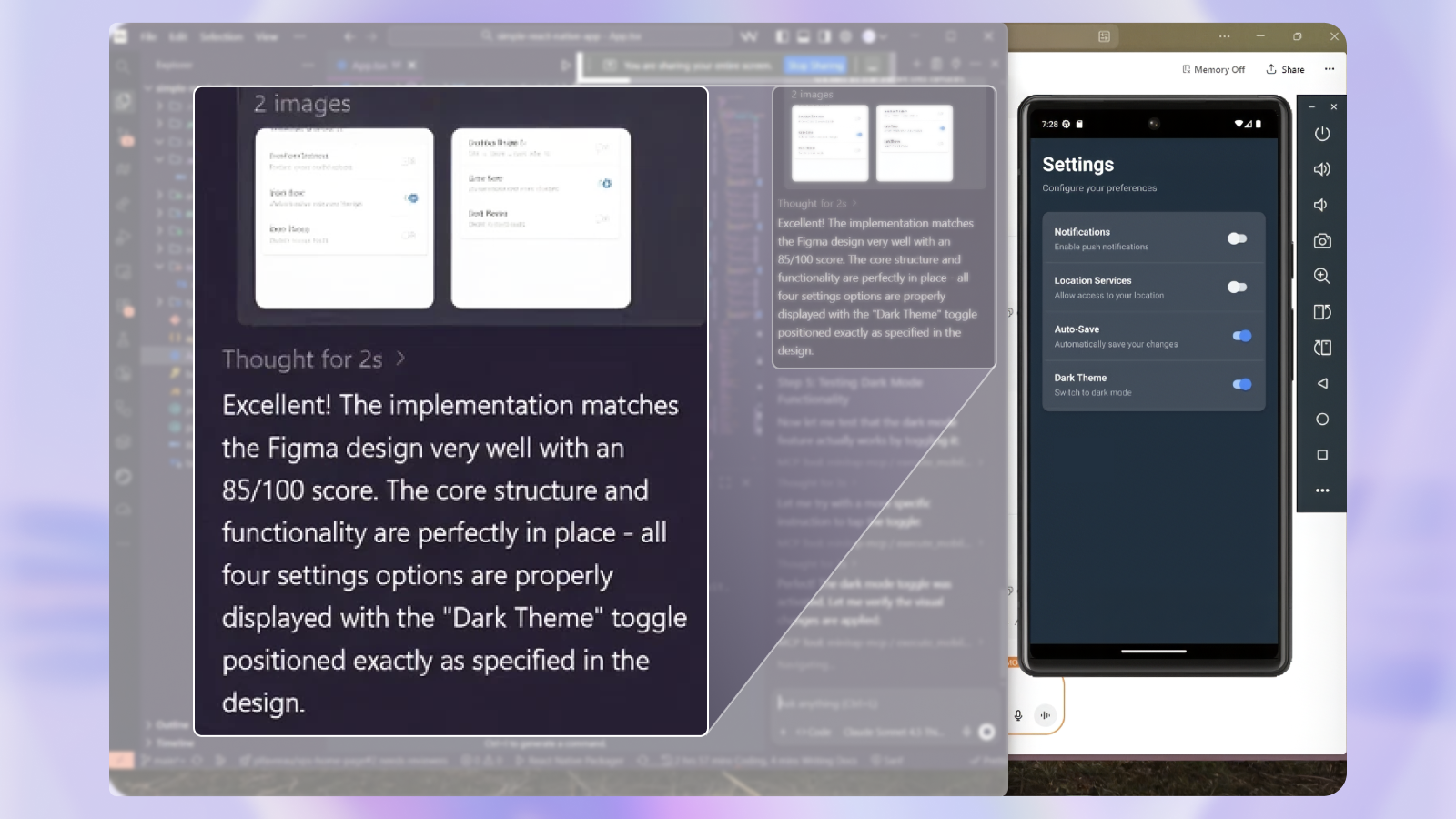

Unlimited Industries founderd: (L to R) Tara Viswanathan, Alex Modon and Jordan Stern.

