General Magic Raises Oversubscribed US$7.2M to Cut Insurance Quote Time to 3 Minutes

General Magic Raises Oversubscribed US$7.2M to Cut Insurance Quote Time to 3 Minutes

AI agents reduce inbound calls by 30%, deploy in 3 minutes, and save teams 250+ hours monthly across pre-quote, post-quote, and claims workflows

Toronto, Feb. 24, 2026 (GLOBE NEWSWIRE) — Insurance is complicated. Customers have questions before they quote, need guidance after, and expect clarity when they file a claim. But the work of answering those questions, collecting documents, and following up still runs on calls, emails, and portals stitched together by manual effort. For brokers and carriers, this coordination overhead is one of the most operationally expensive and taxing parts of the business. General Magic is building AI agents to solve this problem.

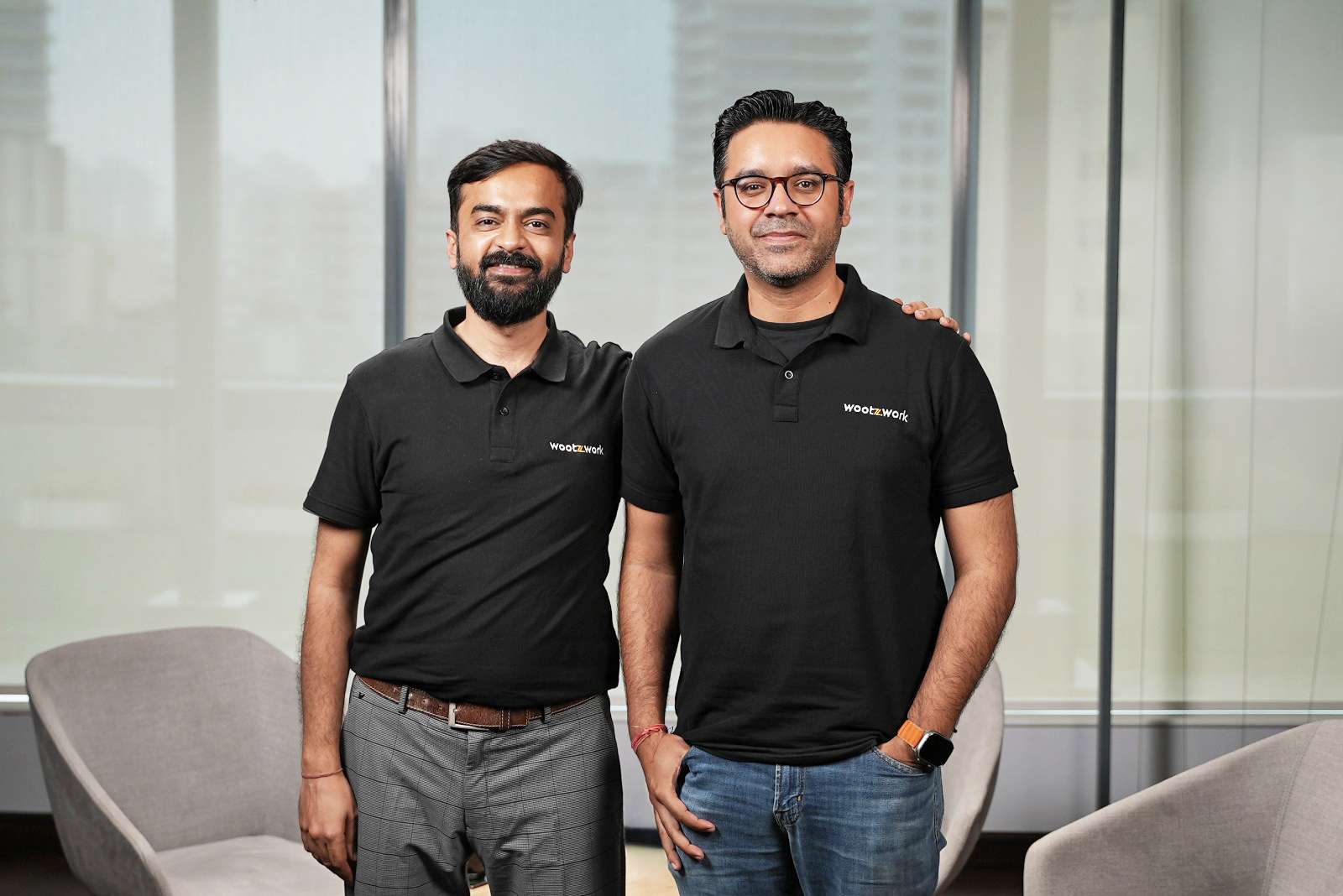

The General Magic team.

Today, the company announced a US$7.2M seed funding round led by Radical Ventures, with significant participation from a16z Speedrun and new investment from Figma VP of Product Brendan O’Driscoll and Larry James Erwin from OpenAI. The company has raised $8.4M to date, backed by Radical Ventures, a16z Speedrun, and Comma Capital, along with operators who have built foundational AI and product platforms, including Aidan Gomez, CEO of Cohere, as well as the executive team at Braze, including Kevin Wang, Chief Product Officer, and Spencer Burke, SVP of Growth.