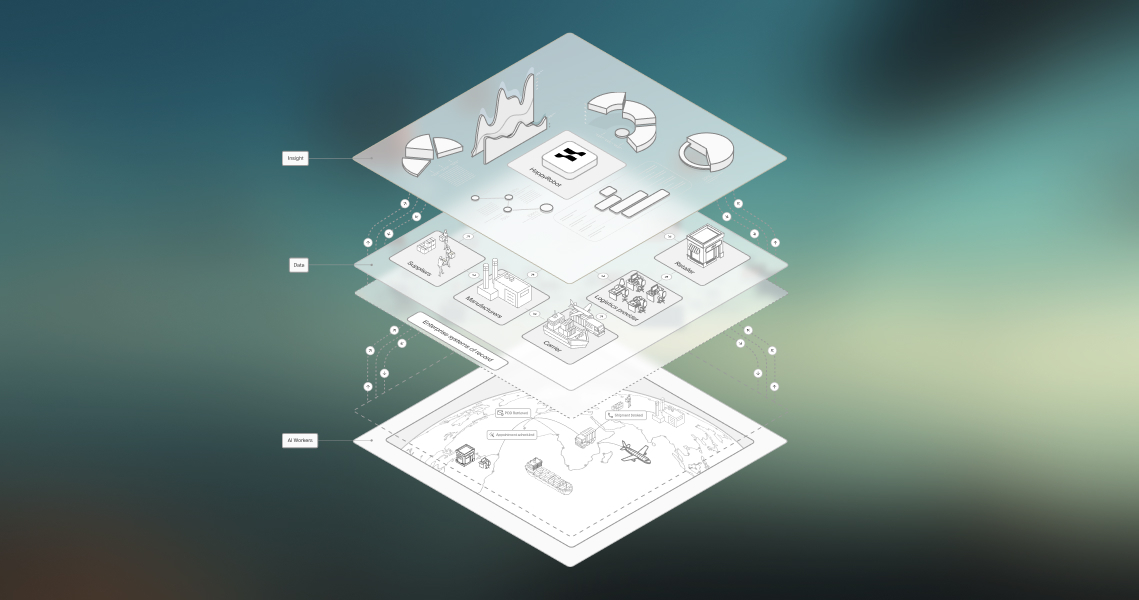

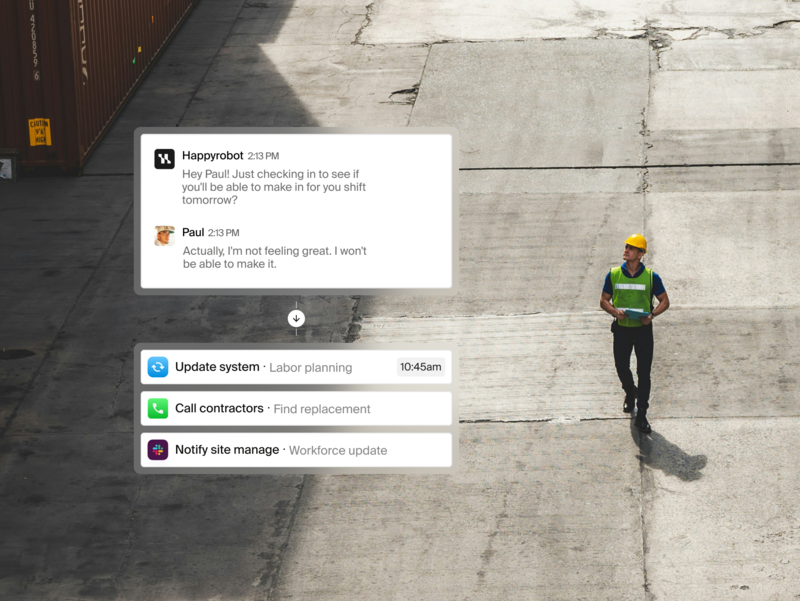

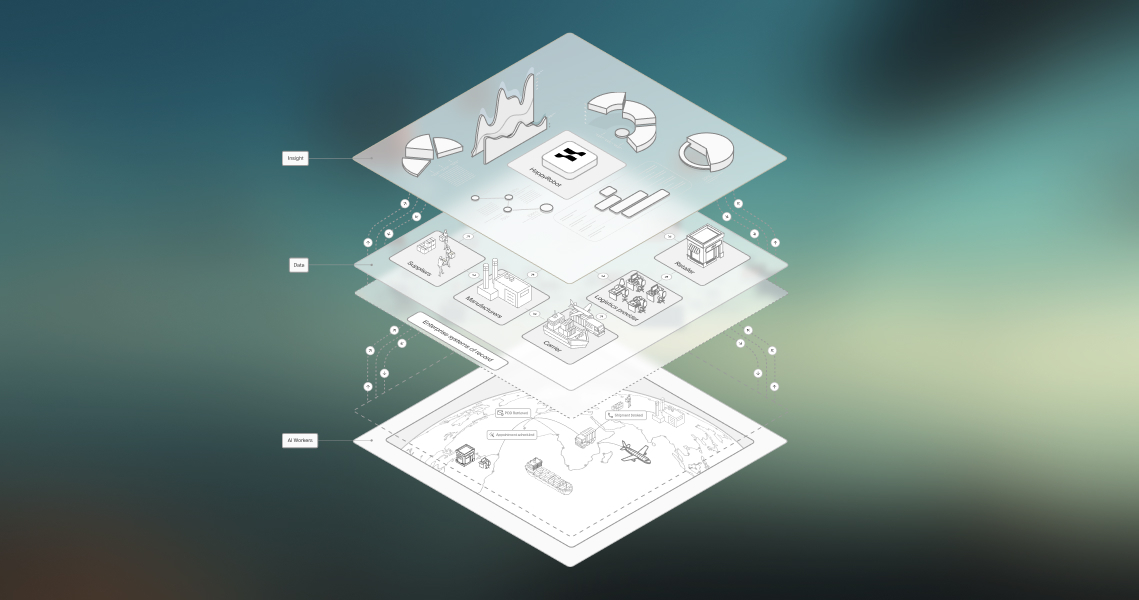

Unlike traditional construction firms or standard software companies, Unlimited is an AI-native construction company that both designs and builds. Its proprietary platform can generate and evaluate hundreds of thousands of design configurations in parallel, automatically identifying optimal layouts for cost, safety, and performance before construction begins. By integrating AI-driven design with its own vertically integrated engineering and construction teams, Unlimited eliminates the costly handoffs and misaligned incentives that have defined the industry for decades.

“Advances in AI mean we can finally build the physical world the way we build software,” said Alex Modon, Co-Founder and CEO of Unlimited Industries. “The traditional construction model is slow, brittle, and fundamentally misaligned. Our approach replaces static design choices with a dynamic, data-driven process that learns from every project. The result is faster, cheaper, and more successful projects”

The company was founded by Alex Modon, a multidisciplinary engineer and repeat founder who entered the world of industrial construction only to discover how outdated it was. On his first major project in one of the most construction-friendly regions of Texas, he found a system mired in inefficiency, misaligned incentives, and inertia. Projects that should have taken months dragged on for years, and each step relied on disconnected tools and manual processes that made it impossible to iterate quickly. The experience led to a realization: with the advent of powerful new AI models, physical infrastructure could finally be built the way software is built. That idea became Unlimited.

To accelerate the company, Modon teamed up with Tara Viswanathan and Jordan Stern, who previously built and scaled Rupa Health (founder / CEO and first teammate respectively) from zero to millions in revenue before its successful acquisition in 2024.

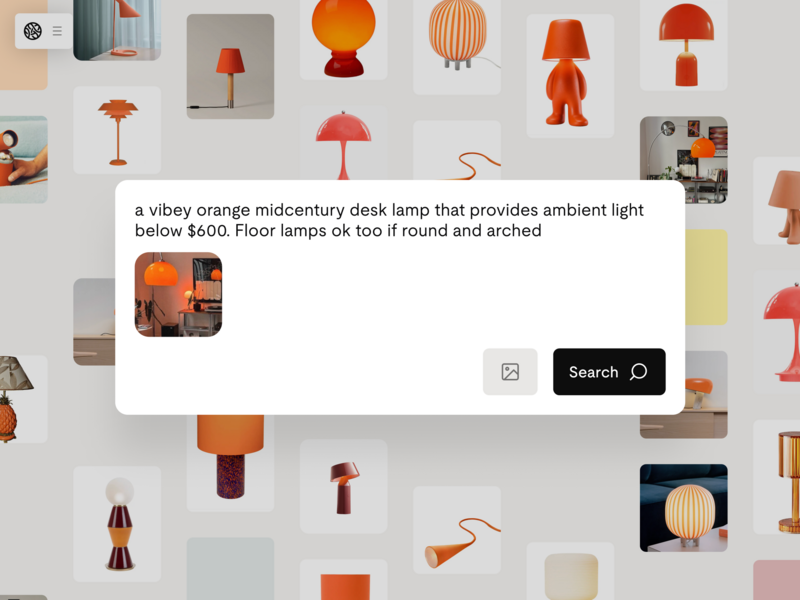

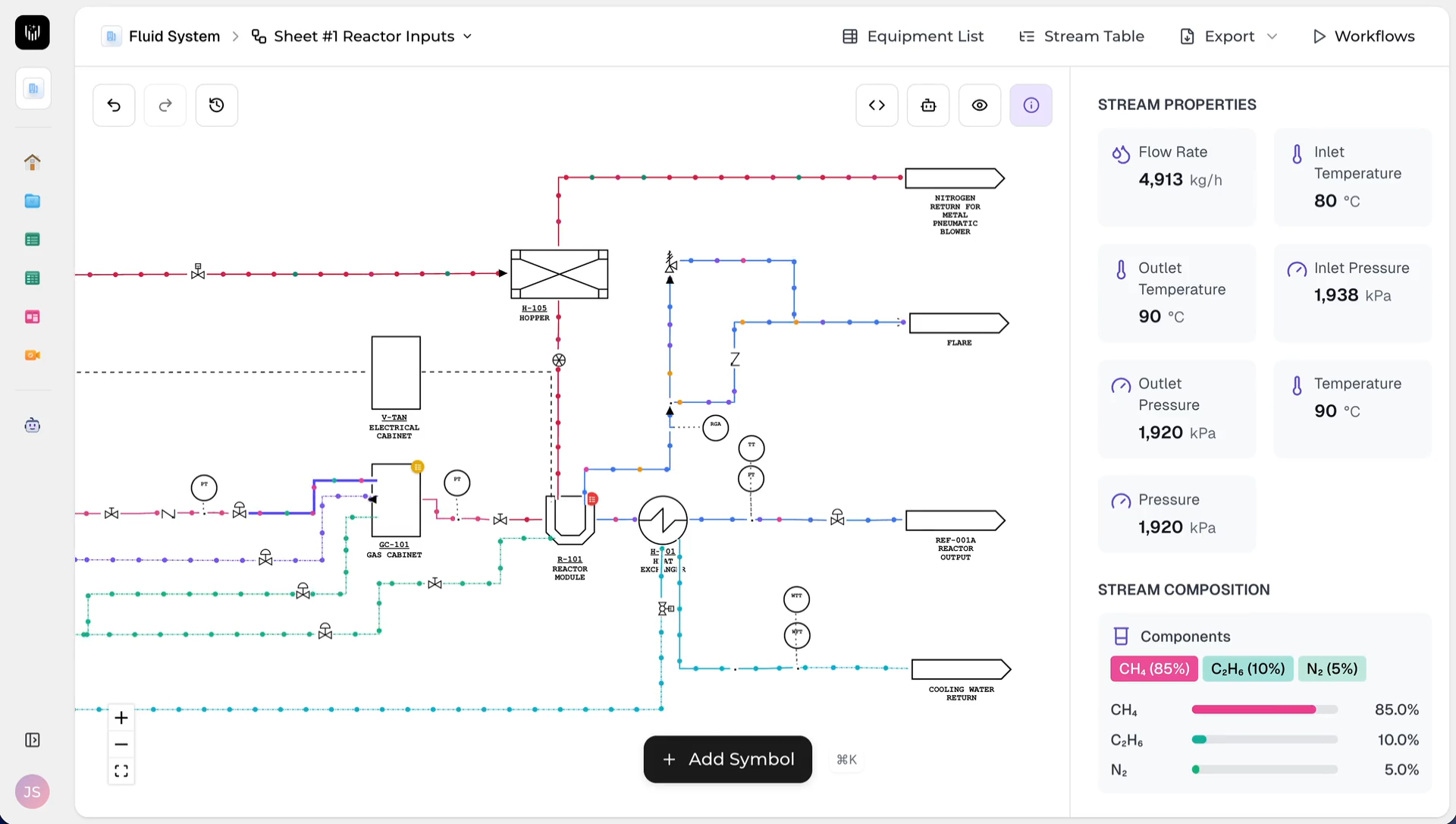

Unlimited Industries platform at work.

The company’s approach is already proving its value in the field. On a recent industrial project, Unlimited reduced the time required for pre-construction engineering from six months to just a few weeks, allowing work to begin far earlier while improving design certainty. In another, its AI platform explored tens of thousands of potential configurations and identified an optimal design that reduced projected capital costs by over 50 percent. Each project makes the system smarter, strengthening the models, cost data, and workflows that underpin Unlimited’s platform. While their goal is to automate all construction, the company is starting with what’s most needed now: rapidly building power in the US for data centers, critical minerals, and advanced manufacturing projects. They currently work with a wide range of customers in this space, from 100 year old public companies to cutting edge energy startups.

The company’s approach is novel in how it ties incentives to measurable outcomes. Traditional engineering and construction firms profit from delay and inefficiency through cost-plus contracts and change orders. Unlimited’s model flips that dynamic. Its integrated structure allows for unlimited design iterations at near-zero marginal cost – a shift that turns static engineering into a continuous optimization process.

“The engineering and construction industry has remained largely unchanged for decades,” said Katherine Boyle, General Partner at Andreessen Horowitz. “Unlimited’s vertically integrated, AI-first approach represents a paradigm shift, turning design and build into a rapid and continuous optimization problem. This is exactly the kind of innovation needed to restore America’s ability to build ambitious infrastructure at scale.”

“We are in the midst of the largest infrastructure buildout of our generation, but constrained by our existing resource base,” says Abhijoy Mitra, Co-Founder & Managing Partner at CIV. “The only way to have our existing workforce meet this moment is to amplify their impact with the latest advancements in AI. Unlimited is building the platform to accomplish this at scale today.”