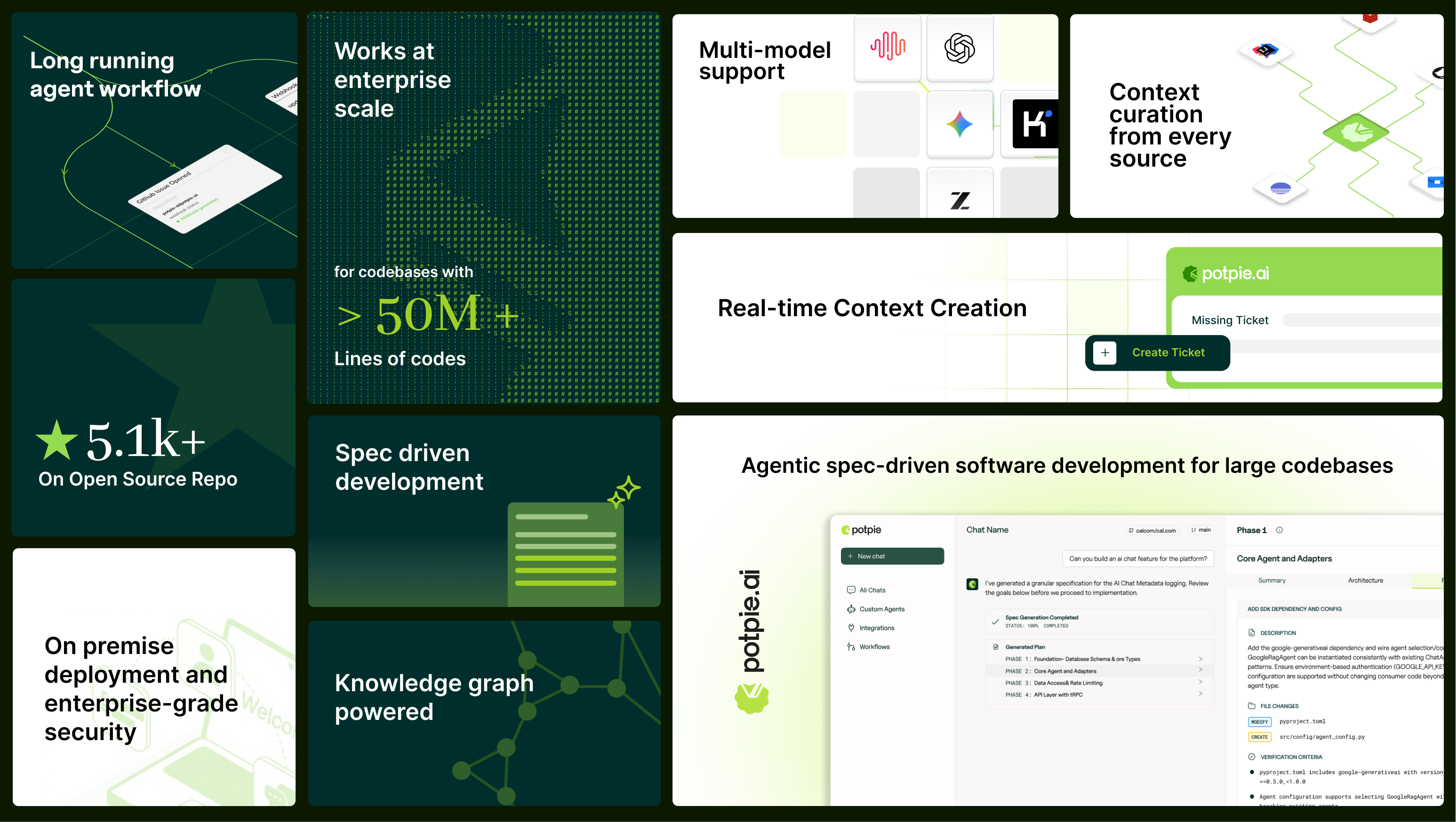

General Magic builds AI agents that take over the work insurance teams spend the most time on: answering routine questions, collecting documents, and following up with customers when clarity matters. These agents work across the full insurance lifecycle, covering pre-quote eligibility, post quote engagement, and claims coordination. They do all of this while connecting directly to broker management systems, quoting platforms, and CRMs.

Early deployments show what’s possible. Working with one of the world’s largest general insurers, General Magic has reduced time-to-quote from roughly 30 minutes down to under 3 minutes via its SMS-based agent.

“Too much of insurance still relies on manual follow through across calls, inboxes, and scattered systems,” said Jai Mansukhani, Co Founder and President of General Magic. “We focus on keeping customers engaged at every stage of the lifecycle, not just at quote or claim. Our agents handle the routine work that slows teams down, while giving insurance leaders real visibility into what customers are asking, where they are getting stuck, and how they are feeling. When that engagement and data flow directly into core systems, teams move faster and customers feel genuinely supported.”