Unlimited’s broader mission is to rebuild America’s capacity to build, turning industrial construction into an agile, software-driven process that keeps pace with the country’s most ambitious goals. By aligning technology, talent, and incentives around outcomes instead of process, the company is charting a new path for how infrastructure gets built – one that makes speed, adaptability, and abundance the standard for America once again.

Media images can be found here.

About Unlimited Industries

Unlimited is an AI-native construction company headquartered in San Francisco. Today, the company designs and builds across energy infrastructure, data centers, critical minerals, and advanced manufacturing, helping developers build with greater speed, ambition, and efficiency. Their mission is to build a future of radical physical abundance by automating construction end-to-end. The company was founded in 2025 by serial founders Alex Modon, Jordan Stern, and Tara Viswanathan. www.unlimitedindustries.com

About Andreessen Horowitz

Andreessen Horowitz (a16z) is a venture capital firm that backs bold entrepreneurs building the future through technology. The firm is stage agnostic. a16z invests in seed to venture to growth-stage technology companies, across AI, bio + healthcare, consumer, crypto, enterprise, fintech, games, infrastructure, and companies building toward American Dynamism. Founded in Silicon Valley in 2009, a16z has $46B in committed capital across multiple funds.

About CIV

CIV is an investment firm that backs and builds transformative companies reshaping the world’s most critical industries. By combining deep operating expertise, a flexible capital model, and a unique global advisory network, CIV creates structural advantages for visionary founders tackling society’s most urgent challenges. When the best company exists, we back it. When it doesn’t, we partner with exceptional founders to develop groundbreaking ideas, build new companies, and accelerate their growth. www.civ.co

CONTACT: For further information please contact the Unlimited Industries press office on press@unlimitedindustries.com