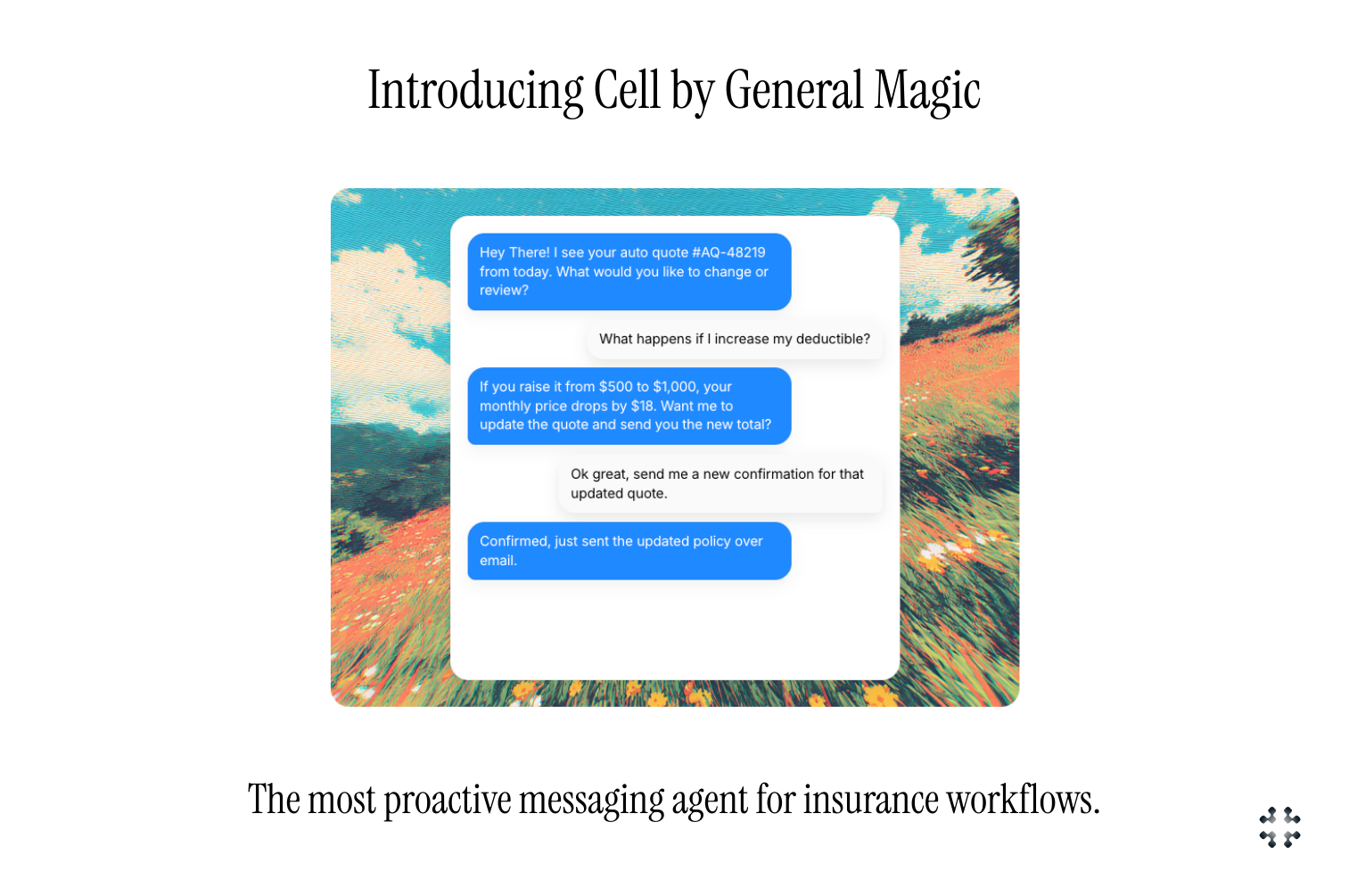

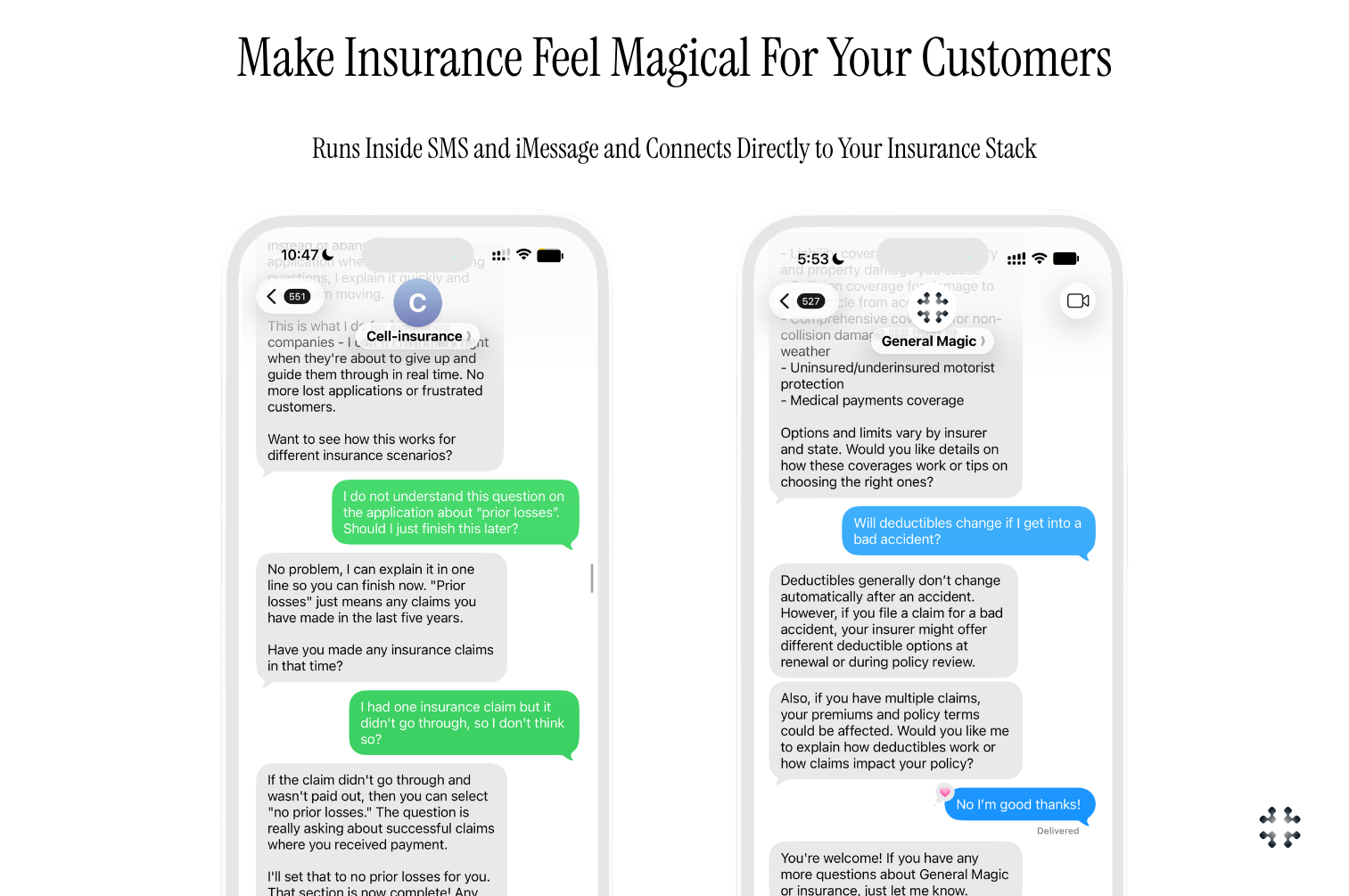

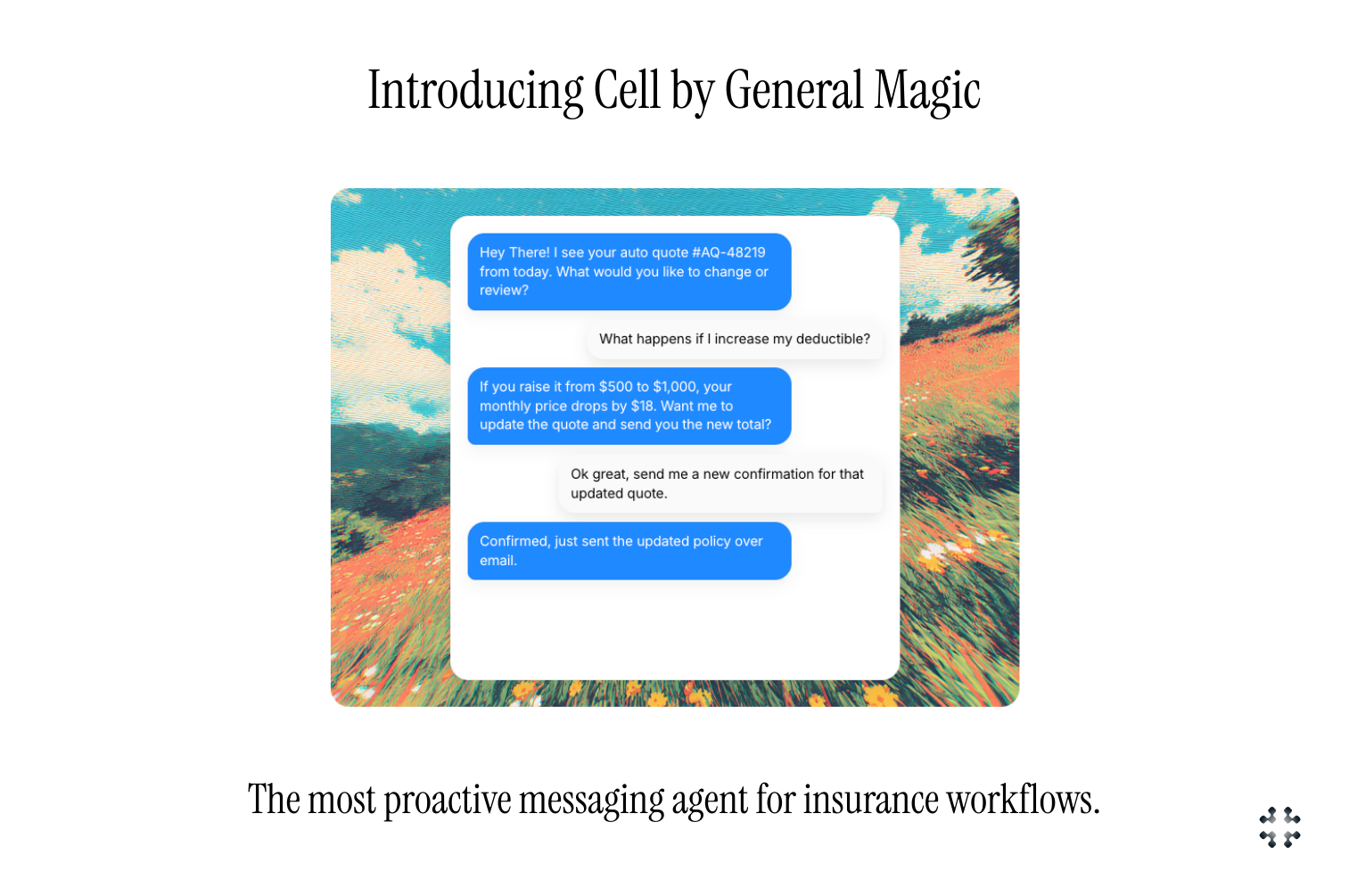

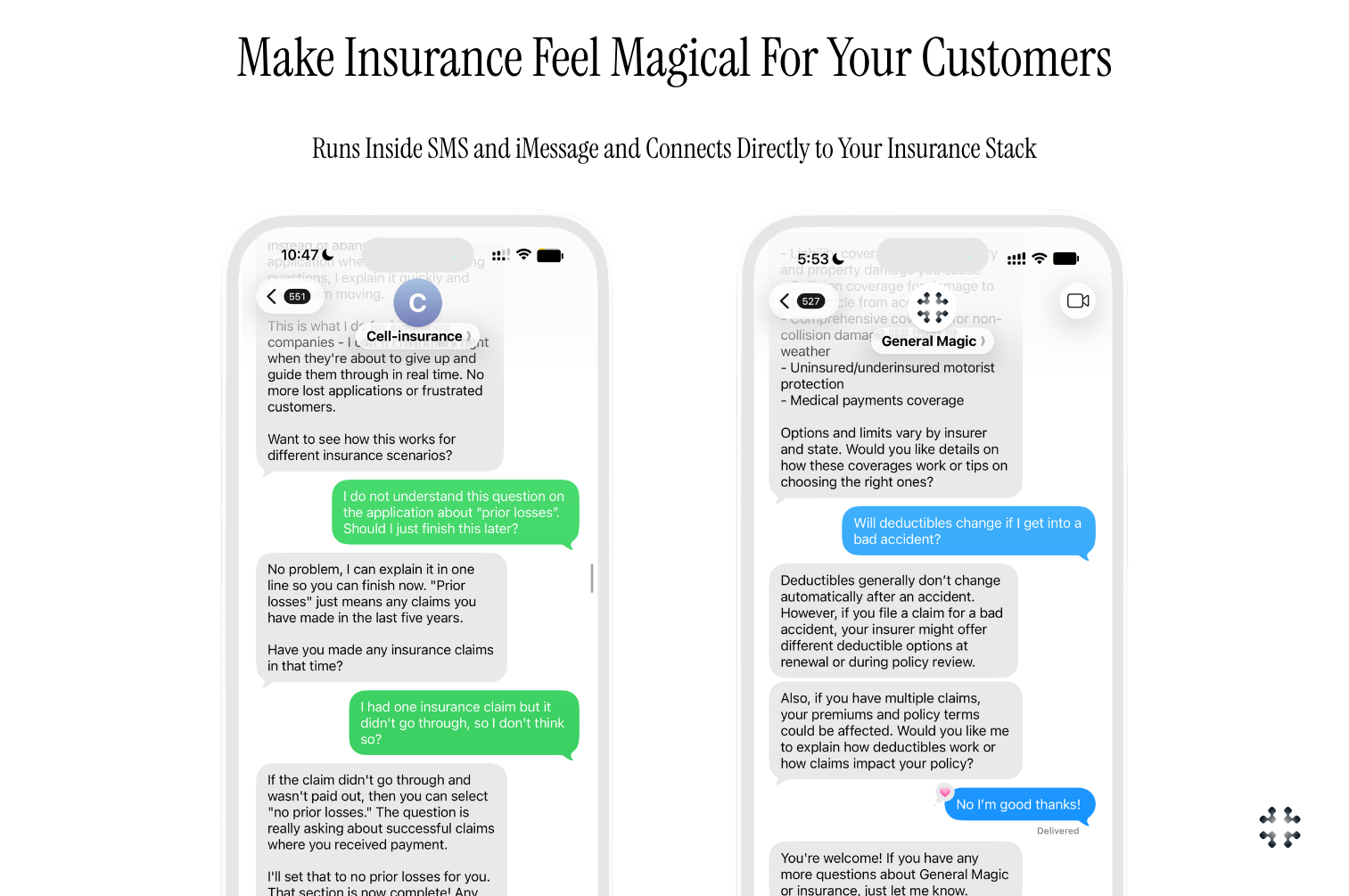

The company’s agentic offerings are centered around a product called Cell, a proactive AI agent that connects directly to the systems insurance teams already use. Cell integrates with broker management systems, quoting and rating platforms and CRMs to support teams. It can be deployed across SMS, iMessage and RCS, and can extend into policy, billing and claims workflows as needed.

When a customer has a question, they can text Cell over SMS, or the insurance team can proactively deploy it to the customer. The agent responds using real system data, asks for missing information, follows up automatically, and updates records as workflows progress. Conversations stay in one thread, context is preserved, and customers move forward at their own pace without being chased or dropped.

Early deployments point to the scale of the opportunity. In early rollouts with large personal lines insurers, General Magic is reducing the time required to generate and finalize quotes from roughly 30 minutes to about 3 minutes by automating routine clarification and follow ups over SMS across auto and life insurance workflows. This increase in speed expands effective quoting capacity while keeping customers engaged through the most failure prone part of the journey after a quote is issued. By handling frequent questions and coordination over text, the agent reduces delays and prevents conversations from stalling. General Magic is currently supporting deployments with carriers across auto and life insurance, where post quote follow through and customer coordination are most critical.

In parallel, the team is focused on building agents that understand the realities of insurance distribution, including licensing and regulatory frameworks such as RIBO, OTL, and other broker and advisor exams. By specializing agents around how licensed professionals are trained to communicate, General Magic aims to ensure conversations feel accurate, compliant, and aligned with how insurance teams actually explain coverage to customers.

General Magic was founded by Anthony Azrak and Jai Mansukhani, second-time founders who previously sold AI products into legacy industries. The company’s move into insurance came from firsthand frustration. After a water leak spiraled into weeks of calls, delays, and higher premiums, the founders began exploring how common this experience really was. What they found was an industry that technically works, but often fails customers and intermediaries in the moments that matter most. That insight shaped General Magic’s decision to go deep into insurance rather than remain a horizontal AI platform.

The broader industry context underscores the urgency. Retention rates in insurance lag behind other sectors, and acquiring new customers costs significantly more than keeping existing ones. As digital distribution accelerates and customers shop more aggressively at renewal, both carriers and brokers that fail to improve post-quote engagement risk losing revenue they already worked to win.

Looking ahead, General Magic plans to expand across insurance lines and workflows, staying focused on moments where customer intent is high and coordination most often breaks down. The platform is being built to support high impact workflows across the insurance stack, prioritizing areas where follow through fails today and where fixing it creates meaningful value for customers, brokers, and carriers.

The long term vision is simple but ambitious: make follow through automatic, reliable, and invisible. By removing the need for manual chasing and fragmented handoffs, teams can spend less time managing processes and more time serving end customers. The team is motivated by solving complex, real world problems

that sit at the center of insurance operations, with the goal of delivering tangible improvements to how people experience insurance when it matters most.

Sanjana Basu, partner at Radical Ventures commented: “Most of the world’s financial and insurance data is locked inside rigid, legacy systems that were never designed for the AI era. General Magic isn’t trying to convince enterprises to throw away that infrastructure. Instead, they are giving them a way to finally talk to it. By building a reasoning layer that sits on top of existing systems of record, the General Magic team are unlocking a massive amount of trapped value. This is how the Fortune 500 becomes AI-native. Not by rebuilding from scratch, but by bridging the gap between old data and new intelligence.”

Troy Kirwin, investment partner at a16z Speedrun added: “We’ve watched Anthony and Jai grow exponentially both during their speedrun cohort and in the months after. They are building a truly compelling product that we believe will revolutionize workflows across insurance carriers and brokerages globally. I have a personal thesis that outsiders will disrupt legacy industries, and General Magic has helped buttress this thesis with the immense progress they’ve made. We are excited to deepen our partnership through supporting their seed round.”

Pete Tessier, BFA, CAIB, President at insurance MGA Taycon Risk added: “What I have seen with General Magic and their approach to AI was a willingness to adapt to the insurance industry’s needs. This is significant because of the varied nuances of the insurance industry and how its products are distributed and why internal and external customer journeys are different. The challenge will be making it scale across all channels of insurance product distribution. This might be the first true ‘game changer’ for the industry and deliver on customer experience and expectations”

Media images can be found here.

About General Magic

General Magic, an AI company headquartered in Toronto, is building SMS native AI agents that power insurance workflows through natural language. The platform translates customer messages into actions across core insurance systems, making it possible to quote, service, renew, and manage claims entirely over text. The company believes natural language will be the default interface for getting work done. General Magic is focused on leading that shift in insurance, starting with SMS.

About Radical Ventures

Radical Ventures is a venture capital firm investing in world-leading entrepreneurs who are applying artificial intelligence to transform massive industries. We partner with extraordinary founders at the forefront of the AI revolution, helping them build companies that will shape the future. Radical operates globally with teams in Toronto, San Francisco, New York, and London.

About a16z speedrun

Speedrun is Andreessen Horowitz’s (a16z) flagship program that invests in new startups across consumer/enterprise AI, bio + healthcare, crypto, fintech, games, infrastructure, and companies building toward American dynamism. Founded in Silicon Valley in 2009, a16z has $90B in assets under management.

CONTACT: For further information please contact the General Magic press office: Bilal Mahmood on b.mahmood@stockwoodstrategy.com or +447714007257